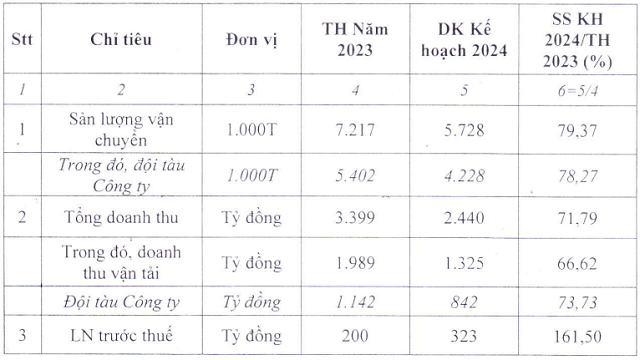

Specifically, VOS estimates that the shipping volume in 2024 will decrease by 21% compared to the performance in 2023, reaching over 5.7 million tons, of which 74% is the output of the Company’s fleet.

With the decrease in shipping volume, it is understandable that the total planned revenue of VOS also decreases by 28%, reaching over 2.4 trillion VND, of which transportation revenue is over 1.3 trillion VND, decreasing by 33%; the Company’s fleet revenue is 842 billion VND, decreasing by 26%. However, after deducting the cost price and expenses, the pre-tax profit increases by 62%, reaching 323 billion VND.

|

VOS’s Business Plan for 2024

Source: VOS

|

Regarding the investment plan in the new year, VOS focuses on developing its fleet, continuing to monitor the market situation, and allocating financial resources to search for and lease additional vessels for appropriate exploitation through various forms or invest in more vessels. Currently, VOS is bareboat chartering 2 50,000 DWT product oil tankers, 2 13,000 DWT product/cargo oil tankers, and a number of dry cargo vessels through the voyage relet form.

VOS will also sell the 47,000 DWT Dai Minh product oil tanker as it is “old” and difficult to be efficiently exploited. It is known that Dai Minh product oil tanker was built in 2004 in Japan, which means it is 20 years old. In addition, VOS will return the 2 Dai An and Dai Phu vessels in 2024 as their charter contracts have expired.

Dai Minh product oil tanker

|

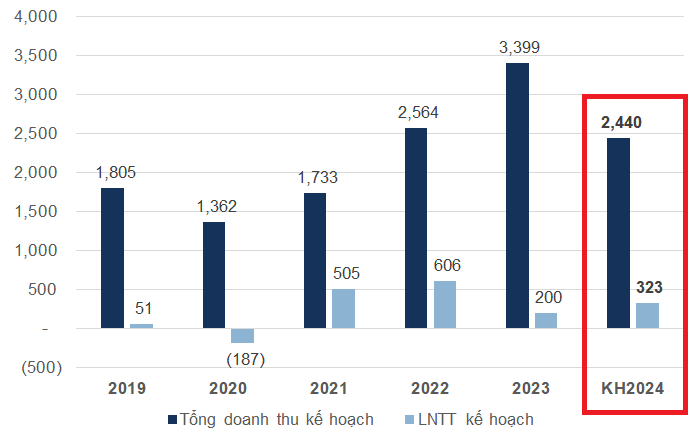

In general, the 2024 business plan differs from the 2023 implementation partly due to many variables that appeared in the past year. Specifically, the 2023 gross revenue of VOS is nearly 3.2 trillion VND, an increase of 32% compared to the previous year. This is also the highest revenue level in the Company’s operational history, thanks to the additional contribution from commercial activities.

However, the net profit for the whole year decreased by 68%, reaching only over 155 billion VND. VOS stated that due to the difficult dry cargo and container ship markets for almost the whole year, the full-year profit in 2023 was lower than in 2022.

|

The business situation of VOS over the years and the business plan for 2024.

Unit: Billion VND

Source: VietstockFinance

|

Record revenue in 2023, but VOSCO’s net profit is less than 1/3 of the previous year