In Vietnam, alongside familiar soft drink products such as Coca Cola and Pepsi, products bearing the Wonderfarm and Kirin brands (such as pumpkin tea, coconut water, milk tea, and soft drinks) from Interfood Corporation (code: IFS) are also quite familiar to the people. In fact, Wonderfarm pumpkin water products often appear during Tet holidays and weddings in rural areas.

The journey of the Wonderfarm brand began in the late 1990s when Interfood was established with the main activity of processing agricultural and aquatic products into canned products for export.

In 2005, Interfood signed a contract with Wonderfarm Biscuits and Confectionery to license the Wonderfarm brand for the company’s products. The Wonderfarm pumpkin tea brand quickly gained popularity, bringing a large market share to the company.

Moving forward, in August 2005, IFS became a joint stock company and at the end of 2006, IFS shares were listed on the stock market, attracting great attention from investors.

The stock “went away to return,” on a strong upward trend, reaching historical highs.

While doing well in business, a major event occurred with Interfood in 2008 when some of the company’s cake products exceeded the allowed melamine levels. In the same year, the company reported a loss of VND 267 billion and continued to incur losses thereafter.

In 2010, IFS’s payable debt reached over VND 600 billion, almost equal to total assets. As a result, IFS’s shares were delisted from the stock exchange at the end of 2012.

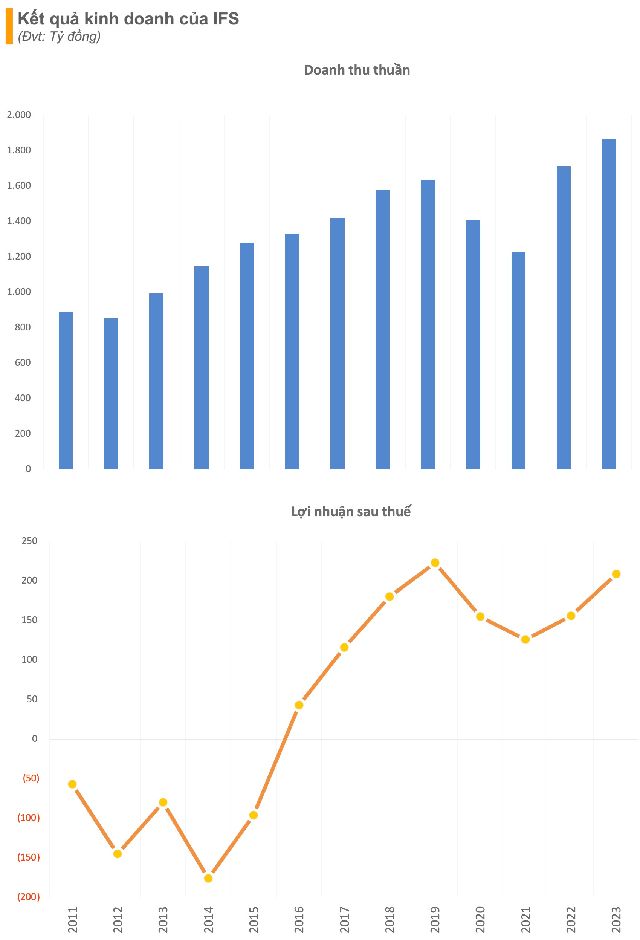

In a difficult context, in 2011, the majority shareholder in Malaysia transferred all of Interfood’s shares to Kirin (a large food production corporation in Japan). Immediately after taking over, Kirin implemented numerous measures to improve IFS’s debt structure, while also developing research on new products and markets for the company. After going through a severe crisis period from 2008-2015, with 7 out of 8 years of losses, Interfood, under the restructuring by Kirin, began to turn a profit in 2016.

IFS shares returned to the stock market at the beginning of November 2016 when registering for trading on the UPCoM, after nearly 3 years of delisting. Up to now, the price of IFS shares has reached VND 35,000/share, the highest level since it was listed on the UPCoM, an increase of more than 16% from the beginning of 2024.

Profitable business results have laid the foundation for the stock price boom. Currently, in addition to the flagship Wonderfarm pumpkin tea product, IFS also has other products such as Swallow Nest Water, coconut extract, biscuits, and various Kirin brand Japanese beverages like Fruit Flavored Water Ice+, Latte, Tea Break, etc.

In 2023 alone, the company’s revenue reached a record high of VND 1,868 billion, an increase of 9% compared to the previous year. Of which, the revenue from soft drinks was nearly VND 1,648 billion, accounting for 88% of total revenue, while the rest came from canned food (VND 342 billion) and scrap sales (VND 5.5 billion). As a result, IFS’s after-tax profit in 2023 was VND 209 billion, an increase of 34%.

As of the end of 2023, Interfood’s total assets reached VND 1,464 billion, an increase of VND 19 billion compared to the beginning of the year. Among them, cash and cash equivalents accounted for 66% of total assets, with Interfood maintaining short-term deposits of VND 700 billion.

In terms of capital sources, equity capital reached VND 1,256 billion, accounting for 86% of total capital. Notably, the company did not record any financial loans.

Especially, after all accumulated losses were cleared in 2021, Interfood immediately distributed all its profits as dividends to shareholders. For example, in 2022, undistributed after-tax profit reached nearly VND 156 billion at the end of the year. IFS then agreed to distribute dividends in cash at a rate of 17.8%, equivalent to over VND 155 billion. The remaining after-tax profit amounted to less than VND 600 million.

The majority of dividends will flow into the pockets of foreign shareholders, Kirin Holdings Singapore Pte. Ltd, which currently holds nearly 96% of IFS shares.