With a pressing need to increase capital, HSC is implementing a stock issuance ratio of 2:1 immediately after completing a dividend payment of 68.58 million shares.

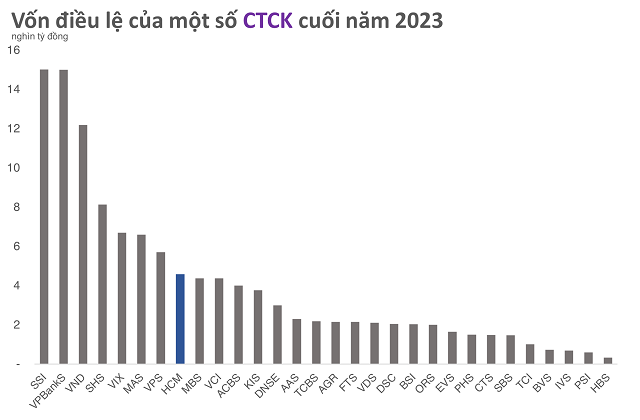

The scale of issuance for existing shareholders is 228.6 million shares, which will help HSC surpass other securities companies like VPS, MAS, VIX after raising its charter capital to over 7,500 billion VND.

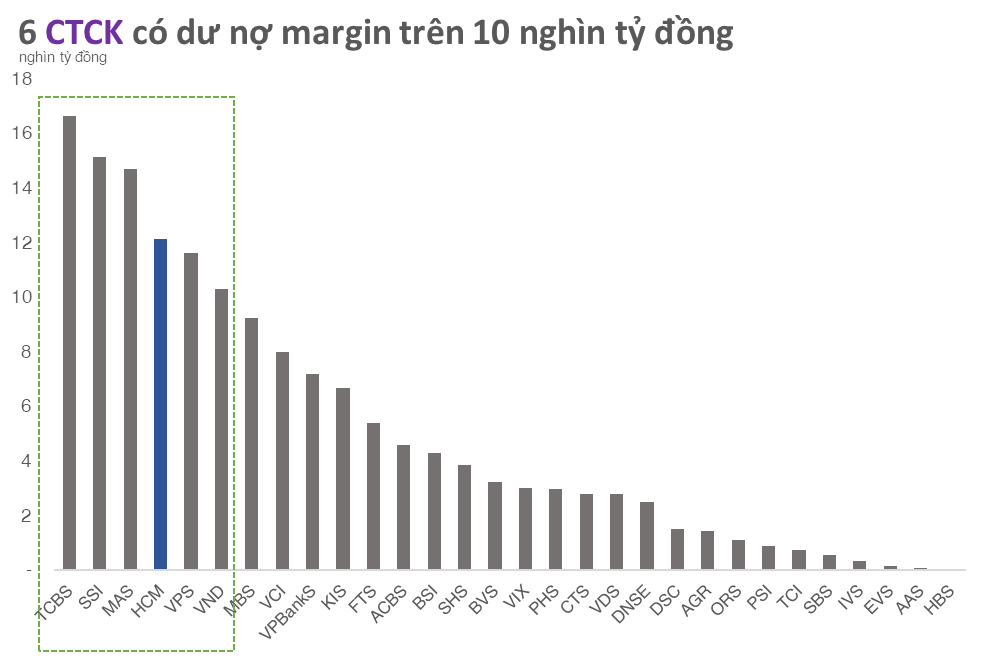

Along with that is the margin position of one of the leading securities companies that will continue to be maintained as HSC, along with SSI, TCBS, MAS, VPS, VND are among the top 6 securities companies lending over 10,000 billion VND.

Margin and advance of some securities companies at the end of 2023

|

Originally, this capital increase should have been implemented in 2022 or later in 2023, but the exchange of documents between HSC and the shareholders of Ho Chi Minh City Financial Investment Company – HFIC as well as the management agency of HFIC, which is the People’s Committee of Ho Chi Minh City, has prolonged the plans of the company’s management.

The recently announced public auction of 105.77 million HSC purchase rights by HFIC on the Ho Chi Minh City Stock Exchange (HOSE) on February 28, 2024, demonstrates the strict compliance with the regulations of this organization.

With many retail investors, the starting price of 7,523 VND / right is not really attractive because the cost price to buy one HSC share will be over 25,000 VND / share.

|

Price movement of HCM shares

|

However, this is also a price level that accurately reflects the adjusted share price on the ex-rights trading day on January 2. In the case of interested investors, HFIC is ready to sell at the right price to avoid asset loss. Conversely, HFIC will still exercise its rights to ensure that its interests are not “white-washed”.

Previously, similar auction sessions took place in the capital increase rounds of HSC in 2019 and 2021.

Specifically, after the unsuccessful auction of 37.5 million purchase rights at 6,200 VND / right in April 2019, HFIC returned to exercise its right to buy 25 million shares at 14,000 VND / share.

