Maintained high dividend thanks to strong financial platform

At the 2024 annual general meeting scheduled to take place in May, Doan Xa Port Joint Stock Company (DXP) is expected to propose to shareholders a plan to distribute dividends for 2023 at a rate of 15%, including 5% cash dividend and 10% bonus shares. If approved, the company is expected to spend nearly VND 3 trillion to pay dividends in cash and issue nearly 6 million shares as a reward to shareholders.

DXP’s strong capital capacity is an important foundation for expanding its business operations, particularly to invest in the hot-mix asphalt business, a necessary product for the transportation sector, which is a key area and a national focus for the coming years.

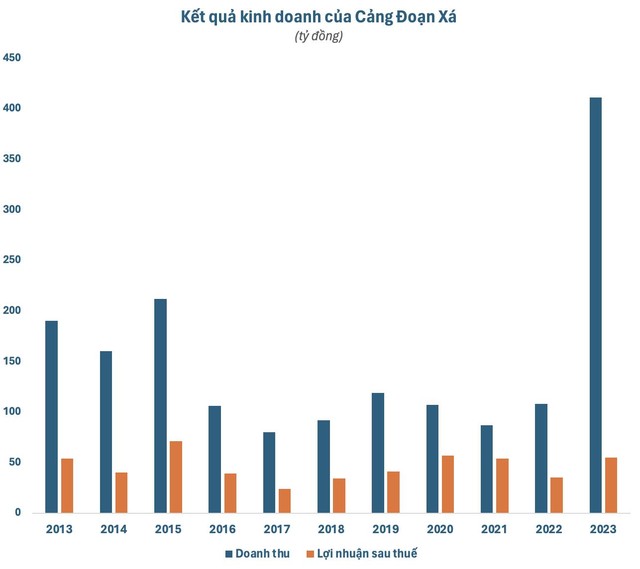

This achievement is reflected in the record revenue in 2023, reaching nearly VND 41.1 trillion, nearly 4 times higher than the previous year. Among them, the asphalt business contributed nearly VND 28.9 trillion, accounting for over 70%. The core business of port services also performed well, bringing in VND 12.2 trillion in revenue, higher than the total revenue in 2022. Last year, the total volume of goods handled through DXP’s port was over 1.2 million tons, and the volume of asphalt reached over 24.3 thousand tons.

After deducting costs, DXP’s pre-tax profit in 2023 was VND 6.79 trillion, an increase of nearly 51% compared to 2022, thereby achieving 159% of the set plan. This can be considered as an initial success of DXP in participating in a new and potential business segment such as asphalt. The high growth in profit further strengthens the possibility that the dividend plan will be approved at the upcoming annual general meeting of shareholders.

Strong business performance has made DXP’s cash flow increasingly robust. Net cash flow from business activities in 2023 was nearly VND 14.8 trillion, 8 times higher than the previous year. Thanks to this, the company has a lot of room for investment and business expansion, even without the need for borrowing capital. Cash balance (cash, cash equivalents, and short-term deposits) of DXP at the end of 2023 also increased fivefold compared to the beginning of the year, reaching VND 48 trillion, accounting for half of the total assets. Having “abundant” finances will help DXP comfortably pay dividends and implement new investment plans in the future.

Continued growth in core areas, expanding the asphalt sector

In 2024, DXP aims to continue its core business operations in port services and expand further into the asphalt sector, with expected total revenue in 2024 exceeding VND 64.4 trillion, a 57% increase compared to 2023. If the plan is completed, the company will set a new record for annual revenue.

This target is considered feasible due to the positive prospects of the asphalt sector, thanks to the rapid disbursement of public investment urged by the government. In addition to wholesale distribution to supply points in the North, DXP will continue to upgrade its machinery and organizational structure in the asphalt business and invest in infrastructure such as transportation vehicles, storage tanks, etc. to directly supply to transportation projects nationwide, especially major transportation projects, highways, and public investment projects…

In general, 2024 promises to be a year of strong breakthrough for DXP after completing the capital increase last year. Continuing to maintain growth in the core business of port services, as well as strengthening the asphalt sector to increase revenue and improve profit margins, is the most important goal for DXP.

Dividends will be the final result reflecting DXP’s efforts and a commitment to shareholders about the company’s healthy business and financial situation. With optimistic prospects in both important business segments, DXP expects to continue maintaining a high dividend ratio not only in 2024 but also in the coming years.