The big group stepped down from the high level, surpassing the annual plan

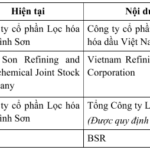

The group of four major players in the industry, including PLX, OIL, GAS, and BSR, only BSR received positive results.

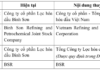

|

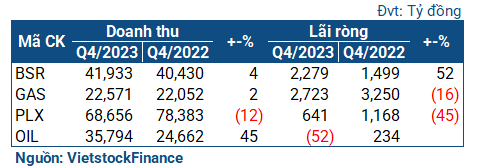

The fourth quarter results of the oil and gas industry giants

|

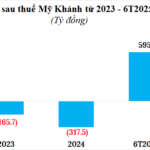

Specifically, BSR had a consecutive second quarter of increased profits, with nearly 2.3 trillion VND in net profit in the fourth quarter of 2023, a growth of 52%. The increase in production and consumption compared to the same period contributed to the increase in fourth quarter profit.

| Business situation of BSR |

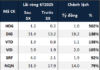

Meanwhile, PVGas (GAS) and Petrolimex (PLX) both experienced a decrease in profits. GAS achieved a net profit of 2.7 trillion VND, a 16% decrease, while PLX saw a sharp decrease of 45%, with a net profit of only 641 billion VND.

GAS stated that the 5% decrease in oil prices in the fourth quarter, along with a 43% decrease in dry gas consumption, led to a decrease in business results. For PLX, difficulties in other business sectors (especially in the two areas that account for a large proportion of profits, namely aviation fuel business and maritime transport), reduced profits due to exchange rate differences, and no longer having income from ship liquidation, were the reasons given.

OIL even had a net loss, with a loss of 52 billion VND (compared to a profit of 234 billion VND in the same period last year), due to the deep decrease in oil prices during the period.

| OIL is the only loss-making name among the 4 oil and gas industry giants |

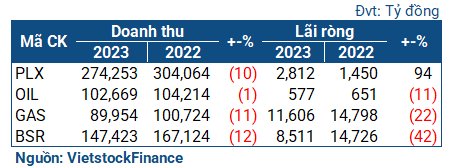

For the whole year, the business situation of this group was similar, with changes only in terms of position. PLX went from a sharp decrease in the fourth quarter to a 94% increase in accumulated profits compared to the previous year, reaching 2.8 trillion VND. However, it is worth noting that this result is actually due to the huge profit from divesting from PGB in the third quarter.

|

Except for Petrolimex, the other 3 names all saw a decrease in profits in 2023

|

The remaining 3 names, including OIL, GAS, and BSR, all reported a decrease in annual profits. OIL decreased its net profit by 11% in 2023, reaching 577 billion VND. GAS and BSR decreased by 22% and 42% respectively, reaching 11.6 trillion VND and 8.5 trillion VND.

However, the decline of GAS and BSR was mostly due to the high base of the previous year when the two enterprises achieved record profits. In addition, the results of all 4 major players exceeded the annual plan, as they had predicted and set modest targets. In terms of after-tax profits alone, PLX exceeded by 22%, OIL by 31%, GAS by 80%, and BSR even exceeded the plan by 5 times.

Differentiation

|

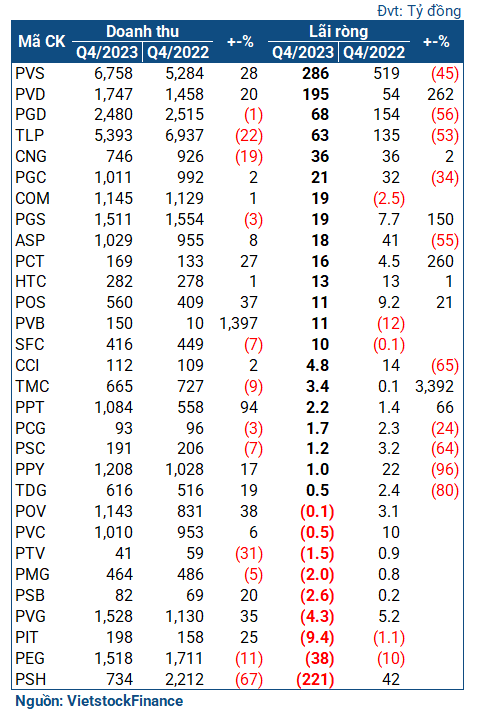

The business results of the oil and gas group in the fourth quarter of 2023

|

In the remaining group of businesses, there was a clear differentiation in the fourth quarter results. Many businesses achieved hundreds of billions in profits, with significant increases. On the other hand, there were also significant losses.

