In 2023, there was a positive shift in investment and an expectation of enhanced investment cooperation from the economic diplomatic activities of the Vietnamese Government and localities. This greatly contributed to the success in the industrial park real estate segment.

According to statistics from the Ministry of Planning and Investment, as of the end of 2023, there were a total of 416 industrial parks established nationwide. The total industrial land area was about 89.2 thousand hectares, a 1.5% increase compared to the same period. The leased land area in industrial parks reached 51.8 thousand hectares, nearly a 6% increase, with an occupancy rate of 58%. Specifically, the occupancy rate of operational industrial parks was over 72%.

In 2023, registered FDI capital reached 36.6 billion USD and disbursed FDI capital reached 23 billion USD, a respective increase of 32% and 3.5% compared to the previous year. Foreign investors invested in 18 out of the total of 21 national economic sectors. In particular, the real estate business sector ranked second with a total investment capital of nearly 4.67 billion USD, accounting for over 12.7%, a nearly 5% increase.

Where did the massive profits come from?

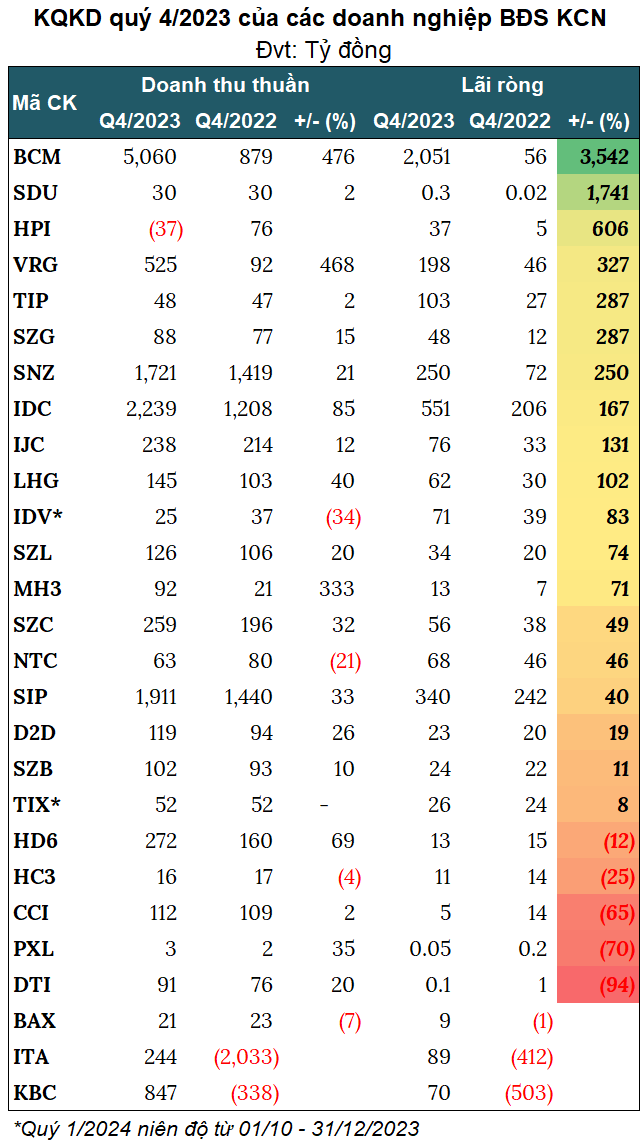

According to statistics from VietstockFinance, 27 industrial park real estate companies listed on the stock exchanges (HOSE, HNX, UPCoM) reported Q4/2023 financial statements, showing that none of them incurred losses. Specifically, 19 companies saw increased profits (accounting for 70%), 3 companies transformed losses into profits, and 5 companies experienced reduced profits.

Source: VietstockFinance

|

The growth list shows that there were dozens of companies with multiplied profits in the past year. Specifically, in Q4/2023, Becamex IDC (BCM) stood out the most. Its real estate business and investment in real estate generated revenues of over 4.67 trillion VND, a 20-fold increase compared to the same period, accounting for 90% of its net revenue. Net profit reached 2.051 trillion VND, a 36.4-fold increase compared to the same period. This is BCM’s most profitable quarter since its listing on HOSE in 2020.

At the end of 2023, Becamex IDC transferred the entire Tan Thanh Binh Duong complex urban area and residential project to Sycamore Co., Ltd., a subsidiary of CapitaLand. The project covers an area of nearly 20 hectares, with a transfer value of 5.085 trillion VND.

