The artificial intelligence (AI) frenzy is propelling technology stocks to new heights. In the US, chip manufacturer Nvidia has achieved an astonishing leap in market capitalization, nearing $2 trillion. On the other side of the globe, the stock of FPT Corporation, Vietnam’s leading technology conglomerate, is also reaching new highs.

FPT’s market capitalization on February 28 broke a record, reaching VND 137.8 trillion ($5.6 billion), a growth of VND 15.7 trillion since the beginning of 2024. This result solidifies FPT’s position as the number one technology company by market capitalization and brings the corporation closer to being among the top 10 most valuable listed companies on the Vietnamese stock exchange.

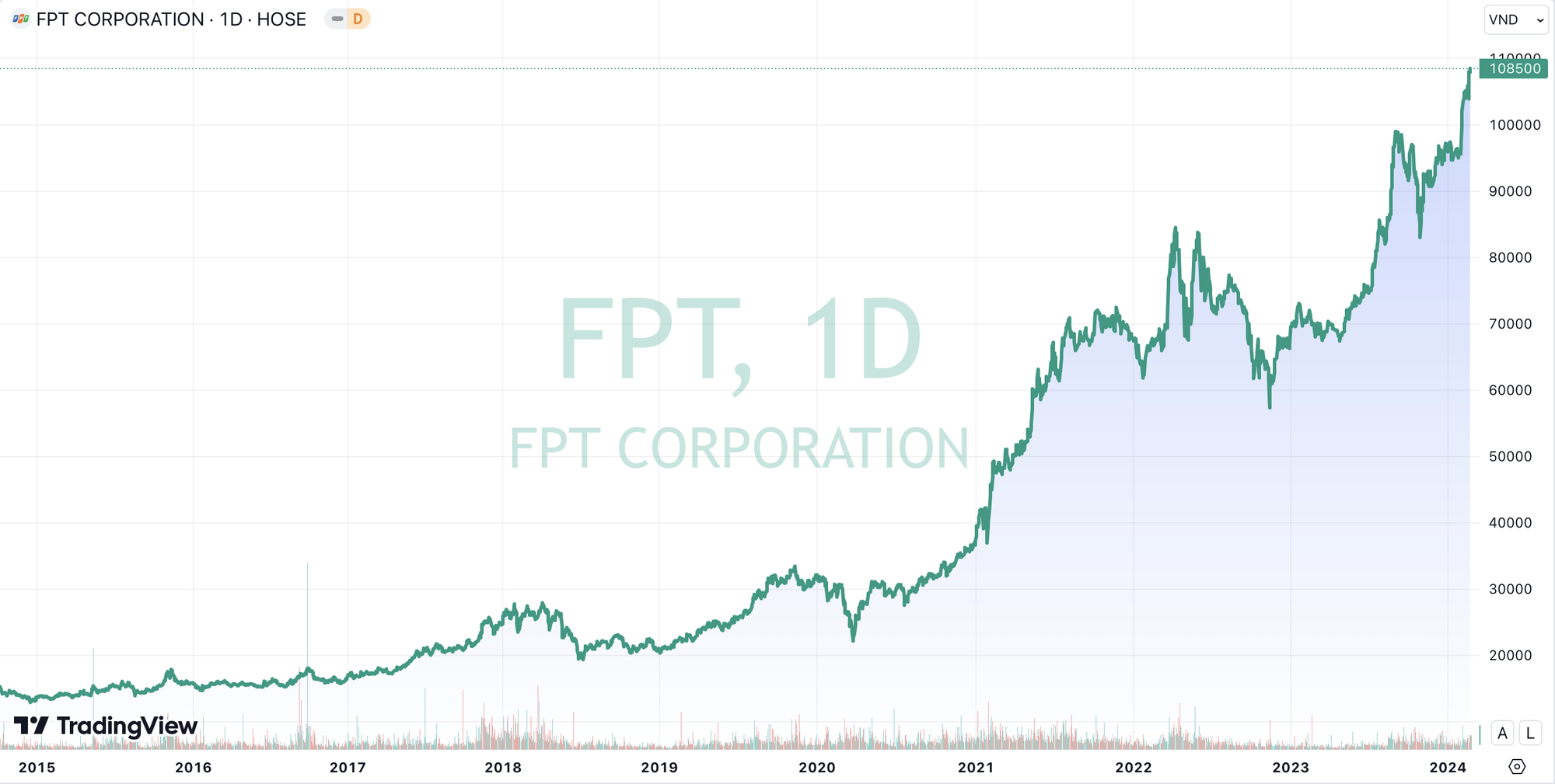

Although not experiencing the same rapid growth as its global counterparts, FPT has proven its resilience. Over the past decade, the value of the technology conglomerate has increased nearly 11-fold, with an annual compound growth rate of almost 27%, an impressive figure. The only year in which FPT did not see growth was 2018.

