The market is seeing a broad expansion of green. Today’s session had over 520 stocks rise, while only about 215 stocks fell.

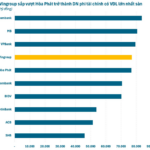

In the morning session, HPG was the strongest mover of the VN-Index. In the afternoon session, VCB joined in supporting the index. These two stocks contributed to an increase of over 4.5 points for the VN-Index. Large Cap stocks also rallied, with notable gains from VHM, GAS, CTG, TCB, VIC, VNM, DGC, and more.

Some sectors experienced slight declines today, including information technology (due to FPT’s drop); transportation and warehousing; accommodation, food services, and entertainment; and equipment manufacturing.

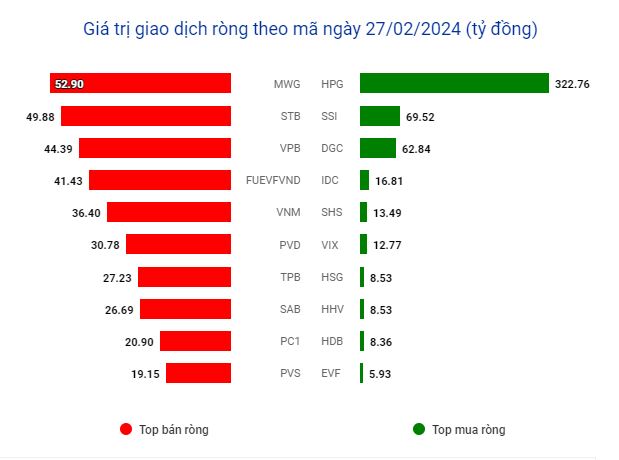

Foreign investors continued to aggressively buy HPG, ending the session with a net purchase value of nearly 450 billion VND. The trading volume for this stock also surged today, with a total of nearly 87 million shares traded. With strong capital flow, HPG rose by over 5.3%.

The total trading value for today’s session reached nearly 26 billion VND (across all 3 exchanges). Foreign investors had a net purchase of over 50 billion VND. Apart from HPG’s strong net buying, SSI, DGC, BID, DIG, and more also attracted attention.

Morning session: Foreign investors strongly accumulated HPG

By the end of the morning session, the VN-Index maintained its positive momentum with an increase of over 5 points, reaching 1,229.5 points. The HNX-Index increased by over 1 point, reaching 234.13 points.

In addition to HPG’s strong performance, stocks in the manufacturing sector such as VNM, DGC, and MSN also supported the market. Financial stocks including SSI, HDB, and BID also performed well.

Foreign investors had a strong net buying position for HPG. In the morning session, they net purchased over 320 billion VND.

* As of 11:30 am. Source: VietstockFinance

|

The finance and banking sector is generally positive but still mixed with declines. EIB, MSB, TPB, EVF, VIB, NAB, and more experienced slight drops.

In the real estate sector, VRE, PDR, NVL, DXG, and CEO had the highest liquidity. All of these stocks maintained gains, with VRE increasing by nearly 2 points.

The morning liquidity was equivalent to the previous session and slightly higher than the average of the past 5 sessions. The total trading value across all 3 exchanges in the morning reached over 13.4 trillion VND.

10:30 am: Continuing to increase

The optimism continues, even more positively. By 10:30 am, the VN-Index continued to rise by nearly 8 points, reaching 1,231.8 points. The HNX-Index increased by over 1 point, reaching 233.8 points.

HPG is leading the market. This stock increased by nearly 5% in the morning session and pushed the VN-Index up by more than 2.2 points. Not only HPG, but other steel stocks like HSG and NKG also showed positive movements, with gains of over 3%.

The information technology sector is thriving, with FPT, VGI, ELC, and CTR all performing well. The rubber sector is also optimistic, with SRC showing a significant increase and DRC and CSM also rising.

Market opening: Maintaining optimism

The market opened on February 27 with a positive mood. The VN-Index turned green right from the start. As of 9:45 am, the index increased by over 4 points, reaching 1,228.4. Meanwhile, the HNX-Index increased by 0.6 points, reaching 233.47 points.

The buying side is optimistic. With 340 stocks rising and over 170 stocks falling, it is clear that buying pressure is prevailing.

The manufacturing sector is leading the market, with stocks like HPG, MSN, VNM, DGC being the best performers for the VN-Index. On the declining side, banking stocks are exerting slight pressure, with ACB, MBB, VIB, and SSB all experiencing slight drops.

Most sectors are experiencing gains. Conversely, the transportation-warehousing and equipment manufacturing sectors are slightly declining.

Dong Tu