Artificial Intelligence (AI) and semiconductor chips are two investment themes that are attracting special attention in the global financial market. Leading technology stocks worldwide such as Microsoft, NVIDIA, Alphabet (Google’s parent company), Meta Platforms (Facebook’s parent company), etc. are all benefiting greatly from this trend.

Vietnam, of course, does not want to be left out of the global technology game but in reality, not many domestic companies are clearly benefiting from the AI and semiconductor waves. However, the two most promising names, FPT Corporation (code: FPT) and Duc Giang Chemicals (code: DGC), are both “riding the trend” quite well.

FPT reaches new peak, close to top 10 market capitalization

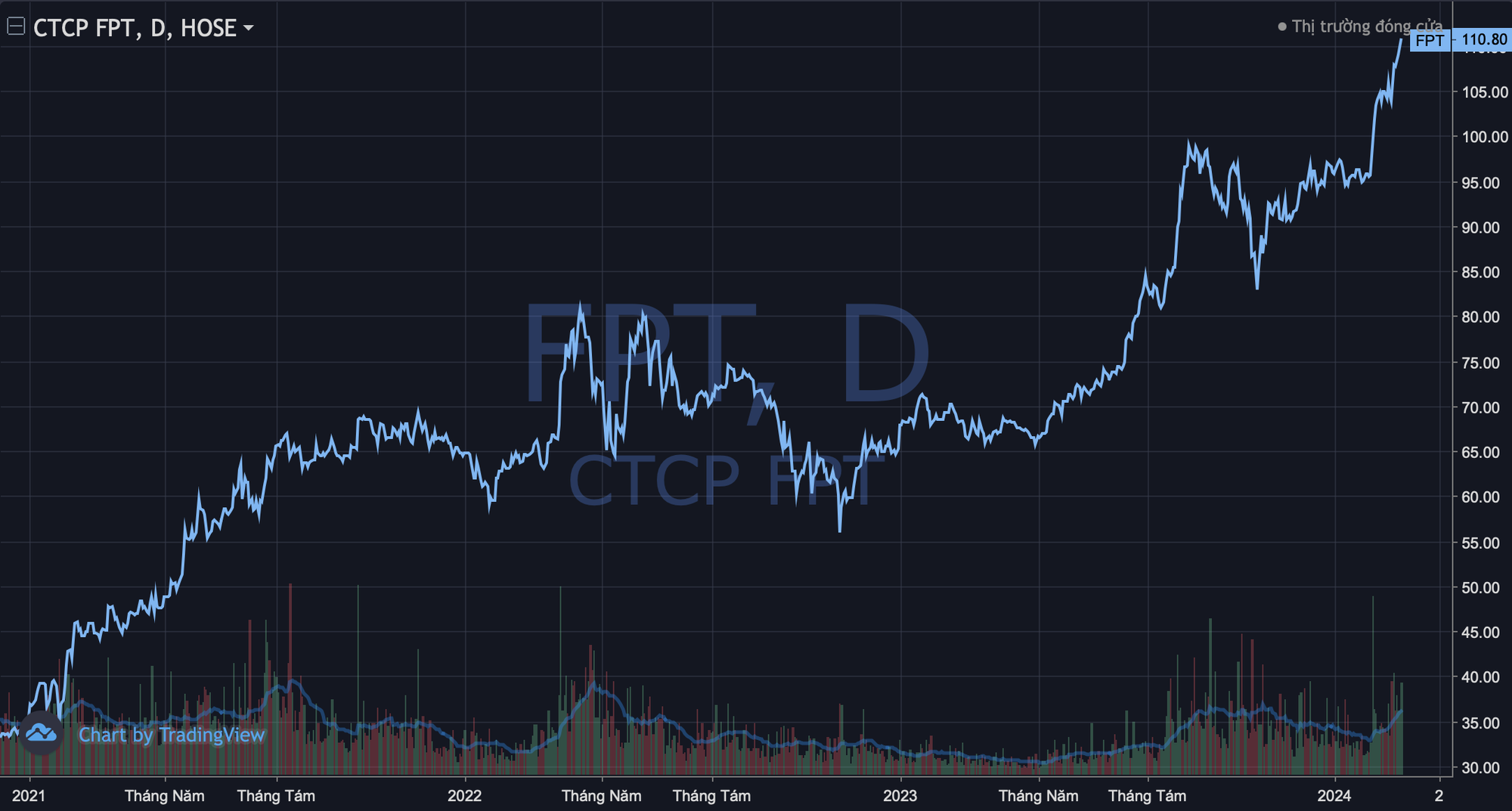

FPT’s stock has just reached a new peak at the price of VND 110,800 per share, with its market capitalization breaking records at over VND 140,000 billion (USD 5.7 billion). Since the beginning of 2024, the value of Vietnam’s No.1 technology conglomerate has increased by an additional VND 18,700 billion (equivalent to over 15%). This result helps FPT come closer to the top 10 most valuable listed companies on the Vietnam stock market.

The “AI frenzy” and semiconductors are the main driving forces behind FPT’s recent breakthrough. In 2023, it was the first year that the conglomerate recorded over USD 1 billion in revenue from its foreign IT services, up 28% compared to the previous year. BSC believes that AI-generated and cloud-based platforms will be strong growth drivers for FPT not only in 2024 but also in the next 5-6 years.

