Illustrative image

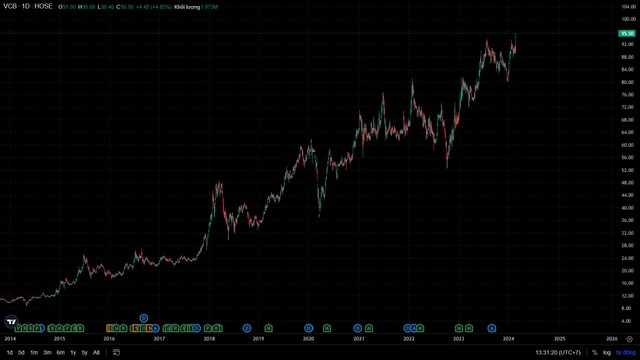

In the afternoon trading session on February 28, VCB stock of Vietcombank unexpectedly surged to the highest historical trading price of 94,000 – 95,000 dong/share (adjusted for dividends), surpassing the previous peak of 93,400 dong recorded at the end of July 2023. There were even times when VCB stock hit the ceiling price, reaching 97,400 dong/share.

Since the beginning of the year, this stock has increased by a total of about 20%, helping Vietcombank’s market capitalization to reach a record level of over 530,000 billion dong.

With this development, Vietcombank continues to consolidate its leading position in the market in terms of market capitalization value, far surpassing the two banks in the same banking group, BIDV (303,000 billion) and VietinBank (194,000 billion).

VCB stock performance in the past 10 years. (Source: SSI)

Vietcombank shares have surged strongly in the context of the bank’s Board of Management (BOM) recently approving the profit distribution plan for 2022 in accordance with the approval process of the State Bank of Vietnam.

Accordingly, with the after-tax profit separately audited for 2022 reaching 29,387 billion dong, plus an adjustment amount of over 3 billion dong from the previous year’s profit, Vietcombank’s profit distribution for 2022 is set at 29,390 billion dong.

After reserving an additional 5% of the charter capital as a supplementary capital reserve (1,469.5 billion dong), a financial provision reserve of 10% (2,939 billion dong), and a reward and welfare fund (3,291.5 billion dong) minus an adjustment reduction of 9.8 billion dong, the remaining profit for 2022 is 21,680 billion dong.

Vietcombank plans to use the entire profit to distribute dividends in the form of shares. This plan will need to be submitted to the State Bank of Vietnam (SBV) for opinions.

Prior to this, the profit distribution plan was approved by the Vietcombank annual general meeting of shareholders in 2023.

In 2023, Vietcombank issued 856.6 million shares to pay dividends at a rate of 18.1%, increasing the bank’s charter capital from 47,325 billion dong to 55,891 billion dong, from the remaining profit in 2019 and 2020.

In addition to the capital increase mentioned above, at the 2023 annual general meeting of shareholders, Mr. Pham Quang Dung, former Chairman of the Vietcombank Board of Management, said that the bank is implementing two other capital increase plans.

The first plan is to increase the charter capital from the remaining profit in 2021 and the accumulated remaining profit until the end of 2018, with an increase of about 27,000 billion dong, which is equivalent to an additional 58.4% of the charter capital. Thus, the new charter capital is expected to reach about 75,000 billion dong. The capital increase policy has been agreed upon by the State Bank of Vietnam and the Ministry of Finance and is preparing the necessary procedures for submission to relevant authorities for approval.

The second plan is the private placement of 6.5% of capital for foreign investors. The bank is carrying out the necessary procedures and is currently at the stage of hiring financial advisory organizations. It is expected that Vietcombank will conduct private placements to foreign partners in 2023-2024.

Recently, Vietcombank also announced that March 26 is the last registration date to participate in the 2024 annual general meeting of shareholders, corresponding to the ex-rights transfer date of March 25. Accordingly, this year’s general meeting of shareholders will be held on April 26, 2022, at the Vietcombank Training and Development Center, Ecopark Urban Area, Cuu Cao Commune, Van Giang District, Hung Yen Province.

The meeting aims to approve documents such as the Report of the Board of Management, the Executive Board, and the Control Board on the business activities in 2023 and the orientation for 2024; the proposal to increase the charter capital from the remaining profit in 2022; the approval of the audited consolidated financial statements and the profit distribution plan for 2023; the remuneration for the BOM and the Control Board, etc.

In terms of business results, Vietcombank recorded a consolidated pre-tax profit of 41,244 billion dong in 2023, an increase of 10.4% compared to 2022.

With these results, Vietcombank continues to outperform other “giants” such as BIDV (27,650 billion dong), MB (26,306 billion dong), Agribank (25,400 billion dong), VietinBank (25,100 billion dong), and sets a new record for profitability in the banking industry.

As of the end of 2023, Vietcombank’s total assets reached over 1,839 trillion dong, an increase of 1.4% compared to the beginning of the year. Of which, customer loans amounted to over 1,270 trillion dong, an increase of 10.9%. Customer deposits increased by 12.2% to nearly 1,396 trillion dong, with a demand deposit ratio of 35.2%.

Vietcombank’s domestic bad debt as of December 31, 2023, was 12,455 billion dong, an increase of 59.3% compared to the end of 2022. As a result, the ratio of bad debt to total loans increased from 0.68% to 0.98%; at the same time, the coverage ratio of bad debt decreased from 317% to 230%. However, Vietcombank still has the lowest bad debt ratio and the highest bad debt coverage ratio in the banking system.