Bitcoin is leading the revival of the cryptocurrency market, up 5.7% in the 24-hour chart, 27.1% in the weekly chart, and over 50% compared to last month. Moreover, the king of cryptocurrencies has skyrocketed 191.4% since March 2023.

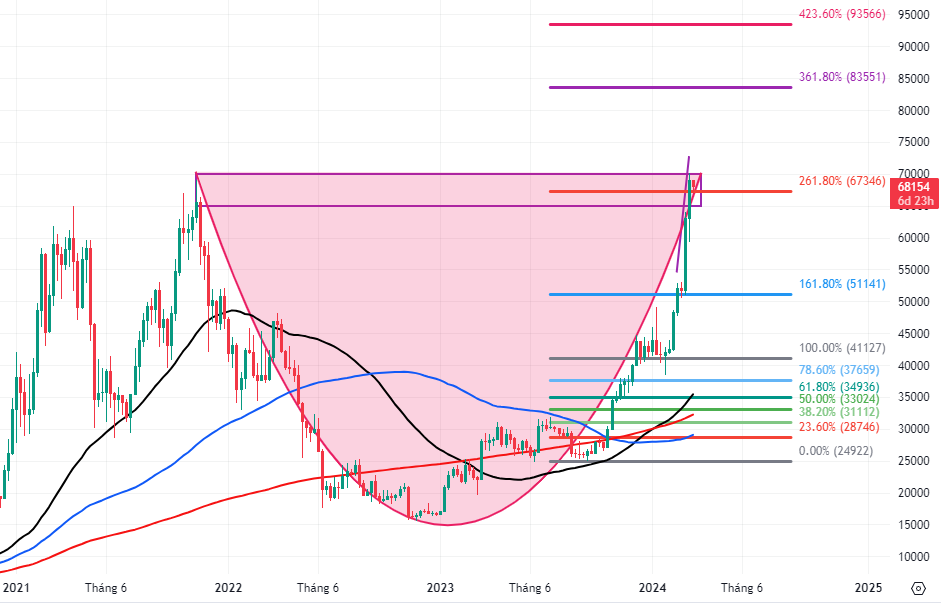

BTC is currently only down 5.8% from its all-time high of $69,044 reached in November 2021, over two years ago. With the Bitcoin Halving cycle approaching in April this year, the price of BTC could rebound and surpass the 2021 peak.

The sudden surge in Bitcoin’s price in the past few days could be attributed to capital flowing into new investment products in Bitcoin spot ETFs. The U.S. Securities and Exchange Commission (SEC) approved 11 Bitcoin spot ETF funds in January this year.

BlackRock’s iShares Bitcoin Trust (IBIT) surpassed $10 billion mark in just 7 weeks since its launch. To put that into perspective, it took over two years for gold-backed ETFs in the U.S. to achieve a similar milestone.

According to Bloomberg analyst Eric Balchunas, “Gold’s pain is Bitcoin’s ETFs, institutional investors have been profiting from seeing Bitcoin as a store of value.”

This development showcases the popularity of Bitcoin ETFs among institutional investors. Capital flow from institutional investors is one of the most significant market catalysts and can push BTC price even higher.

Furthermore, the Fear and Greed Index for Bitcoin (BTC) is currently at 82, signaling “Extreme Greed” among investors.

With the Bitcoin Halving cycle taking place in April, investors can expect more money to flow into the market. Some analysts predict that the cryptocurrency market will continue to rise due to the Halving event.

Profits from Bitcoin could spill over to other Altcoins, leading to a new surge in the Altcoin market.