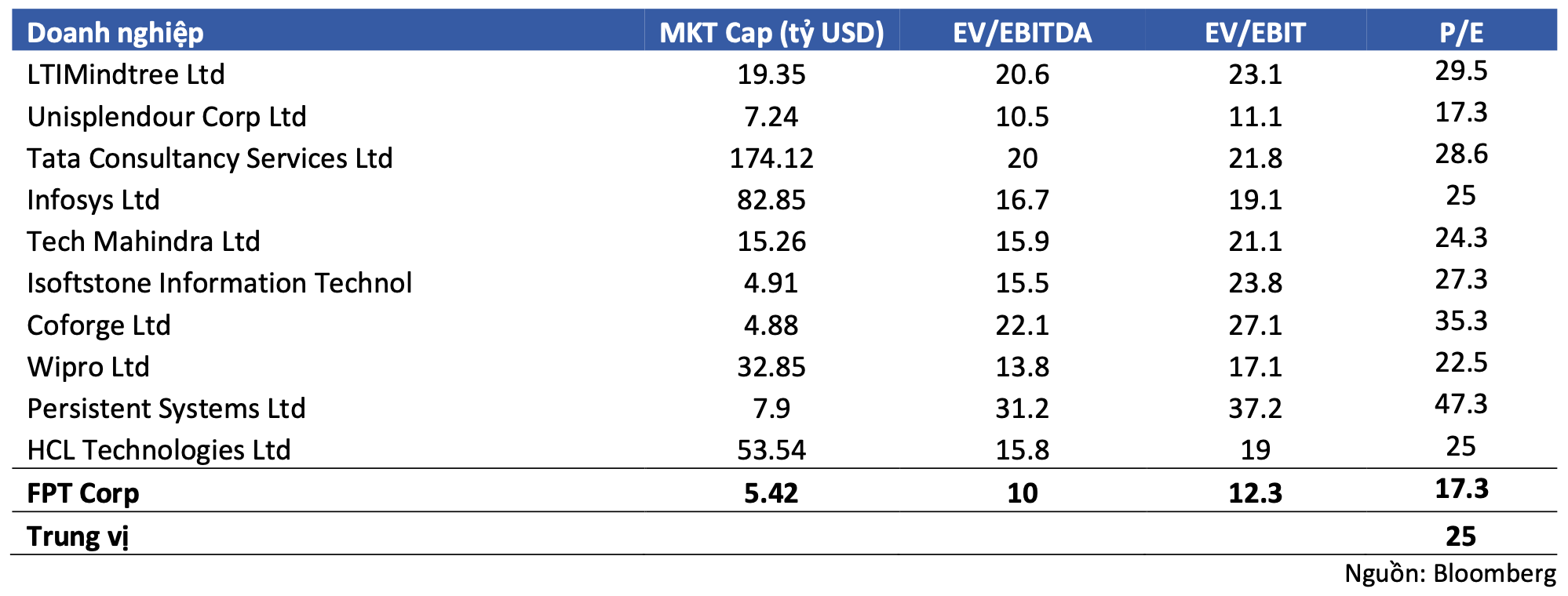

Notably, despite its consistent growth over the years, FPT’s valuation according to BSC remains relatively low, potentially not fully reflecting its long-term growth potential. Metrics such as EV/EBITDA, EV/EBIT, and P/E, as calculated by Bloomberg, are all among the lowest in the region.