In the capital increase round of 2021, HFIC organized an auction of 73 million purchase rights at 13,150 VND / right and sold 10.11% of the registered amount. The remaining part was still purchased by HFIC shareholders, with 32.8 million shares at 14,000 VND /share. And this is the main reason why the next capital increase round of HSC was postponed due to the suspended capital contribution of HFIC and required the approval of the Government.

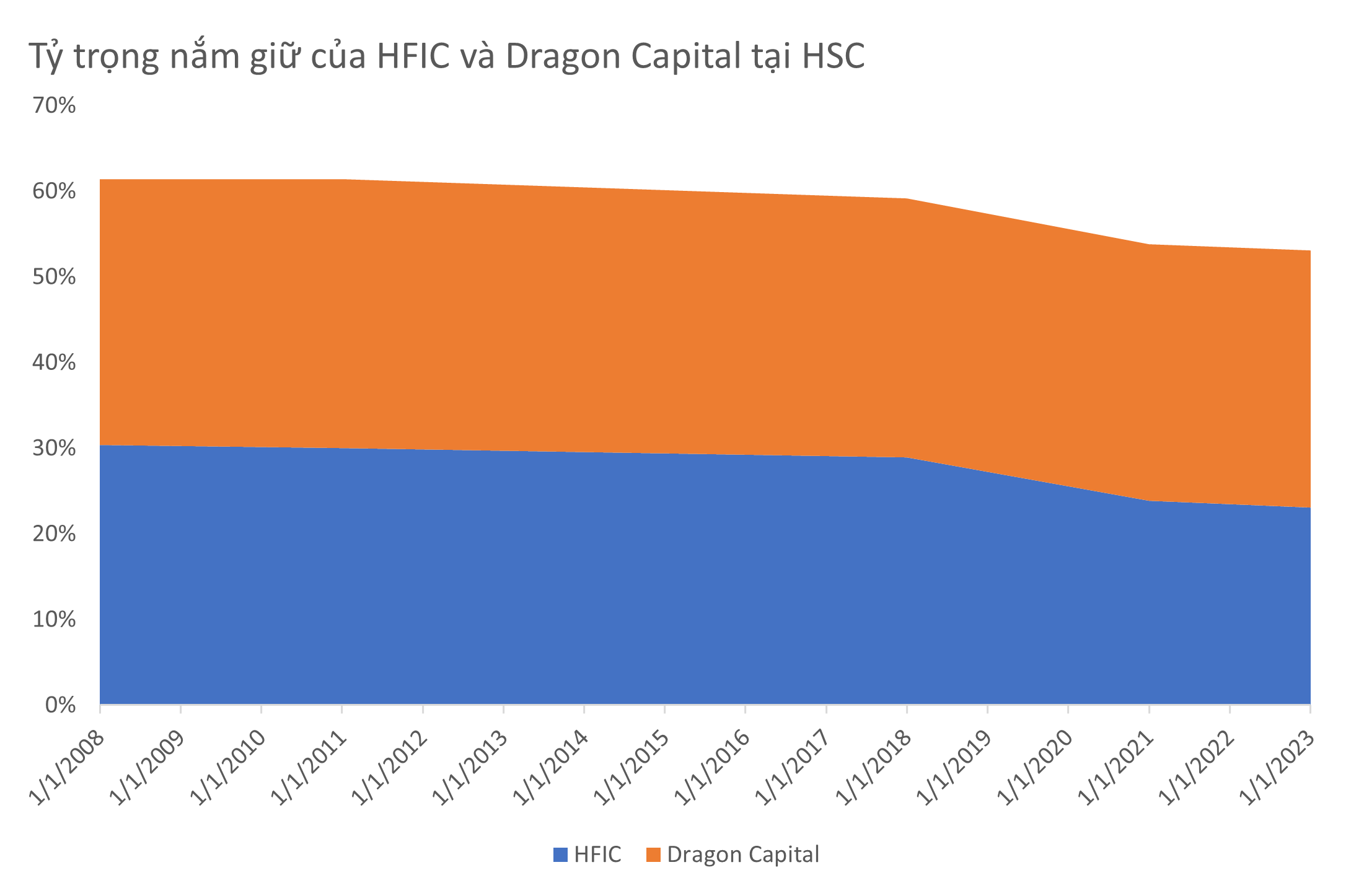

Dragon Capital – a strategic shareholder participating in HSC since 2005 has always maintained a ownership ratio of around 30% in HFIC, which is gradually decreasing.

|

Returning to the current auction session, there is a high possibility that HFIC will still exercise its right to purchase shares if there are no investors repurchasing the purchase rights in the 2024 capital increase round. Currently, the value of the auctioned rights is relatively large, and the market has not had a “wave” like in 2021, so there will be fewer interested investors.

However, this is a positive signal that shows that the management levels are more open in financial market operation. At the same time, the constraint on HSC’s capital increase has also been somewhat removed in the context of a series of securities companies like SSI, DNSE, ACBS actively increasing capital. Most recently, Guotai Junan Securities (IVS) announced a plan to double its charter capital to nearly 1,400 billion VND.

Quân Mai