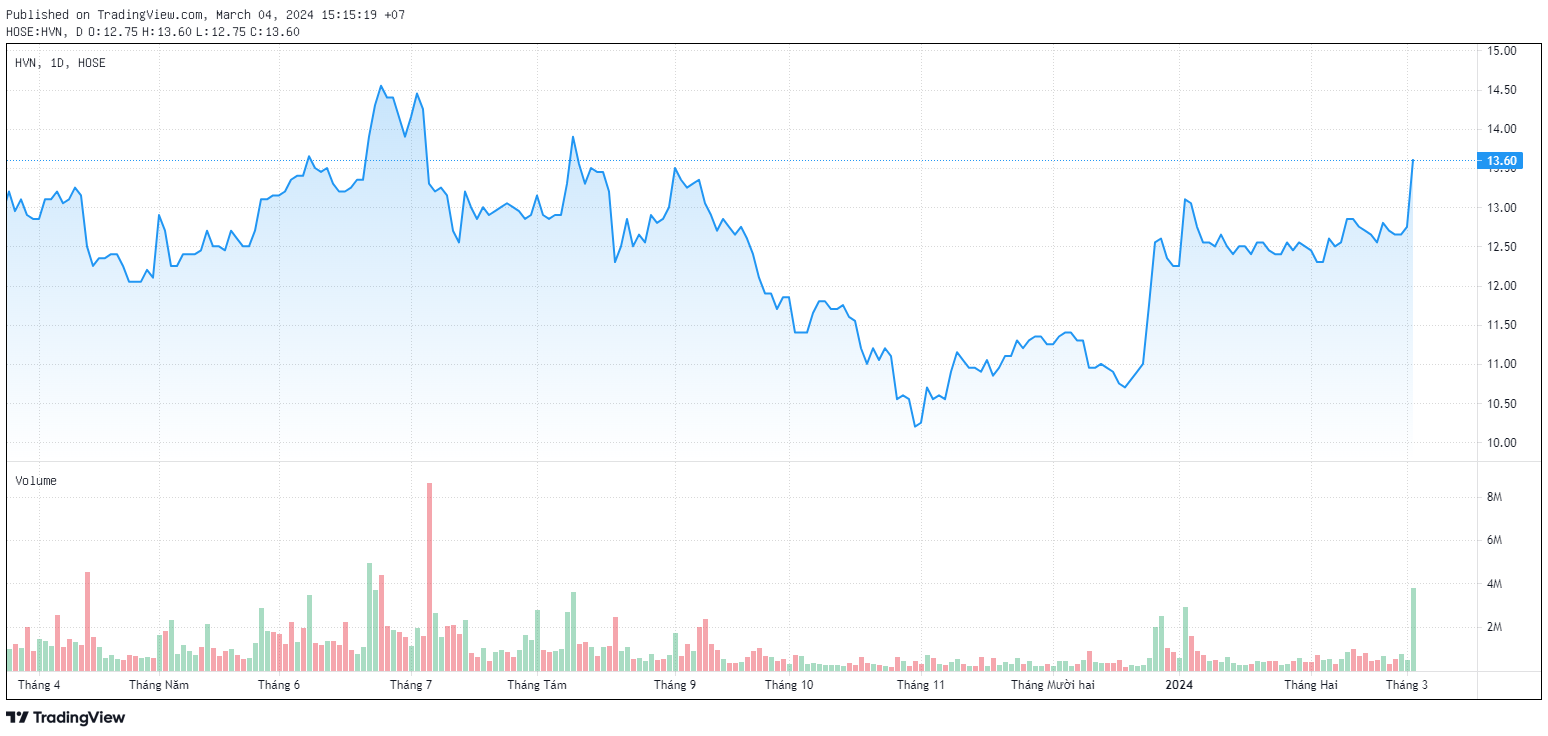

In the midst of a volatile market session, HVN stock of Vietnam Airlines has become a standout, surging to its highest level in 9 months at VND 13,600 per share.

Notably, HVN’s trading volume has also exploded with 3.7 million shares changing hands, far exceeding the average daily trading volume of around 500 thousand shares. This is also the highest trading volume for this stock since July. 2023.

The aviation stock has taken off after receiving positive news recently. Specifically, starting from March 1, Circular No. 34/2023 amending and supplementing several articles of Circular No. 17/2019 of the Ministry of Transport on adjusting the fare framework for domestic passenger transport on main domestic routes officially took effect. Accordingly, the ceiling fares on domestic routes will be adjusted up by 5% compared to the previous level. This is the first upward adjustment of domestic airfares in nearly 10 years (the most recent one was in 2015).

Speaking at the International Airline Symposium 2024, the CEO of Vietnam Airlines, Mr. Le Hong Ha, said that starting from March 1, the ceiling fares for domestic flights will increase by an average of 3.75% compared to the ceiling fares applied since 2015. This adjustment helps airlines offset input costs, especially skyrocketing fuel prices and exchange rates over the past 10 years.

In addition, Prime Minister Pham Minh Chinh recently assigned the State Capital Management Committee to submit a comprehensive plan to resolve difficulties for Vietnam Airlines due to the impact of Covid-19 during the period of 2021-2026 in February 2024.

In 2023, the business situation of Vietnam Airlines improved, but the consolidated after-tax loss was still about VND 5,500 billion. Compared to 2022, this loss has been halved, equivalent to over VND 5,700 billion. By the end of 2023, the owner’s equity of the national flag carrier was negative at nearly VND 17,000 billion. The accumulated loss of the airline exceeded VND 40,000 billion.

It is forecasted that the international market will gradually recover, and the business activities of Vietnam Airlines are expected to show better results in 2024-2025.

Explaining the measures and roadmap to overcome the controlling situation of HVN, Vietnam Airlines leadership said that the company has completed the restructuring plan for the 2022-2025 period, which is being reported to shareholders and competent authorities for approval.

In the plan, in 2024, the company will implement a synchronised set of measures to overcome the consolidated loss situation and negative owner’s equity, such as implementing a synchronised set of measures to enhance adaptability, quickly recover and improve business results; restructuring assets and investment portfolios to increase income and cash flow.

“The company’s business activities have gradually stabilised, and we are preparing the necessary conditions for recovery and development in the coming period,” affirmed the representative of Vietnam Airlines.

The Ministry of Finance is amending the Decree on investment and state capital management at enterprises, which proposes solutions for Vietnam Airlines to divest its stake in Pacific Airlines Joint Stock Company. This is also one of the contents of the comprehensive plan to resolve difficulties for the corporation.