According to a report by the Vietnam Real Estate Research and Evaluation Institute, the total housing supply in the market in 2023 reached 55.3 thousand units, an increase of 14% compared to 2022, but only 32% compared to 2018, before the COVID-19 pandemic.

Very few new commercial housing projects were approved in the past year, not to mention the thousands of projects that were delayed due to legal complications and lack of funds, leading to a shortage of housing supply in the market.

Meanwhile, the number of successful housing transactions in 2023 was about 18.6 thousand units. This result is equivalent to 2022 with 18.9 thousand units, but only 17% compared to 2018, before the pandemic.

The mid-end apartment segment leads in terms of transaction volume, accounting for 43%; followed by the high-end segment, accounting for 27%, with transactions gradually improving over time and stabilizing by the end of the year.

In the context of the overall stagnant property market, the net revenue of 64 real estate companies listed on the stock exchanges (HOSE, HNX, and UPCoM) in 2023 increased by nearly 33% compared to 2022, reaching nearly 322 trillion VND. However, the total net profit decreased by nearly 11%, only recording nearly 44 trillion VND.

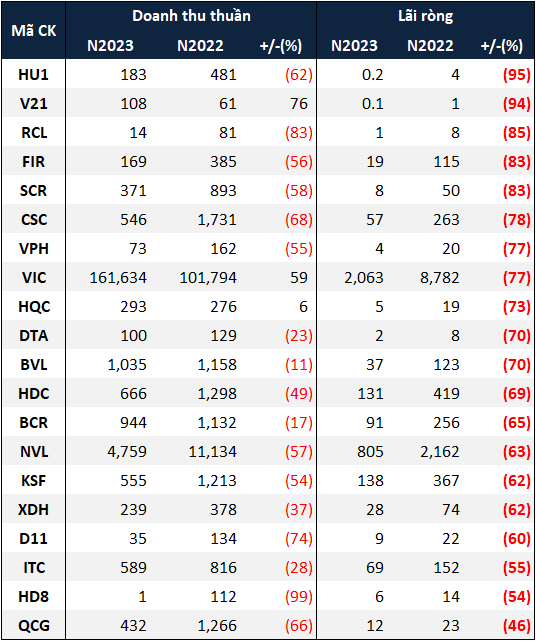

31 companies experienced a decrease in profits

Statistics from VietstockFinance show that as of 31/64 real estate companies recorded a decrease in net profit in 2023. The leading decline was seen in HUD1 Investment and Construction Joint Stock Company (HU1) with a 95% drop in profit compared to the previous year, earning less than 200 million VND. HU1 stated that the reason for the decline was the difficulties in the overall real estate market and ongoing construction activities, leading to a decline in the company’s employment and inefficiency.

|

Top 20 real estate companies with a decrease in net profit in 2023. Unit: Billion VND

Source: VietstockFinance

|

On the other hand, even giants in the industry like Novaland (NVL) had to “regretfully” witness a 63% decrease in profits, earning only 805 billion VND, amid a 57% decrease in net revenue, amounting to nearly 4.8 trillion VND.

The company stated that the main revenue came from real estate transfer activities, thanks to the handover at projects such as NovaWorld Phan Thiet, NovaWorld Ho Tram, Aqua City, Palm City, Lakeview City, Saigon Royal, and other central real estate projects.

Financial revenue became the bright spot for NVL with over 5.7 trillion VND, a 15% increase, thanks to trading securities.

Not only did profits decrease, but many companies also recorded 2023 as the year with the lowest profits in nearly a decade. This includes Vạn Phát Hưng Joint Stock Company (VPH) and Quốc Cường Gia Lai Joint Stock Company (QCG), with net profits in 2023 being the lowest in the past 9 and 11 years, respectively, at 4 billion VND (a 77% decrease) and 12 billion VND (a 46% decrease).

VPH stated that 2023 was a challenging year, and the company is making efforts to complete the legal procedures to implement projects. In reality, the total net revenue in 2023 only reached over 73 billion VND, a 55% decrease compared to the previous year. Of which, over 21 billion VND came from the transfer of a portion of land in Nhon Duc commune, Nha Be district, Ho Chi Minh City.

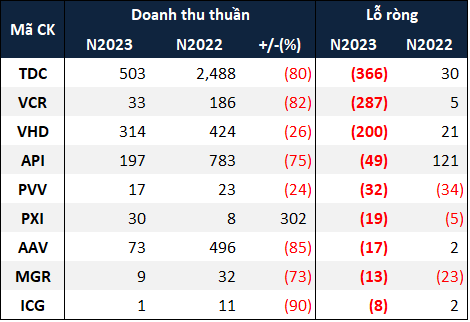

9 companies had losses

Despite the decrease, the above-mentioned companies still achieved results in 2023, while many other companies in the industry were less fortunate and incurred losses. Three companies had losses exceeding hundreds of billion VND: Binh Duong Trading and Development Joint Stock Company (TDC), Vinaconex Investment and Tourism Development Joint Stock Company (VCR), and VINAHUD Housing and Urban Development Investment Joint Stock Company (VHD).

|

9 real estate companies with losses in 2023. Unit: Billion VND

Source: VietstockFinance

|

TDC, despite having a significant financial revenue thanks to interest income from bank deposits, incurred a loss of nearly 366 billion VND due to high total interest expenses, increasing by 10%, while the revenue decreased significantly by 30%. In the previous year, the company earned a profit of 30 billion VND.