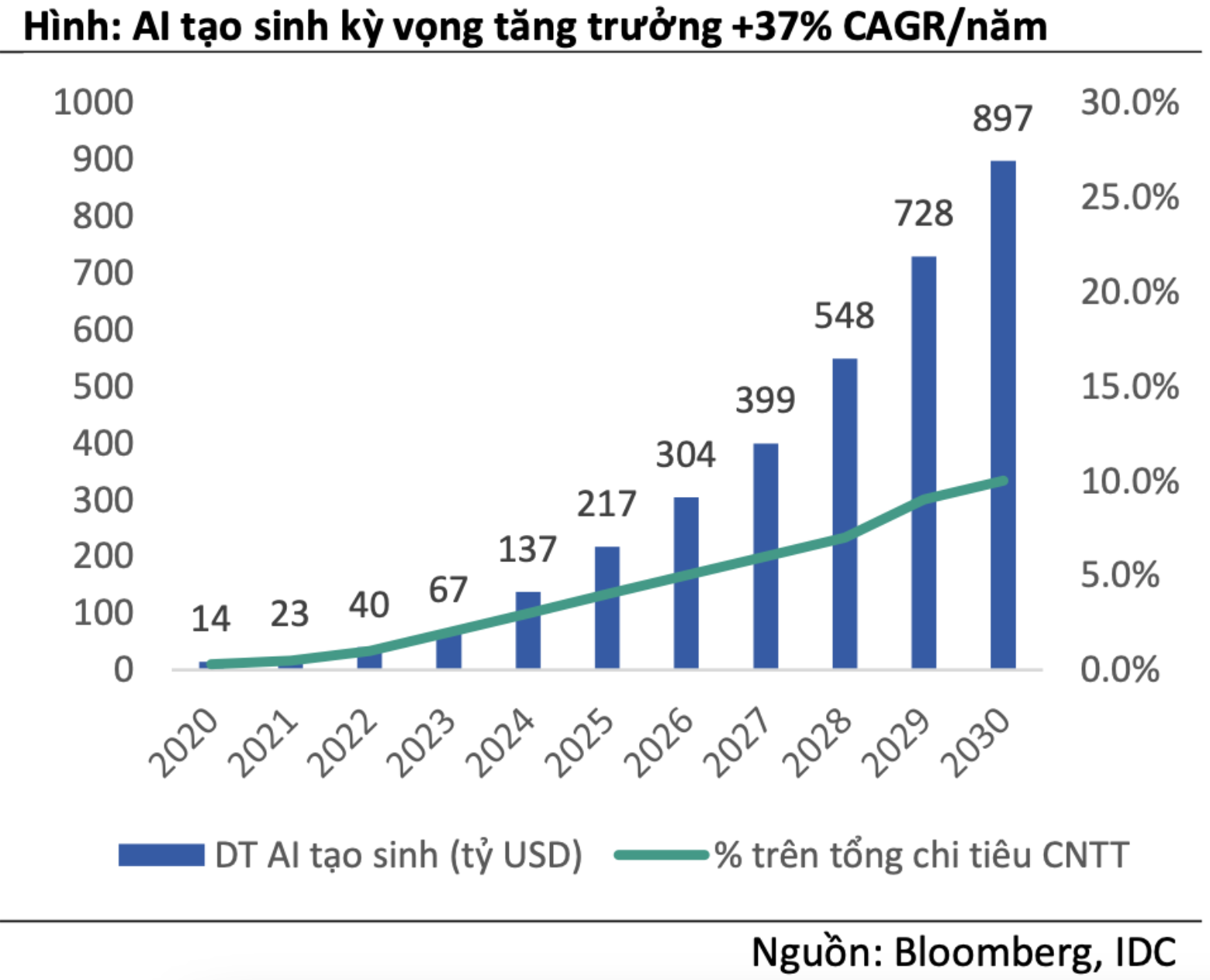

According to forecasts, global revenue from AI-generated services is expected to reach USD 137 billion (+104% YoY) in 2024 and grow at a CAGR of 37% per year from 2024 to 2030 thanks to (i) the significant impact of this technology on the efficiency of operations in most current economic sectors, and (ii) AI-generated services making the most of big data sources.

FPT’s leadership has also set a target of reaching USD 5 billion in revenue from foreign markets (equivalent to 25% CAGR/year) by 2030 thanks to (1) a large market share improvement potential, competitive prices, and high-quality services, (2) aggressive M&A activities in foreign markets, and (3) large-scale digital transformation needs from 2024 to 2030.

SSI Research also expects FPT to increase its AI revenue in 2024 (currently at a relatively small percentage of total revenue) to improve overall business performance. According to FPT, the company plans to partner with Microsoft to develop additional generative AI use cases for customers, and is also actively promoting collaboration with NVIDIA in the field of AI.

In the domestic semiconductor industry, the Government has set a target of training about 30,000-50,000 engineers and semiconductor specialists by 2030, of which FPT will train approximately 10,000-15,000 experts for this industry. To pursue this goal, in Q3/2023, the FPT University established the Microelectronic Department and aims to train its first batch of students in 2024.

Holding the key to the semiconductor industry, DGC doubles its value after one year