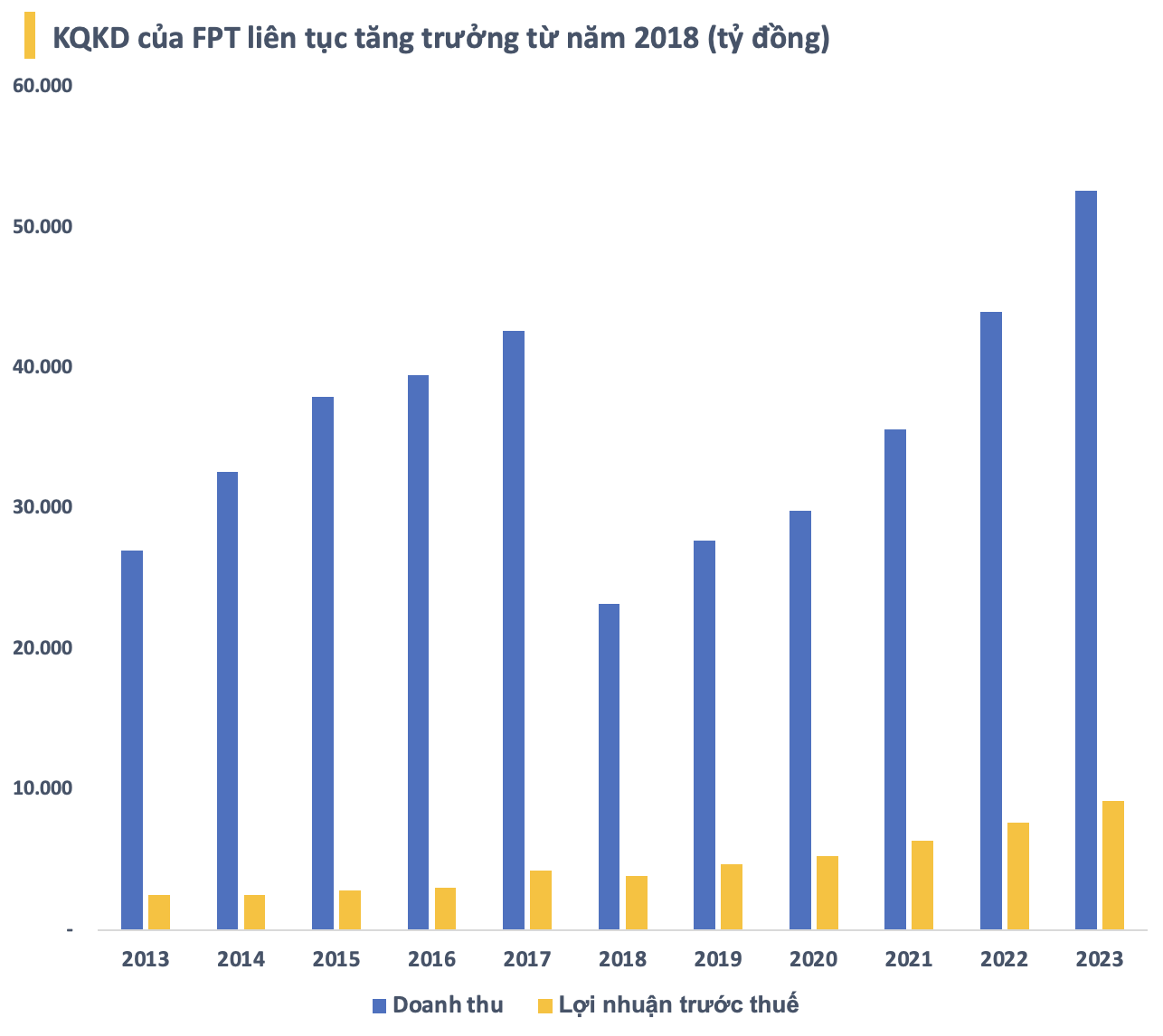

Steadily Impressive Profit Growth

FPT’s growth in recent years has been supported by a strong fundamental foundation. Since restructuring its operations in 2018, the conglomerate has consistently experienced significant growth in both revenue and profit. Its growth rate has remained around 20%, an astonishing number.

In 2023, FPT recorded revenue of VND 52.618 trillion ($2.3 billion) and pre-tax profit of VND 9.203 trillion ($400 million), an increase of 19.6% and 20.1%, respectively, compared to the previous year. This marks the sixth consecutive year of growth for the company, with both revenue and profit reaching record levels.

Last year, overseas IT service revenue reached VND 24.288 trillion ($1 billion), a growth of 28.4%, thanks to the strong growth in the Japanese market (+43.4%) and the Asia-Pacific region (+37.7%). The new signings for the overseas IT service segment reached VND 29.777 trillion ($1.3 billion), with 37 projects worth over $5 million. FPT aims to achieve $5 billion in revenue from the overseas IT service segment by 2030, equivalent to an annual compound growth rate of 26% from 2024 to 2030.