VCR, after being profitable in 2022, returned to losses in 2023 with a record loss of 287 billion VND. The developer of the Cat Ba Amatina project in Hai Phong had a continuous 5-year loss from 2017-2021 prior to that.

What is even more unfortunate for VCR is that with the termination of the cooperation and investment contract for a sub-zone in the Cat Ba Amatina project by its parent company – Vietnam Export-Import and Construction Corporation (Vinaconex, VCG), VCR will have to repay Vinaconex 2.2 trillion VND.

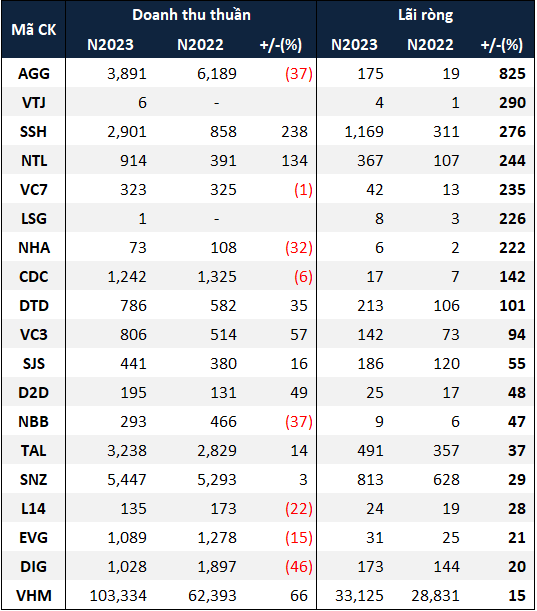

19 real estate companies achieved growth

In contrast to the pessimistic picture above, there are still 19/64 real estate companies that increased profits in 2023. The most notable is An Gia Investment and Development Corporation (AGG) with a net profit of 175 billion VND, more than 9 times higher than the previous year. The company attributes this exceptional result to the handover of the Westgate complex in Binh Chanh, Ho Chi Minh City.

|

19 real estate companies with the highest net profits in 2023. Unit: Billion VND

Source: VietstockFinance

|

Although only listed in 2021, Sunshine Homes Development Joint Stock Company (SSH) achieved a record profit in 2023, with a net profit exceeding a thousand billion (1,169 billion VND), nearly 4 times higher than in 2022. The driving force behind SSH’s profit was the exceptional net revenue of 2,901 billion VND, more than 3 times higher than before.

SSH does not disclose which project the revenue comes from, but considering the company’s inventory structure, three main projects of SSH, namely Sunshine City Nam Thang Long, Sunshine Capital Tay Thang Long, and Sunshine Garden (Hanoi), have made significant contributions to SSH’s success in 2023.

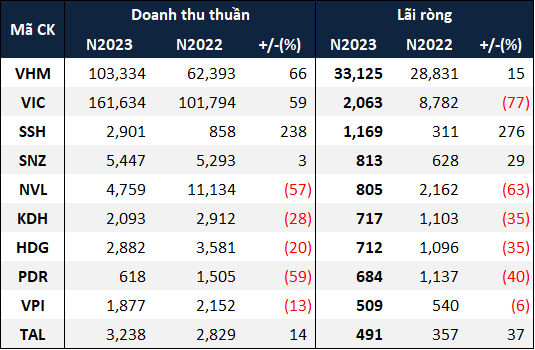

For “the giant” Vinhomes (VHM), although it ranks last in terms of growth among real estate companies, its net profit in 2023 leads the entire stock market, with over 33.1 trillion VND, a 15% increase.

Similar to SSH, VHM’s profits mainly came from real estate business activities, with a total consolidated net revenue (including revenue from Vinhomes activities, business cooperation contracts, and real estate transfers recorded as financial revenue) reaching 121.4 trillion VND, a 49% increase compared to 2022, mainly thanks to the timely handover of 9,800 low-rise real estate units at Vinhomes Ocean Park 2 and 3.

|

Top 10 real estate companies with the highest net profits in 2023. Unit: Billion VND

Source: VietstockFinance

|

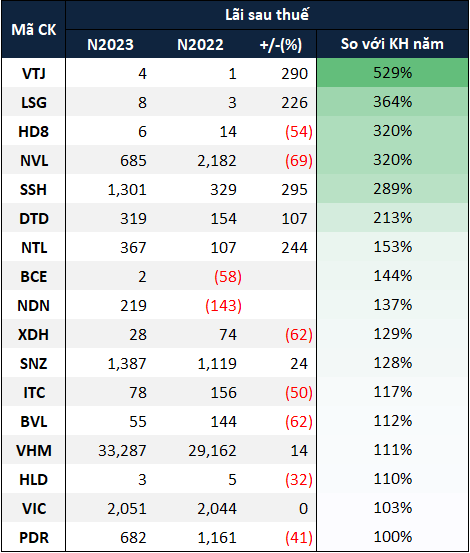

Despite the alternating increase and decrease in profits, 17/64 real estate companies achieved their profit plan for 2023.

|

17 real estate companies that achieved profit plans in 2023. Unit: Billion VND

Source: VietstockFinance

|

Entering 2024, Prof. Dr. Nguyen Khac Quoc Bao – Vice Rector of Ho Chi Minh City University of Economics, at the 2024 macroeconomic forum, assessed that the real estate market is still a crucial factor for the Vietnamese economy. The recent policies and decisions have helped the real estate market deal with bad debts and defuse the “bond bomb” of corporate bonds, thereby gradually bringing money flows back.

Ha Le