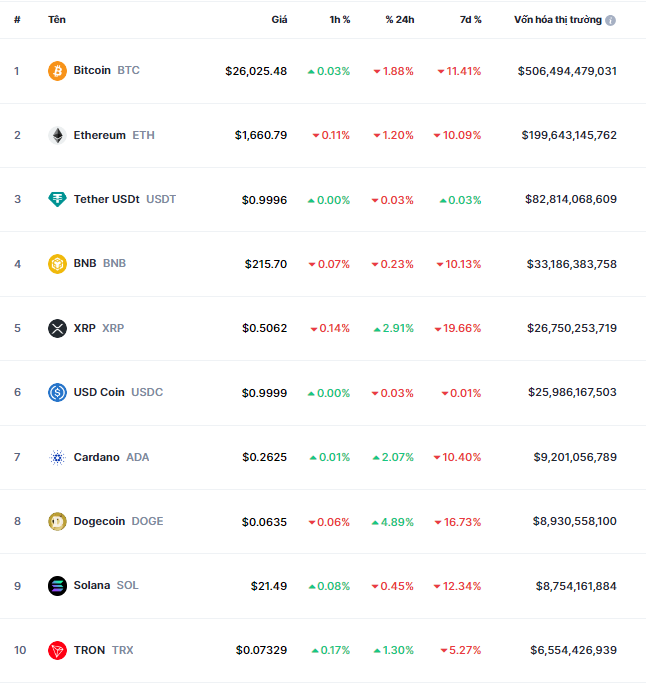

Reviewing Last Year’s Spending Habits

The transition between the new year and the old year is the time to review the income and expenses in the past 12 months, in order to adjust the money-making plan and accumulate for the next phase. If you find yourself stuck in the “paycheck-to-paycheck” cycle every month, compare and consult the famous 50-30-20 financial rule to use money more effectively.

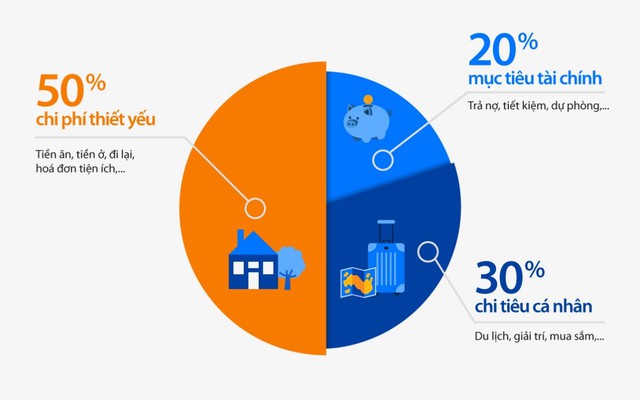

The 50-30-20 rule, initiated by Senator Elizabeth Warren, suggests dividing income into 3 parts: 50% for essential expenses (rent, utilities, groceries, gas…), 30% for personal spending (travel, entertainment, clothing, education…), and 20% for savings and investments to secure your financial future.

According to this rule, total expenses should only account for 80% of income, and even lower to 50% if you want to increase savings. If it exceeds this amount, you should review if there are any unnecessary expenses that can be reduced this year.

To be more disciplined with spending, many people have applied 2 principles: 1) Convert the value of expensive items into the number of hours it takes to earn the corresponding amount of money; and wait for 24 hours with inexpensive items to delay the desire. This method will make you take more time to consider before buying anything, however, it is very effective for those who want to become savvy consumers.

Planning Your Spending for the New Year

After evaluating last year’s spending habits, you should plan your finances more reasonably and implement them more disciplined. One of the popular methods is to set aside a consumer fund immediately when receiving salary, to avoid overspending into savings. For expenses that cannot be eliminated, you can save more by choosing non-cash payment methods to maximize promotional programs.

For example, with VIB credit cards, you can save millions of VND each month when shopping and receive cash back/points with the highest ratio in the current market.

Young people who have a habit of online shopping should take advantage of the cash back rate of up to 3% on online spending in the country and 6% abroad with VIB Online Plus 2in1, even up to 50% with VIB LazCard. VIB Cash Back can refund up to 24 million VND/year if you register a fixed expense category such as dining, entertainment or insurance…

VIB Rewards Unlimited has a high points accumulation rate for rewards at supermarkets and doubles total rewards points for each month’s statement over 10 million VND, suitable for food shopping for the family.

Parents have to allocate a larger budget for education investment for their children, so they should open a VIB Family Link card to enjoy 0% installment for education expenses, both lightening the financial burden each month and accumulating points for rewards.

For those who often go on business trips or set a goal to travel 2-3 times a year, they should open a VIB Travel Élite or VIB Premier Boundless card to enjoy free access to airport lounges, accumulate reward miles to exchange for Vietnam Airlines tickets.

The spending plan for 2024 should also be prepared for times when more than usual spending is needed, such as: Tet holidays, summer travel season, personal and others’ birthdays, etc. Your spending journey will be more complete if you own the VIB Super Card, which can switch spending categories according to the needs of each period to receive an instant 15% refund.

Credit cards will be the ideal financial tool to save money when spending for essential needs in life, as long as you use them correctly and pay off the balance on time each month.

Instant Savings When Spending

In addition to waiting for credit card cash back at the end of each billing cycle, cardholders can save more immediately when spending by taking advantage of discounts of up to 30% when shopping, entertainment, dining, and traveling…

VIB is currently offering a 10% cash back promotion for cardholders who spend from 1,000,000 VND at Lotte Mart stores; a 100,000 VND discount when shopping on Shopee; 50% off beauty and healthcare services…

For those who travel every year, you can also save millions when joining the VIB cardholder club with the attractive Mastercard Travel Rewards program that offers cash back of up to 20% at over 400 brands and 20 duty-free shops worldwide, valid until 12/31/2024. In addition, programs offering 10% off or 250,000 VND off when buying Vietnam Airlines tickets, buying services on Klook, booking rooms on iVIVU… will take place throughout the year.

Especially, during the beginning of the year, VIB customers will receive 3 simultaneous unprecedented offers if they open a card before March 31. Specifically, VIB will waive the annual fee for the first year if you open the card on special days (double days 2/2 and 3/3; International Women’s Day; VIB card day every 20th of the month; cardholder’s birthday) and spend at least 3,000,000 VND within 30 days.

Cardholders will be reimbursed up to 10% based on spending, up to a maximum of 1,500,000 VND in the first 3 months of card issuance, and receive an additional annual fee refund for supplementary cards.

The annual fee for the following year will continue to be waived if the accumulated spending reaches from 12,000,000 VND/month.

Open a VIB card here to spend efficiently and be ready for a financially secure and abundant year!