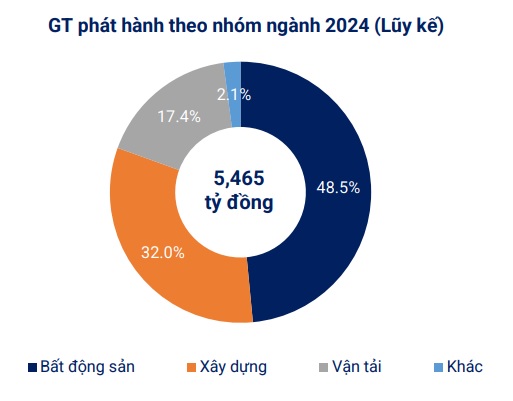

As of March 1, 2024, there have been 3 private corporate bond issuances totaling VND 1,165 billion in February 2024.

Source: VBMA

|

Continuing the lackluster issuance trend in January, the value of issuances in February remained significantly lower compared to the 2023 benchmark, as certain provisions of Decree 65 came back into effect and tightened regulations regarding corporate bond issuances. For example, the criteria for determining professional individual investors and credit rating requirements.

Source: VBMA

|

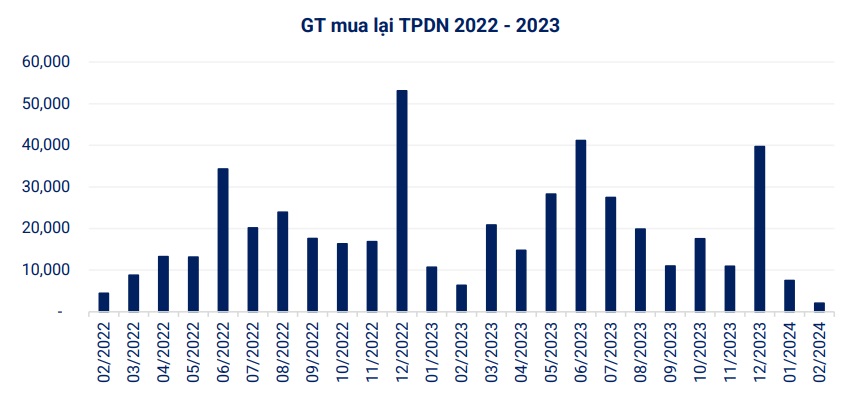

In February, the value of early redemption of corporate bonds only reached VND 2,056 billion, a 68% decrease compared to the same period in 2023. Over the remaining 10 months of 2024, it is estimated that there will be approximately VND 256 trillion in bond maturities, with the majority being real estate bonds, valued at over VND 98 trillion (equivalent to 38.4% of the total value).

Source: VBMA

|

In terms of unusual information disclosure, 7 companies delayed principal and interest payments in the month, with a total value of over VND 6.2 trillion (including interest and remaining bond balance). In addition, 24 bond codes had their interest, principal, or early redemption periods extended.

Regarding upcoming issuance plans, there are only private bond issuances from Vietnam International Bank (UPCoM: BVB). Specifically, the Board of Directors of BVB has approved a plan to issue private bonds in 2024 with a maximum total value of VND 5.6 trillion, expected to be divided into 6 issuances.

These are non-convertible bonds, without warrants, and backed by assets. The bond face value is VND 100,000, with a maximum maturity of 8 years and a fixed interest rate of 8% per annum.