Based on the balance sheet, as of December 31, 2023, Becamex IDC still had short-term receivables of nearly 2.776 trillion VND from Sycamore. Therefore, Sycamore may only make partial payments after receiving the project transfer.

CP Urban and Industrial Development Corporation – Vietnam Rubber Industry Group (VRG) also achieved a record profit in Q4/2023 since its listing in 2014, earning over 198 billion VND, a 4.3-fold increase compared to the same period. VRG stated that in Q4, the company recognized 90% of the value of two contracts for leasing land attached to infrastructure in Cong Hoa Industrial Park, Chi Linh, using the one-time recognition method for revenue.

Thanks to a seven-and-a-half-fold increase in financial revenue compared to the same period, reaching over 92 billion VND, from a cooperation deal with Petroleum Port Investment and Exploitation Joint Stock Company (PAP), investment transfer income at Olympic Coffee Corporation from related investment to other investment, and dividends from Phuoc Tan Trading and Construction Corporation (an affiliate company), Tín Nghĩa Industrial Park (HOSE: TIP) achieved nearly 103 billion VND in net profit, a 2.4-fold increase compared to the same period. This is also the highest net profit quarter for TIP since its listing on HOSE in 2016.

Rental revenue from infrastructure and pre-built factories tailored to the requirements of Long Hau Corporation (HOSE: LHG) in Q4 increased by 140%, reaching over 76 billion VND, helping Long Hau earn almost 62 billion VND in net profit, a 90% increase.

In addition, there are many other companies with multiplied net profit, such as Song Da Urban Development and Construction Investment Joint Stock Company (SDU) with over 300 billion VND, an 18.4-fold increase; Hiep Phuoc Industrial Park (HPI) with over 37 billion VND, a seven-fold increase; Sonadezi Giang Dien (SZG) with 48 billion VND, a 3.9-fold increase; Sonadezi Corporation (SNZ) with 250 billion VND, a 3.5-fold increase; Infrastructure Development Joint Stock Company (IDC) with nearly 551 billion VND, a 2.67-fold increase; and Becamex IJC (IJC) with 76 billion VND, a 2.3-fold increase.

The companies with the lowest business performance

The worst performing company in the quarter was Duc Trung Investment Joint Stock Company (DTI), with a net profit of just over 63 million VND, a 94% decrease. DTI attributed this to the frozen real estate market and the large costs incurred due to its stimulus policies, causing a decline in profits.

Following closely behind is Long Son Petroleum Industrial Park Investment Joint Stock Company (PXL), which also had a net profit of nearly 46 million VND, a 70% decrease.

In Q4, the net profit of No. 6 Hanoi Construction and Development Investment Joint Stock Company (HD6) reached over 13 billion VND, a 12% decrease, as the company’s total expenses in the period increased to 46 billion VND, 4.5 times higher than the same period. This is the main reason for the decline in HD6’s net profit.

In addition, two other companies also recorded a decrease in net profit in Q4: Hai Phong Construction Joint Stock Company No. 3 (HC3) with nearly 11 billion VND, a 25% decrease, and Cu Chi Industrial and Commercial Development Investment Joint Stock Company (CCI) with nearly 5 billion VND, a 65% decrease.

In contrast to Q4/2022, three companies turned losses into profits in Q4/2023. One notable example is Kinh Bac Urban Development Corporation – Joint Stock Company (KBC) with a net profit of 70 billion VND, compared to a loss of 503 billion VND in the same period.

No longer experiencing negative revenue like the previous year, Investment and Industrial Development Corporation Tan Tao (ITA) achieved a net profit of 89 billion VND in Q4/2023 (compared to a loss of 412 billion VND in the same period). This is due to the absence of nearly 2.2 trillion VND in returned goods resulting from the liquidation of long-term land lease contracts related to the Kiên Lương Power Center for New Energy Development Joint Stock Company (TEDC) in 2022.

Thong Nhat Joint Stock Company (BAX) achieved a net profit of over 9 billion VND, compared to a loss of over 1 billion VND in the same period, thanks to a reduction in the cost of goods sold and expenses.

