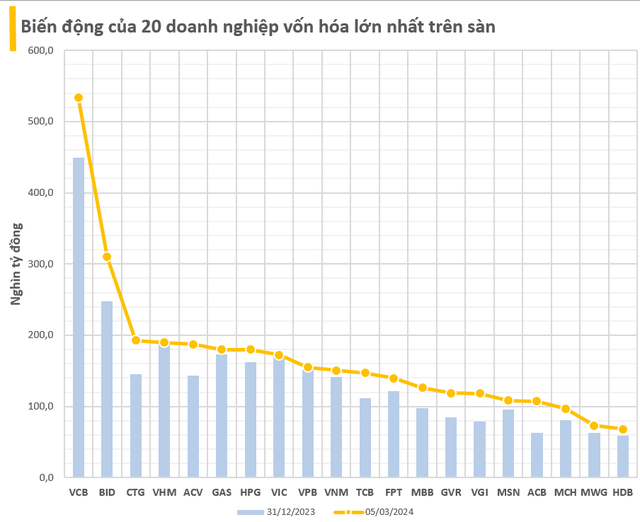

Since the beginning of the year, the stock market has witnessed continuous growth as the VN-Index has increased by 140 points to 1,269.98 points. Over the past 2 months, the main driving force of the market has come from blue-chip stocks. Among them, the market capitalization of the top 20 companies has seen the strongest growth.

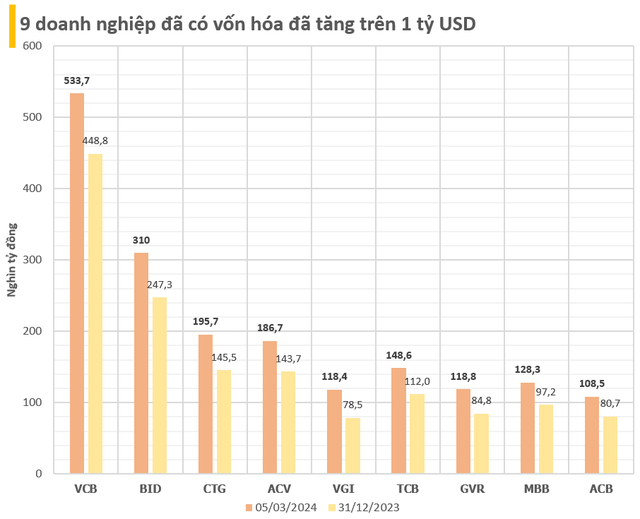

Among the companies that have seen a increase in market capitalization, there are a total of 9 companies with market capitalization over 1 billion USD (24,500 billion VND). Vietcombank (VCB) is the company with the strongest increase in market capitalization during the recent period, reaching nearly 85,000 billion VND (about 3.4 billion USD), to 533,800 billion VND. This bank is also the largest entity by value on the Vietnamese stock market.

Behind Vietcombank in terms of market capitalization growth is the other two “Big 4” banks, BIDV (increased by 62,700 billion VND) and VietinBank (increased by 50,200 billion VND). In addition to the 3 banks in the Big 4, there are ACB, Techcombank, and MB, which are banks on the list of 9 entities with market capitalization over 1 billion USD.

In addition to the strong increase, the total market capitalization of the 3 banks Vietcombank, BIDV, and VietinBank has reached 1 million billion VND, equivalent to about 1/5 of the total value of the HoSE market. This is an unprecedented record in the history of the Vietnamese stock market.

