In the context of the market struggling around the 1,250 point range, the stock of Gemadept (code GMD) has surged to conquer a new all-time high at the price of 80,500 dong/share. The trading volume has also increased significantly compared to the average level, with nearly 3 million shares traded.

In fact, GMD has been gradually moving up and continuously setting new highs since the end of October 2023. Overall, in the past 4 months, GMD stock has increased over 36% in value, with the corresponding market capitalization adding more than 6,600 billion dong to reach 24,624 billion dong. This is a record high market capitalization since the company’s listing in 2002 and also marks the first time Gemadept joins the billion-dollar market capitalization club.

The acceleration of GMD and the shipping stock group in general is believed to come from the positive signals of Vietnam’s export activities in the early months of the year. According to preliminary statistics from the General Department of Customs, from January 1 to February 14, the total value of goods import and export nationwide reached 82.56 billion USD, an increase of 17.1% compared to the same period in 2023. Of which, Vietnam’s exports reached 43.83 billion USD, up 21.6%, and imports reached 38.73 billion USD, up 12.4%. Therefore, from the beginning of the year to February 14, Vietnam has achieved a trade surplus of more than 5.1 billion USD.

SSI Research predicts that the seaport industry in 2024 will have positive prospects due to the recovery of production when import-export demand improves, especially with the addition of inventory in the US and Europe. In particular, the growth of production may be higher for deep-water ports with an increase of over 15%, which is beneficial for GMD.

In addition, disruptions in trade at the Red Sea – the busiest maritime route in the world – is expected to push up oil prices and logistics shipping rates, which is a positive factor for Vietnamese shipping companies on the stock exchange such as Gemadept, according to the opinion of Yuanta Securities.

Gemalink Port will create a breakthrough for Gemadept in 2024

In addition to benefiting from informational factors, GMD is also expected to have positive prospects from existing potentials. Gemadept is one of the largest container terminal and logistics service providers, especially Gemalink – the largest deep-water port in Vietnam, one of 19 ports in the world capable of accommodating the largest super vessels today. In terms of business structure, port operations contribute about 70-80% of revenue, while the rest comes from the logistics sector.

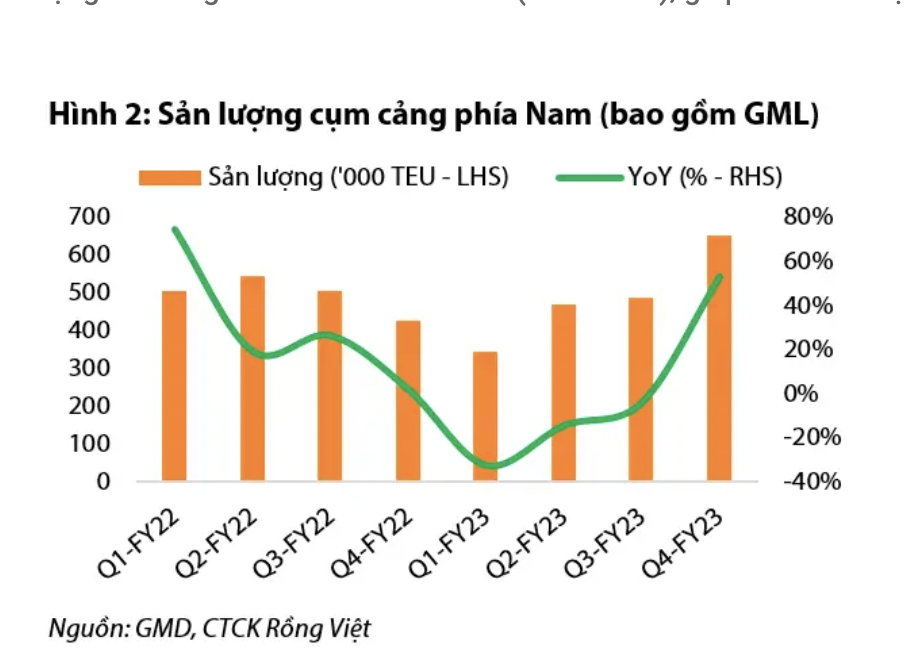

In 2023, GMD recorded 3,846 billion dong in net revenue, which was not much changed compared to the previous year. Notably, the net profit reached nearly 2,222 billion dong, the highest profit level since the listing, thanks to the transfer of all capital in Nam Hai Port Joint Stock Company. In the fourth quarter of 2023, net revenue and net profit reached 1,034 billion dong and 115 billion dong, a decrease of 3% and 39% respectively compared to the same period. The highlight is the business sector from Gemalink port, which recorded a net profit of 111 billion dong in the fourth quarter after four consecutive quarters of losses.

Rong Viet Securities (VDSC) believes that Gemalink port will create a breakthrough for Gemadept in 2024. With the ability to negotiate with shipping lines, Gemalink has added four new service lines in the second half of 2023. With shipping lines expected to receive more new vessels in 2024, they will open more routes or add more port calls to optimize vessel capacity utilization. VDSC expects Gemalink to add 1-2 new service lines. It is projected that the container throughput at Gemalink area will reach 1.4 million TEUs, an increase of 40% compared to the same period.

On the other hand, analysts believe that Gemalink port benefits from the policy allowing a 10% increase in container handling fees at deep-water ports according to Circular 39/2023/TT-BGTVT. This helps Gemalink expand profit margins and escape from alternating profits/losses due to cargo shortage.

For GMD’s business results in 2024, VDSC forecasts that the company’s revenue and net profit attributable to shareholders will reach 4,139 billion dong, an increase of 8%, and 1,324 billion dong, a decrease of 40% compared to the same period in 2023. Of which, the profit from core business operations reaches 1,124 billion dong, an increase of 46% compared to the same period, and 200 billion dong profit from divestment at Nam Hai port.

Similarly, SSI Research believes that GMD has the capacity and land fund to expand existing ports (Nam Hai Dinh Vu Phase 3, Gemalink Phase 2A+2B) in the 2024-2026 period, increasing port capacity by 66% compared to 2023. Besides, the company has the ability to acquire new port projects for expansion. With these advantages, SSI estimates that GMD’s core profit growth will be 23% compared to the same period in 2024 (excluding the large one-time profit from divestment of the port in 2023).