In 2023, FPT also aggressively expanded its market through mergers and acquisitions to drive future growth. The company acquired three US-based companies and one EU-based company in 2023, significantly enhancing its technological capabilities and sales capabilities. Specifically, FPT announced the acquisition of Intertec in February, Landing AI (US) in October, Cardinal Peak (US) in November, and Aosis (France) in December.

Leveraging AI and Cloud Platforms

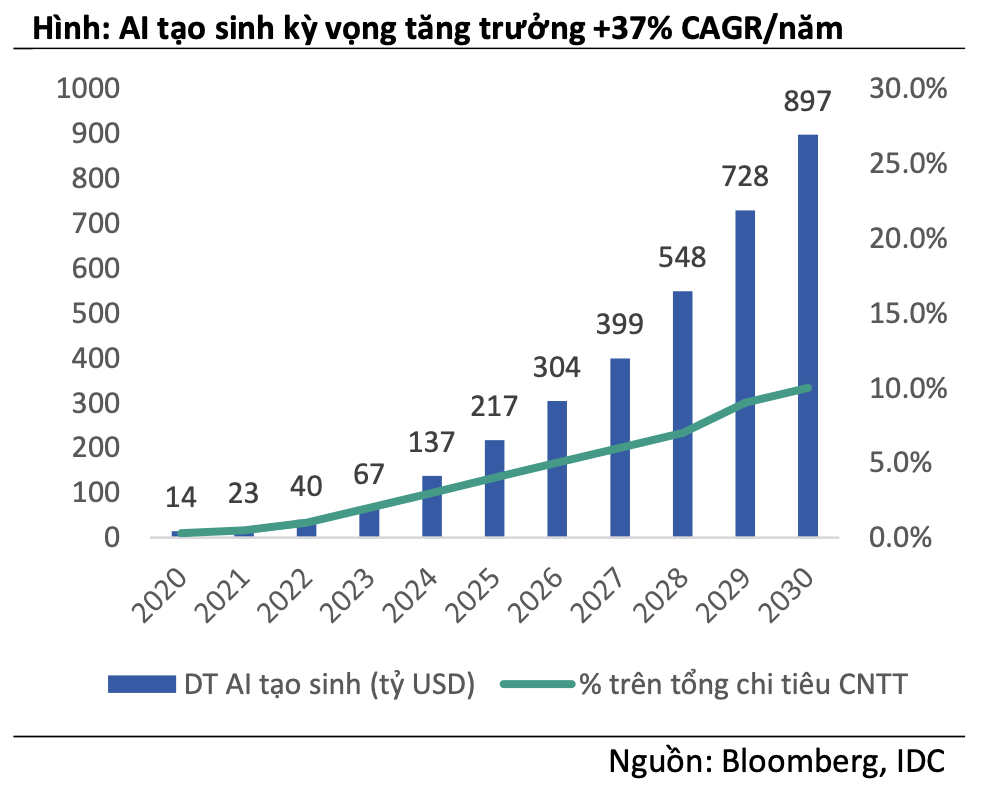

Looking ahead to 2024, BSC forecasts high demand for digital transformation in FPT’s international markets (Japan, the US, Asia-Pacific, EU) driven by (1) the expected explosive growth of AI, and (2) the trend of shifting storage and data processing to cloud platforms and data centers.

It is estimated that global AI-generated revenue will reach $137 billion (+104% YoY) in 2024 and grow at a rate of 37% CAGR per year from 2024 to 2030, driven by (i) the significant impact of this technology on the operational efficiency of various industries, and (ii) the ability of AI to harness big data.

In addition, most current digital technology applications (sales management, customer relationship management, etc.) are deployed on cloud platforms, resulting in (i) reduced management costs and data storage, and (ii) prevention of data loss in sectors such as insurance and banking.

BSC believes that this will be a strong growth driver for FPT, not only in 2024 but also over the next 5-6 years. FPT’s leadership has set a target of reaching $5 billion in revenue from international markets by 2030 (equivalent to a CAGR of 25%), driven by (1) significant room for improvement in market share, competitive pricing, and quality services, (2) active M&A activities in international markets, and (3) high demand for digital transformation from 2024 to 2030.

In the long term, BSC expects FPT to significantly improve its market share in international markets through proactive M&A activities and competitive pricing compared to other competitors such as China and India (15-20% lower). Additionally, FPT’s position in international markets has significantly strengthened after years of providing services and acquiring other technology companies. Furthermore, the profit potential from the education sector is expected to contribute more to FPT’s overall profitability.