$22 billion Bitcoin ETF traded in the past 5 days. ETFs have seen strong inflows in the past week, which has helped Bitcoin experience an impressive price increase.

Bloomberg senior analyst, Eric Balchunas, has observed significant growth in the Bitcoin Spot ecosystem. Balchunas revealed that $22 billion Bitcoin ETF traded in the past 5 days, equivalent to the trading volume of the previous month.

The analyst noted that BlackRock’s IBIT alone traded over $1 billion daily in the past week. However, he advised caution and emphasized the need to monitor the activity of ETFs in the coming week.

Meanwhile, Balchunas’ post disclosed the top-performing funds in the past week including BlackRock’s IBIT, Grayscale’s GBTC, and Fidelity’s FBTC.

These ETFs consistently bring in significant volumes and attract massive capital inflows into the Bitcoin ecosystem.

Notably, the influx of ETF spot capital has led to an impressive price increase for Bitcoin, as Bitcoin has experienced a remarkable surge breaking the $60,000 mark since its last bull run.

In the latest surge, Bitcoin’s weekly performance marked a 25% increase, a weekly performance that Bitcoin hasn’t seen in years. Many users believe that Bitcoin ETFs themselves had an impact on this price surge.

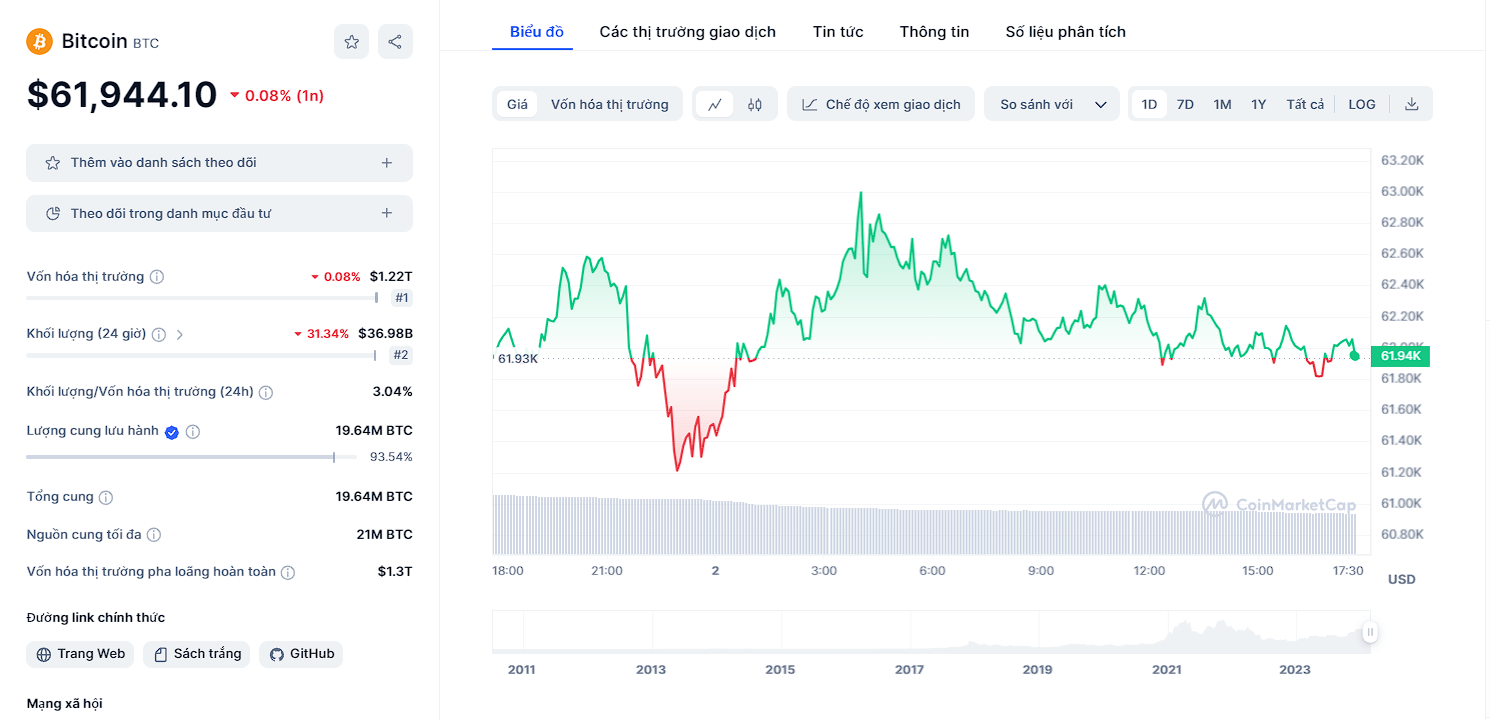

However, recent market action shows a downward trend in BTC’s price, with some experts suggesting that a price correction is necessary for capital rebalancing, after which prices will reverse and create another impressive surge.

At the time of writing, Bitcoin is trading at $61,944.1 and has experienced a 0.08% decline in the past 24 hours.