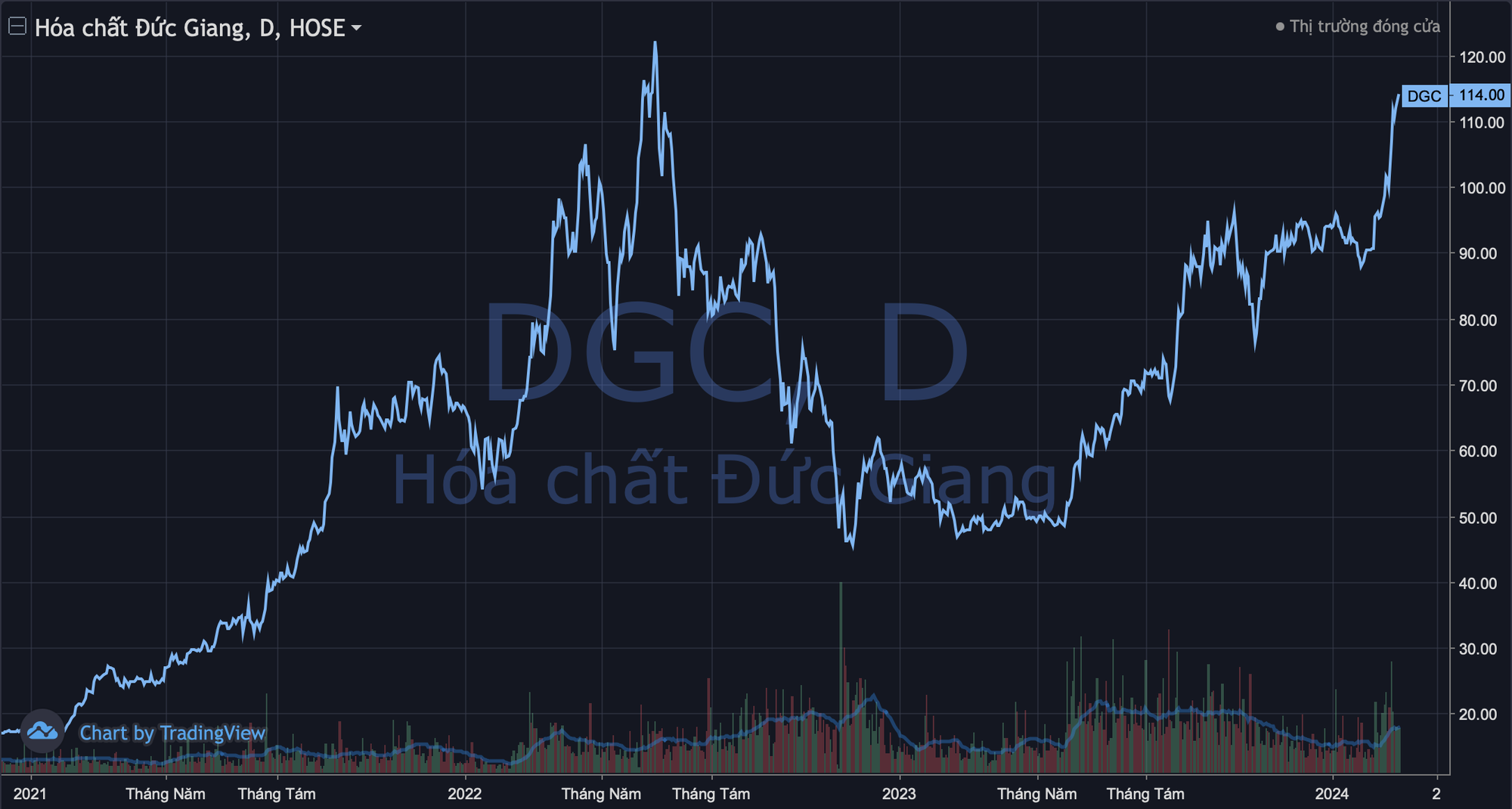

When it comes to the semiconductor industry, DGC cannot be ignored as it accounts for nearly one-third of the world’s total exports of yellow phosphorus (a raw material for chip production). The semiconductor wave has also propelled DGC’s stock to grow significantly. Since the beginning of 2024, this stock has increased by over 20% and is getting closer to its all-time record high reached in mid-June 2022. The corresponding market capitalization has reached about VND 43,200 billion (USD 1.8 billion), up 2.4 times compared to a year ago.

Vietcap Securities (VCSC) predicts that global demand for yellow phosphorus will grow in the single-digit range in the medium term, led by EV battery and AI chip demand. Among them, DGC will benefit and continue to gain market share in the industrial yellow phosphorus (IPC) market in the medium term as China is no longer exporting yellow phosphorus.

The Semiconductor Equipment and Materials International Association (SEMI) predicts that global semiconductor sales will increase by 12% compared to the same period in 2024. In addition, the stable inventory of chip manufacturers also reinforces chip production activities, thereby increasing demand for industrial yellow phosphorus in the future.

In the semiconductor field, DGC has established its dominant presence in East Asia (excluding China) in the gold phosphorus market and is quickly entering the US market. The company’s top-quality yellow phosphorus surpasses all competitors in the global export market. According to Vietcap, DGC is expected to benefit from the increased chip production by the US and its allies, regardless of the position of the factories.

Despite the great potential, DGC’s management remains cautious in their business plan for 2024. According to the documents of the 2024 Annual General Meeting, DGC aims to achieve consolidated total revenue of VND 10,202 billion, up 4.6%, but the estimated after-tax profit is only at VND 3,100 billion, down 4.4% compared to the result achieved in 2023. Dividends for 2024 are expected to be maintained at 30%.

In general, technology will be the world’s development trend for many years to come. Those companies seizing the opportunity to integrate into this game are expected to thrive. Although Vietnam does not have many representatives, at least two names, FPT and DGC, are leveraging their strengths to “ride the trend”.