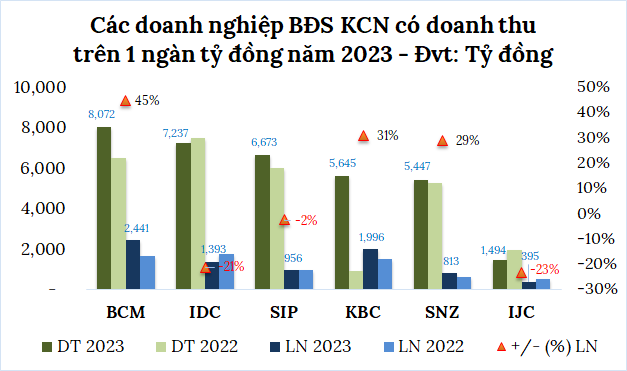

Which companies achieved over one trillion VND in revenue in 2023?

A total of 6 out of 27 companies achieved revenue of over one trillion VND in 2023. Topping the list is Becamex IDC with revenue of 8.072 trillion VND, a 23% increase compared to the previous year. Net profit exceeded 2.441 trillion VND, a 44% increase. This is also BCM’s highest profit year since its listing on HOSE in 2020.

| BCM’s revenue and net profit from 2020 to 2023 |

Not far behind BCM, IDICO had revenue of 7.237 trillion VND and net profit of 1.393 trillion VND, a respective decrease of 3% and 21% compared to 2022. The main contributors to IDC’s revenue in 2023 were the industrial park infrastructure sector, earning over 3.297 trillion VND (accounting for 46%), and the electricity business, earning nearly 2.924 trillion VND (accounting for 40%).

Source: VietstockFinance

|

With a doubled profit in Q4, Sonadezi ended 2023 with a 29% increase in profit, reaching 813 billion VND. This is the second-highest profit year for SNZ since its listing, surpassed only by 2021. SNZ’s revenue reached 5.447 trillion VND, a 3% increase.

Other companies with revenue of over one trillion VND in 2023 include Saigon VRG Investment Joint Stock Company (SIP) with 6.673 trillion VND, an 11% increase; KBC with 5.645 trillion VND, nearly a six-fold increase; and Infrastructure Development Technical Joint Stock Company (Becamex IJC) with 1.494 trillion VND, a 24% decrease.

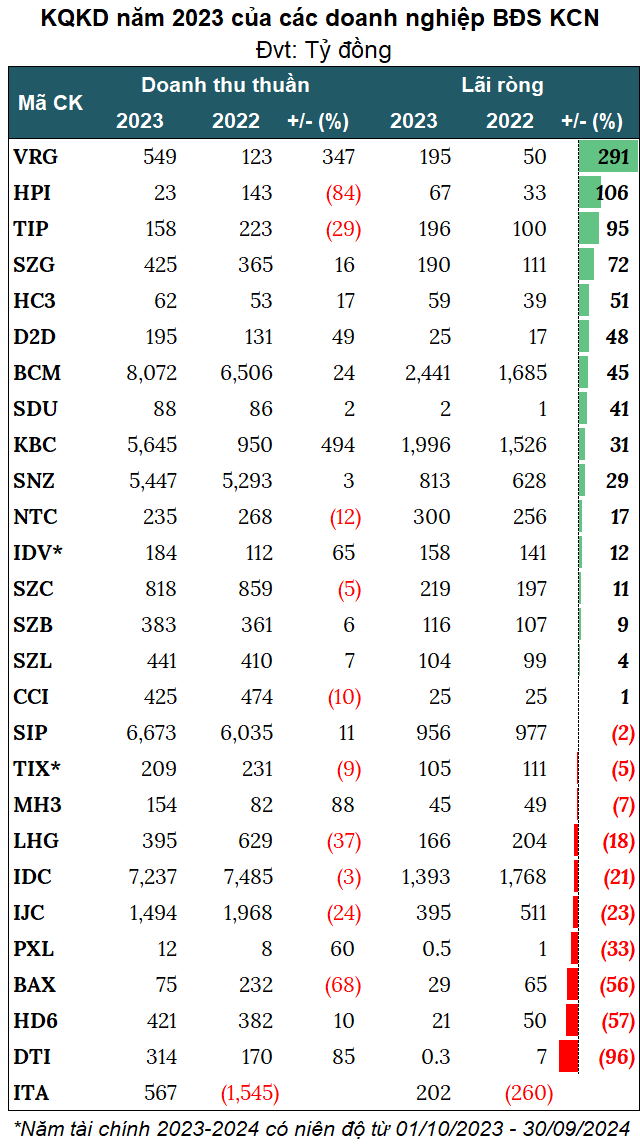

In general, in 2023, the entire industrial park real estate industry made remarkable progress. Out of the 27 companies, 16 saw profit growth, 1 transformed losses into profits, 10 experienced decreased profits, and none incurred losses.

Source: VietstockFinance

|

Thanh Tu