To learn more about the prospects and investment opportunities, HSC Securities is organizing the C2C – Connecting to Customers online seminar on 06.03.2024 with the theme “Prospects of the Banking Industry in 2024 with the perspective from Techcombank”.

Vietnam economy stands strong amidst the storm

2023 was a challenging year for the Vietnamese economy. However, the economic indicators in the last quarter of the year showed more positive signs as exports recovered and the real estate market began to revive from its lowest point. The economy has experienced shocks since 2022, with many real estate businesses facing liquidity shortages. This highlights the effectiveness of risk-controlled business models in 2023 compared to businesses pursuing rapid growth.

Fitch Ratings upgrading Vietnam’s national credit rating to BB+ with a “Stable” outlook is good news for the economy at the end of 2023. This reflects that Vietnam’s mid-term profit growth prospects are reinforced by the recent strong inflow of foreign investment. According to Fitch, Vietnam still has significant policy space to manage short-term risks as the real estate market continues to face challenges and progresses slowly.

A powerful year of the Dragon

2024 promises to bring more positive developments as stable inflation and lower interest rates will stimulate consumer demand and investment across the economy. The decline in commodity prices and the prolonged sluggishness of the Chinese economy seem to be unfavorable for developing economies. However, the lower interest rates of the United States and the ECB in 2024 allow developing countries’ central banks to maintain low interest rates throughout the year.

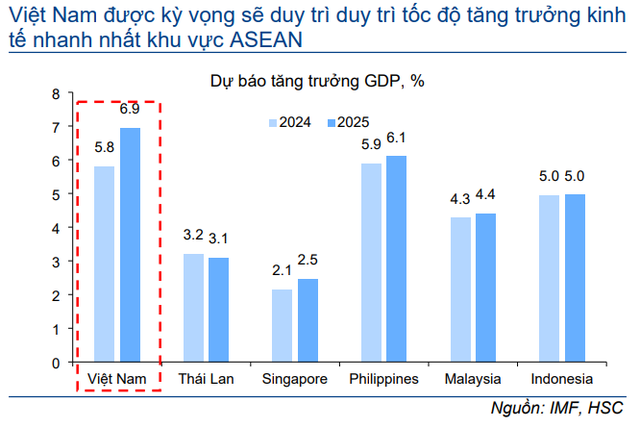

HSC believes that as the Vietnamese Government aims for economic growth in the 2021-2025 period, the State Bank of Vietnam (SBV) will maintain a loose monetary policy by keeping the operating interest rate low and further enhancing investment activities. This is due to Vietnam maintaining the lowest government debt-to-GDP ratio in the region, with government debt scale in 2022 at about 35% of GDP. We forecast that GDP will return to a high trajectory with growth rates of 6.1% and 6.7% in 2024-2025, thanks to strong contributions from investment and exports that will grow significantly as Vietnam continues to enhance its position in the global supply chain.

Banks – Signs of recovery returning

The macro difficulties created macroeconomic uncertainties, causing credit demand to decline, with businesses and individuals becoming more cautious in 2023. Liquidity in the banking system improved as the deposit interest rate environment returned to lower levels compared to pre-pandemic times. Specifically, the growth of deposit rates (13.2% vs. 13.7%) in 2023 was equivalent to credit growth, after a lower growth rate in the 2021-2022 period. HSC believes that banks have effectively addressed liquidity challenges in recent times. As a result, credit growth is expected to be faster, as the lower cost of capital is also expected to help reduce the non-performing loan ratio of the banking sector (reaching the highest level since 2012).

Playing a crucial role in the economy, HSC has observed positive improvements in the banking sector since the second half of 2023 in terms of the business performance trend. This is reflected in credit growth, stable NIM ratios, and improved asset quality.

Among the banks analyzed by HSC, we noted positive signals at Techcombank when full-year credit growth was strong, bancassurance and consumer lending activities recovered, consolidating the leading position, and the non-performing loan ratio was lower than planned. Notably, non-term deposits increased sharply to nearly 40% thanks to low interest rates, combined with Techcombank’s introduction of some products and customer attraction policies such as TCB being chosen as the primary transaction account (T-pay, QR payment solution, and accounts for business households).

With the improving macro backdrop, HSC expects the banking industry to enjoy more favorable conditions in 2024 compared to 2023, as credit demand in the economy gradually recovers when interest rates are no longer a barrier to borrowing. The banking system’s total credit growth target of 15% set by the SBV for 2024 is likely to be well-absorbed, and there may even be room for higher growth in the second half of the year as the SBV will have more flexibility in managing operations. In addition to the general economic recovery, credit demand for public investment and FDI corporate sectors continues to be an important growth driver. For retail customers, we expect credit demand to slowly recover along with the restoration of consumer confidence, which will take more time than before.

To gain further insights into the prospects and motivations of the banking industry with perspectives from HSC and from those involved, Techcombank in particular, HSC is organizing the C2C – Connecting to Customers seminar on March 6, 2024, with the theme “Prospects of the Banking Industry in 2024 with the perspective from Techcombank”.

Investors can register to attend the seminar at: https://event.hsc.com.vn/c2c_TCB2024/

Open an investment account at HSC in 3 minutes here.