Since the beginning of November 2023 until the trading session on February 28th, the stock of HCM Securities Joint Stock Company has increased by 68% on HOSE. This is also the period when information about capital increase and the implementation of the auction of rights to existing shareholders of HFIC has attracted a lot of attention from investors in the stock market.

| Securities stocks need to show a more impressive price performance, providing enough returns to compensate for the inherent weaknesses of the industry. |

The price increase of HCM stock has brought encouragement to investors interested in the auction of HFIC shareholders, which was held on February 28th. However, it is also a way to help the stock market create highlights in the context where the profit potential is still not truly impressive.

Typically, for every stock investment, investors always build expectations based on capital gains and dividends.

However, with the securities stock group, dividend payments are considered a short-term trade-off as companies in the industry, especially securities companies, continuously increase capital to gain market share and expand margin lending.

In fact, the high level of competition in the securities industry is also reflected in the efficiency of operations of companies.

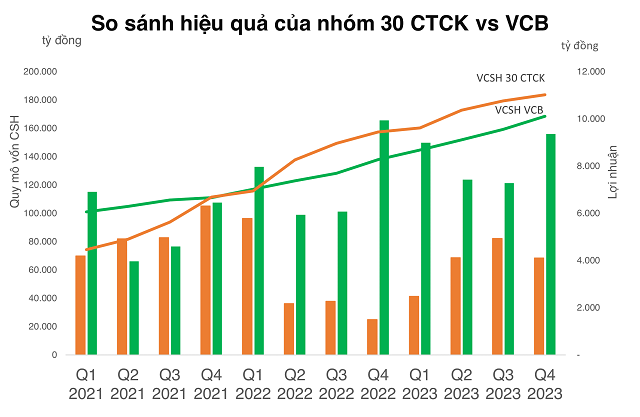

According to data compiled from 30 securities companies, the scale of shareholders’ equity of these 30 companies has exceeded the scale of the banking giant VCB since the second quarter of 2022, reaching over 183 trillion VND at the end of 2023.

However, from the second quarter of 2022 until now, there hasn’t been a single quarter where the profit of these 30 securities companies can be compared with VCB. VCB’s after-tax profit in the fourth quarter of 2023 alone is more than twice the total gross profit of the 30 securities companies combined, reaching 9,360 billion VND.

Simply put, VCB’s ROE is regularly maintained at over 20% per year, while the 30 securities companies currently reported in the statistics are only fluctuating around 10% per year.

Although the above comparison is somewhat biased, in terms of long-term investment, investors can still fully consider when faced with the decision to choose between banking stocks and securities stocks.

At the same time, this also requires securities stocks to show a more impressive price performance, providing enough returns to compensate for the inherent weaknesses of the industry, as in the case of HCM stock recently.

In the newly released 2024 strategy report by SSI Research, besides HSC, large securities companies like SSI, VCI, and VND are also recognized for their capital increase plans.

In addition, recently, there have been more securities companies such as ORS and IVS announcing capital increase plans. ORS is currently implementing a capital increase from 2,000 billion VND to 3,000 billion VND and the stock price has increased by more than 16% since the beginning of 2024.

Meanwhile, IVS stock has been flat until the announcement of a doubling of capital to nearly 1,400 billion VND. In just 2 trading sessions from February 23rd to 26th, IVS surprisingly increased by over 20%.

According to statistics until the end of the trading session on February 28th, the securities stock group currently has only 10 out of 35 stocks that perform better than the VN-Index.

The only stock that has increased by over 30% is TVB, while many banking stocks such as CTG, MBB, and TCB have provided returns of over 30% for investors since the beginning of 2024.

Quân Mai