According to the Chairman, there are still many opportunities for Bach Hoa Xanh (BHX), especially in markets that BHX has not yet reached in the northern and central provinces, even with a lot of potential in provinces and cities that already have BHX stores.

Also at the meeting, Mr. Pham Van Trong – General Director of Bach hoa xanh shared about the plan to open 100 BHX stores in 2024, focusing on Ho Chi Minh City, specifically in areas such as district 4 and district 7, which have a dense population but not yet have many stores.

Updating the business results, Ms. Le Thi Thu Trang – Investment Director and Shareholder Relations shared, based on preliminary calculations, the average revenue of BHX stores is about 1.8 billion VND at the end of 2023 still maintained in the first 2 months of 2024. Meanwhile, the revenue of The Gioi Di Dong and Dien May Xanh chains also remained stable compared to the previous year, despite the context of a reduction in the number of stores.

The newly opened BHX stores in the second half of 2023 have revenues ranging from 900 million to 1.4 billion VND, mainly with an area of 150-200 square meters, mostly located in apartment buildings, most of them have achieved their revenue and EBITDA breakeven targets for the store within 3-6 months after opening. Depending on the store, CAPEX investment costs range from 1.5-2.5 billion VND, depreciated over 5 years.

Also related to the activities of BHX, Mr. Trong said that logistics costs currently account for about 4-4.5% and the company aims to reduce this ratio to about 3.5% by the end of 2024. Cost reduction, including logistics costs and store operation costs, is also emphasized by this CEO as one of the important goals of BHX in 2024, along with the focus on improving quality, safety and shopping experience to drive revenue.

Regarding the business results in 2024, according to Mr. Trong, for old stores, the average revenue of 2 billion VND/store/month is completely within reach, because in fact, many areas have reached that level. However, in the context of opening many new stores, the ability to achieve this figure when calculated for all may not be feasible.

Image inside Bach Hoa Xanh store

|

In another development, when asked about the progress of the sale of shares and valuation for BHX, MWG said that due to the confidential nature of the information, it cannot share details.

Recently, on February 28, information from Reuters related to the asset management company CDH Investments from China negotiating to buy a minority stake in the BHX chain has attracted public attention. If an agreement is reached, the valuation of the chain could reach $1.7 billion.

CDH is known as one of the largest alternative investment firms in China and is also a familiar partner of MWG when it used to hold shares here. An anonymous source from Reuters said that CDH is one of the leading candidates in buying back 10% of the stake in Bach Hoa Xanh, after surpassing many other competing opponents.

“CDH is targeting a 5 – 10% stake” – quoting a source from Reuters. However, this source notes that the story is still under negotiation, and there is no guarantee that the deal will actually happen. Another source revealed that the deal “could be completed as early as next month if the negotiations proceeded smoothly.”

Familiar partner from China wants to buy Bach Hoa Xanh shares, valuing it at $1.7 billion?

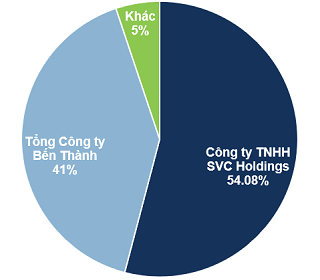

As of the end of 2023, MWG held 99.95% of the capital in Bach Hoa Xanh Trading Joint Stock Company, in the total charter capital of nearly 13,882 billion VND of the legal entity owning the fresh food and necessities chain BHX.

Regarding the business results of BHX in the past year, in the context of the retail sector still facing countless difficulties and dragging down the business results of MWG, the revenue of the BHX chain saw a growth rate of 17%, reaching nearly 32 trillion VND. In which, fresh food items increased by 35-40% and FMCGs group increased by 5-10%.

|

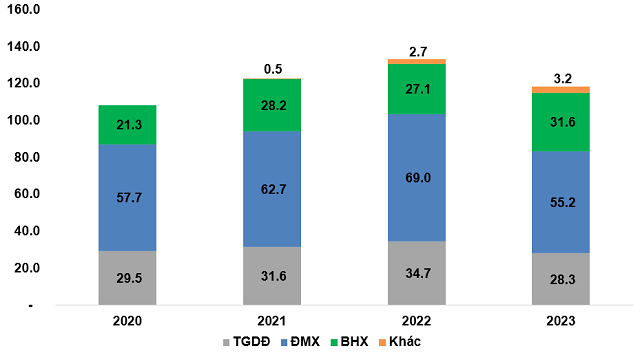

Bach Hoa Xanh is contributing more and more to MWG’s revenue

Unit: Billion VND

Source: VietstockFinance

|

|

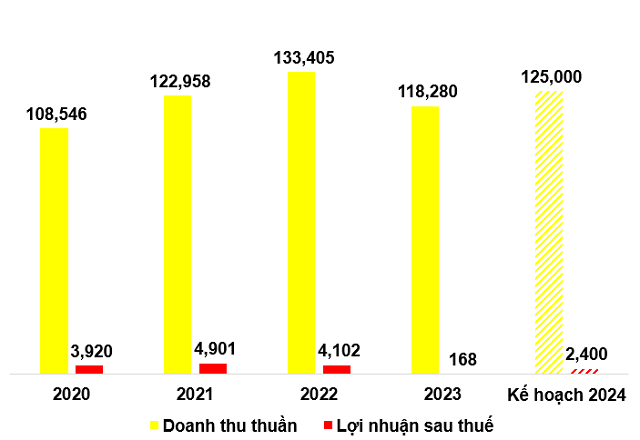

MWG sets a business plan to recover in 2024

Unit: Billion VND

Source: VietstockFinance

|