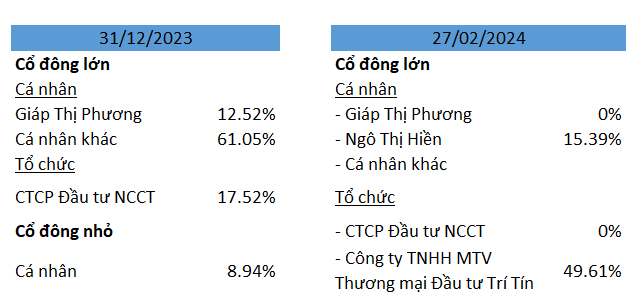

In terms of selling, Ms. Giap Thi Phuong – Chairwoman of CASC and NCCT Investment Corporation transferred all of her shares, 12.5% and 17.52% respectively.

On the other hand, an individual and an organization received 65% of CASC’s capital. Specifically, Ms. Ngo Thi Hien received more than 4.6 million shares, equivalent to 15.39% of the capital. Trí Tín Trading and Investment Limited Company received 13.8 million shares, accounting for 49.61% of the capital.

|

Ownership changes in CASC

Source: Compiled by the author

|

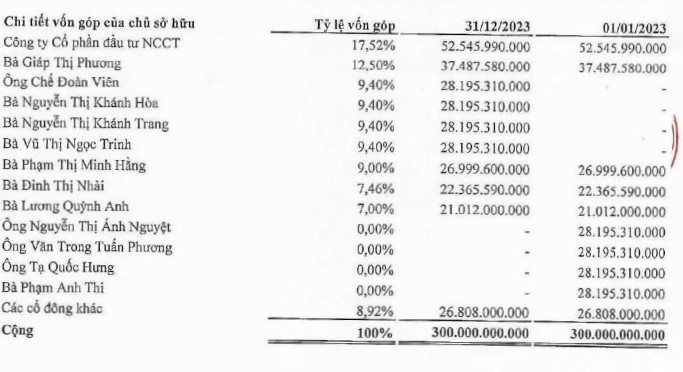

As of December 31, 2023, the shareholder structure of CASC only has one organization, NCCT Investment Corporation (owning 17.52%).

The total shares transferred by Ms. Giap Thi Phuong and NCCT Investment Corporation is over 30% of the capital, lower than the amount transferred by the two new shareholders.

With the transfer of 65% of the capital to Ms. Ngo Thi Hien and Trí Tín Trading and Investment as mentioned above, it is likely that many individual shareholders have also decreased their capital in CASC.

|

List of shareholders of CASC

Source: CASC

|

Trí Tín Trading and Investment was established in September 2023, headquartered in Thu Duc City, Ho Chi Minh City. Initially, the company’s name was Thanh Long Real Estate One Member Limited Liability Company, with a charter capital of 95 billion VND. The registered business line is real estate trading. As of February 2024, the company only has 1 employee.

The legal representative of the company is Mr. Nguyen Ba Long (born in 1993). Mr. Long is also the Chairman.

Regarding the organization that has stepped down as a major shareholder of CASC, NCCT Investment Corporation was established in April 2021, with an initial charter capital of 100 billion VND, which was later increased to 110 billion VND in August 2021. The company has 3 founding shareholders. The registered business line is also real estate trading.

CASC was established in 2006 with an initial charter capital of 60 billion VND. From 2009-2019, due to changes in business direction, the company reduced its brokerage, underwriting, and proprietary trading activities.

In 2020, the company returned with restructuring initiatives to restore its business activities. As of 2021, the charter capital of the company is 300 billion VND. The company is licensed to conduct brokerage, proprietary trading, and underwriting activities again.

On August 31, 2021, Bamboo Financial Corp (BFC) – a member of Bamboo Capital Group (BCG) – completed an investment transaction and became a major shareholder of CASC with a 20% ownership stake. However, by December 2022, Bamboo Financial Corp had divested its stake and was no longer a major shareholder of this securities company.

| Profit and cumulative profit of CASC |

After the restructuring, CASC’s business performance improved during the 2020-2022 period. In 2022, the company’s after-tax profit was nearly 8 billion VND.

However, in 2023, the company recorded a sharp drop in after-tax profit to over 700 million VND.