Workers working at the factory of Jia Hsin Co., Ltd., 100% Taiwan (China) invested in Long An. (Photo: Minh Hung/TTXVN)

|

Vietnam is the most attractive investment destination in ASEAN in the coming years and this assessment is based on practical and justifiable grounds such as economic diversification, international integration, investment law reform, and effective economic policies.

This assessment was made in an article published on mondaq.com (USA) recently.

The author of the article made this assessment based on various criteria. First, in terms of economic recovery and stable development, the author cited a study “World 2050” by consulting firm PwC, which stated that Vietnam will achieve the second highest annual GDP growth rate in the world.

Vietnam will grow at an average of 5.3% per year from 2014-2050. This means that Vietnam will become the fastest-growing economy in Asia by 2050. Furthermore, the Vietnamese government has also effectively controlled inflation at 3-5%, much lower than the maximum inflation rate of 4.5% allowed in 2023.

These two important macroeconomic indicators are evidence of the Vietnamese government’s success in recovering and maintaining stable development of the economy.

Second, it is the effectiveness of economic policies. According to the author, alongside macroeconomic stability, the Vietnamese government is determined to improve the investment and business environment and strive to achieve important economic indicators like the leading countries in the region.

Vietnam has issued many policies to encourage FDI in projects using advanced, emerging, high-tech, clean technologies, modern management methods, and positive contributions to global production and supply chains.

Third, it is regional and international integration. Up to now, Vietnam has negotiated and signed many bilateral and multilateral free trade agreements (FTAs) with most major economies worldwide, including 16 FTAs with over 60 comprehensive partners across continents.

In terms of market access liberalization, according to the World Trade Organization (WTO), Vietnam is on par with Singapore – the most developed country in Southeast Asia.

Vietnam has also successfully concluded an FTA with the European Union (EU) and has joined the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). The author believes that from the perspective of trade and international investment, Vietnam has no rivals in terms of partner relations and the level of market access openness.

Fourth, it is the Investment Law. The article specifically identifies the new laws as the most open and investor-friendly in the region, such as the new Enterprise Law, Investment Law, and Public-Private Partnership Law that have been passed. Business and investment barriers have been removed, paving the way for a transparent, transparent, and opportunistic environment for foreign investors.

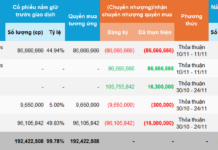

Fifth, it is the relaxation of foreign ownership regulations in listed companies. To alleviate the burden on investors, since 2015, the Vietnamese government has allowed the relaxation of foreign ownership ratios in listed companies, up to 100% in some cases; allowing unrestricted foreign investment in government bonds, government-guaranteed bonds, provincial government bonds, or enterprises.

The author of the article stated that Vietnam is a dynamic and reforming country and is currently bringing many opportunities for foreign enterprises. The internal strength of the economy is demonstrated through controlled macroeconomic indicators, strong productivity growth, and deep integration into the regional and global economy. This is the time for foreign investors to start business plans and capture upcoming opportunities.

Thu Hang