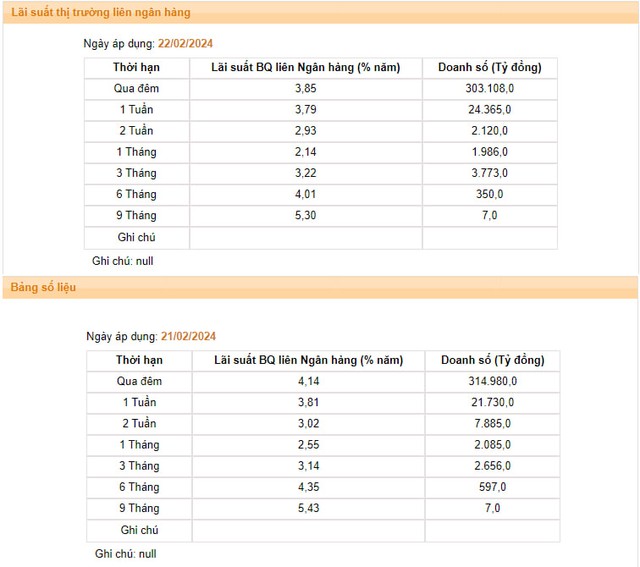

According to the latest data from the State Bank of Vietnam (SBV), the average interbank VND interest rate for overnight term (the main term, accounting for about 90 – 95% of the transaction value) in the session on February 22 decreased to 3.85% from 4.14% in the session on February 21.

Along with the overnight term, interest rates for other key terms also decreased: 1-week term decreased from 3.81% to 3.79%; 2-week term decreased from 3.02% to 2.93%; 1-month term decreased from 2.55% to 2.14%. Meanwhile, the 3-month term increased from 3.14% to 3.22%.

Source: SBV

Prior to this, the interbank interest rate had continuously increased sharply in the first 3 sessions of the week, with the overnight term exceeding 4% and reaching the highest level since the end of May 2023. The 1-week to 1-month terms also increased significantly.

In this context, the SBV has conducted 2 consecutive sessions of injecting liquidity into the banking system through the open market operations (OMO) channel for lending against valuable papers (OMO). Specifically, in the sessions on February 20 and 21, there was 1 market member winning OMO tender with a total accumulated volume of more than VND 6,037 billion, a 7-day term and an interest rate of 4% per year.

This is the first time that the SBV’s liquidity support channel has seen significant transactions. Previously, OMO lending activities had virtually no transactions in the second half of 2023 and the beginning of 2024, despite the SBV’s continued tender activities to support liquidity for banks in need.

The sharp increase in interbank interest rates, along with the resurgence of borrowing and lending through the OMO channel after many months of “freeze”, indicates a shortage of liquidity in the system after the Lunar New Year holiday. However, the rapid and strong increase in interbank interest rates, with the overnight term still higher than the 1-week to 3-month terms, shows that this development is more short-term in nature.

In fact, after 2 consecutive sessions of injecting liquidity, the SBV no longer needs to support liquidity in the banking system in the session on February 22 and 23. In addition, the overnight term interest rate remains inverted (higher than the 1-week to 3-month terms), indicating the market’s expectation that interbank interest rates will continue to cool down in the future.

Sharing with the writer, an expert with many years of experience in the Capital and Bond Market segment of banks said that the sharp increase in interbank interest rates after the holiday was partly due to the withdrawal of deposits by individuals and businesses from the system to spend during the Lunar New Year holiday, which has not yet returned to the system. At the same time, the need for reserve compensation from a credit institution also contributes to the pressure on system liquidity. In addition, the need for foreign currency payments to serve the importation of petroleum products also affects the VND liquidity of the system when foreign currency exchange transactions increase.

This expert predicts that interbank interest rates will soon cool down in the future when people’s deposits return to the system after the Lunar New Year holiday and short-term influencing factors pass.