The Fed signals that interest rate cuts are coming as inflation slows

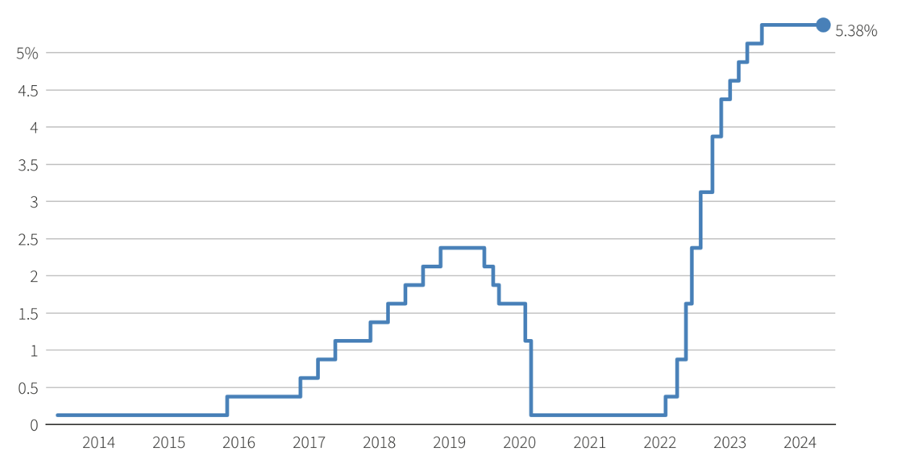

The U.S. Federal Reserve left interest rates unchanged Wednesday but signaled that its next policy move is more likely to be a rate cut. Fed Chair Jerome Powell also suggested that the Fed is unlikely to raise rates again, as markets had recently feared, even though the Fed sees progress in bringing down inflation as having stalled.

After three months of inflation coming in higher than expected, Powell said the Fed “will need to see a sustained decline in inflation” before it becomes “confident that inflation is moving back down to 2%” in comments following the Fed’s two-day policy meeting. For much of 2023, progress on inflation was running ahead of schedule, leading to expectations that the Fed might start cutting rates this year.

**FED WILL WAIT FOR MORE EVIDENCE OF EASING INFLATION**

Inflation has now largely stalled in the U.S. Powell said another rate increase is unlikely, but his comments at his press conference were interpreted as giving the Fed more room to hold its benchmark interest rate at its current level of 4.5% to 4.75%. That’s where it’s been since the Fed’s last rate hike in March.

Powell said Fed policymakers believe that current interest rate policy is exerting enough downward pressure on the economy to bring inflation under control, and they are willing to wait as long as necessary to become more confident that inflation is headed back to 2% before cutting rates. He said the Fed will wait even if inflation stays at its current elevated level.

The Fed’s preferred inflation measure, the personal consumption expenditures price index, rose 2.7% in March from a year earlier, an acceleration from the previous month.

“Inflation is still too high,” Powell said. “There is no guarantee that these recent lower monthly readings will be sustained. We will remain patient as the disinflationary process unfolds, and we will stay the course until the job is done.”

The head of the world’s most powerful central bank said he still expects inflation to come down over the rest of this year, but “my confidence in that process has diminished somewhat.”

Powell dismissed the prospect of another rate increase, something financial markets had begun to worry about recently. “I do not see us raising rates again. I would say it’s a very difficult case to make for raising rates again,” he said.

He was less certain about whether the Fed will cut rates later this year.

“If we were to get a sustained period where inflation comes in below expectations, the unemployment rate continues to go down, and inflation begins to come down more firmly, that would be an environment where it would be appropriate to consider moving policy in a more accommodative direction,” he said. “It may or may not be appropriate to cut rates. It really is going to depend on the data.”

Analysts at Evercore ISI said Powell’s comments were “materially less hawkish than markets generally feared going into the meeting. The clear takeaway is that the Fed has pushed out the timing of their rate cuts, but they have not ruled them out.”

**FED TO SLOW QT TO KEEP FINANCIAL SYSTEM LIQUID**

Interest rate futures markets continue to price in a strong likelihood that the Fed will begin cutting rates by September. The probability that the Fed will wait until later in the year to cut rates fell after this week’s meeting.

The Fed’s post-meeting statement also did not offer a clear signal about when rate cuts might begin, but it stressed policymakers’ concern that progress on inflation has slowed in the early months of this year.

“Recent developments suggest that the disinflationary process has slowed,” and “it will likely take some time to get inflation back down to 2% and longer to get inflation down to levels prevailing prior to the pandemic,” the statement said.

The Fed also announced at this meeting that it will slow the pace of its quantitative tightening (QT) program. Starting in June, the Fed will reduce the pace at which it allows bonds on its balance sheet to mature without being reinvested. The Fed will now allow $25 billion of U.S. Treasury bonds to mature each month without reinvesting, instead of $60 billion currently. However, the Fed will continue to reduce its holdings of mortgage-backed securities by $35 billion each month.

Slowing QT should ease financial conditions. The Fed is slowing QT, in part, to make sure that the financial system does not become as illiquid as it did in 2019 during the Fed’s last round of QT.

Asked if the U.S. is headed for a period of economic malaise marked by both high inflation and stagnant economic growth, known as stagflation, Powell said the current economic conditions do not resemble the 1970s, when U.S. inflation spiked above 10% at times and unemployment also rose.

“We now have an economy that has solid job growth and inflation below 3%. I don’t think we see a recession or out-of-control inflation,” Powell said.