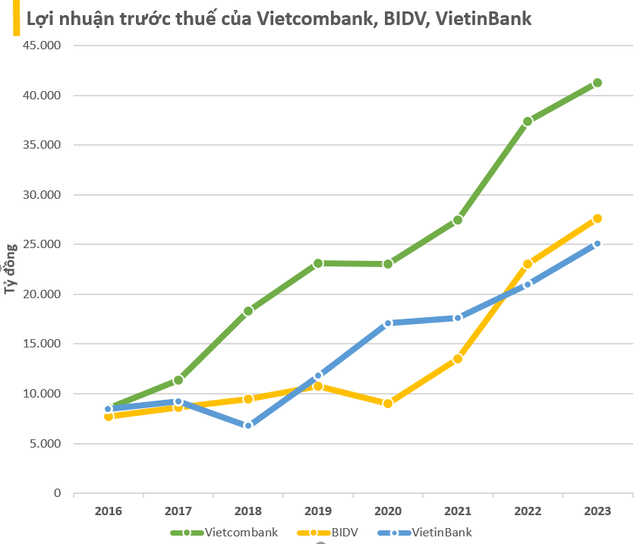

Regarding the reason for the strong increase in market capitalization of the 3 banks in the Big 4 group in the early months of the year, it can be mentioned that both Vietcombank, BIDV, and VietinBank have recorded consistent growth in recent years. In addition, these banks have also set new profit records in 2023.

A common point of the “Big 3” banks is that they all have plans to increase capital as recently Vietcombank, BIDV, and VietiBank have all devised profit distribution plans for previous years. In the 2024 strategic report, SSI Research evaluates that banks with the ability to increase capital sooner will have better conditions to accelerate the bad debt resolution process, gain more market share, and achieve better results than other banks.

Non-financial companies with market capitalization over 1 billion USD

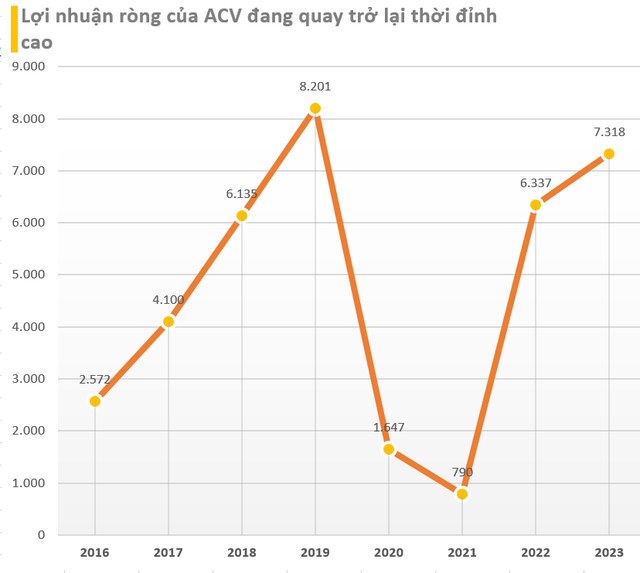

Not only banks, but there are also three non-financial companies with market capitalization over 1 billion USD. First of all, we have to mention the “tycoon” of the Vietnamese aviation industry, ACV. Specifically, the company has also recorded a market capitalization of 43,000 billion VND, up to 186,700 billion VND.

The sharp increase since the beginning of the year has placed ACV at the 5th position in the list of the largest companies on the stock market, above a series of “famous” names such as Hoa Phat, Vingroup, Vinamilk, VPBank, Techcombank,… The market capitalization of ACV is currently only inferior to the “Big 3” banks – Vietcombank, BIDV, VietinBank, and Vinhomes.

ACV currently holds the monopoly in providing aviation services for domestic and international airlines such as security services, ground services, passenger services, takeoff and landing services…The company is entrusted to manage, coordinate operations, and invest in the entire system of 22 airports throughout Vietnam, including 9 international airports and 13 domestic airports.

After being listed on the stock market, ACV’s business results have been continuously improved with revenue and profit growth in previous years before the Covid-19 pandemic. After the difficult 2020-2021 period, ACV quickly resumed its growth after the pandemic was pushed back and the economy entered a recovery phase.

In addition to ACV, the other two non-financial names that have seen market capitalization increase over 1 billion USD in the first two months of the year are two surprising names: Vietnam Rubber Group (GVR) with an increase of 34,000 billion VND and Viettel Global (an increase of 39,900 billion VND). This is also a surprising development as GVR recorded a decrease in profit in the past year, but this company is still being highly expected by many investors because it owns many iconic industrial real estate projects. As for Viettel Global, the company is still accumulating losses and is highly influenced by exchange rates and political instability in some countries where the company is investing.