Notably, in the positive group, PVD stood out. In the fourth quarter, PVN’s oil drilling unit achieved a “strong” profit with 195 billion VND in net profit, nearly 4 times the same period last year. This profit also contributed to a much brighter overall business performance for PVD compared to the previous year’s losses. The company ended the year with 579 billion VND in net profit (compared to a loss of 103 billion VND the previous year), also the highest profit year for PVD since 2015.

| PVD achieved its highest profit year since 2015 |

Comeco, a retail petroleum company, also had a good business performance with a net profit of 19 billion VND (compared to a loss of 2.5 billion VND in the same period), mainly due to increased gross profit and the reversal of environmental risk provision. Accumulated throughout the year, COM achieved a net profit of 34 billion VND, 27 times higher than the previous year, and exceeded the 30% profit target approved at the 2023 shareholder meeting.

On the other hand, there were also names that experienced significant declines. PGD saw a decrease of 56% in profits, with only 68 billion VND in the fourth quarter. The company stated that customers in the period encountered difficulties in consuming output products, especially in the real estate-related group (tiles, iron and steel, construction materials), which led to a decrease in revenue. Moreover, the global economic situation under pressure from high inflation, along with geopolitical fluctuations, causing fuel prices to increase according to the fuel market, also had a strong impact on business results.

| PGD witnessed a sharp decrease in profits in the fourth quarter |

“Petroleum giant of the West” PSH also only achieved a profit of 63 billion VND in the fourth quarter, a decrease of 53% from the same period, with the main reason being the significant decrease in revenue compared to the same period. However, 2023 was still a strong growth year for PSH, with a profit of 159 billion VND, 4.6 times higher than the previous year, and the highest profit year for PSH since 2015.

The sharp increase in management costs and the decrease in warranty provision for construction projects led to a nearly 50% decrease in PVS’s fourth quarter profits, reaching 286 billion VND. This decrease also affected the annual achievement of the enterprise, with 866 billion VND in net profit (a 12% decrease compared to 2022). However, this is still considered a successful year for the company, as it exceeded the after-tax profit target by 61% approved at the 2023 shareholder meeting.

Some names even experienced losses. The heaviest is “petroleum tycoon of the West” PSH, with a net loss of 221 billion VND (compared to a profit of 42 billion VND in the same period). The company explained that the increase in input material prices directly affected the cost of goods sold. Other reasons were the high interest costs and losses from exchange rate differences. However, it is also worth noting that revenue in the fourth quarter decreased significantly by 67%, reaching 734 billion VND, which is also partly the reason for PSH’s loss in the period.

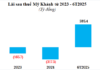

| The fourth quarter loss affected the annual results of PSH |

Despite the losses, PSH still achieved a profit of nearly 57 billion VND throughout the year (compared to a loss of nearly 237 billion VND), so it can be considered a decent business year for the petroleum tycoon of the West. In addition, despite having to pay more than 1 trillion VND in forced tax, the company recently signed a cooperation agreement to receive credit funding of 720 million USD with Acuity Funding (Australia). A significant portion of this amount will be disbursed to deal with outstanding debts (banks, taxes), helping to resolve many immediate issues for the company.

Expectations for 2024?

According to MBS, oil prices are unlikely to exceed $90 per barrel in 2024. Business results of oil and gas companies will be based on an average oil price scenario of $85 per barrel in 2024 and an estimated average oil price of $82 per barrel in 2023.

For the oil and gas exploitation sector, the Lô B – Ô Môn gas and power project is the most anticipated and has many expectations. MBS believes that the final investment decision (FID) for this project cannot be approved in 2023 and will be postponed to the first half of 2024, but the limited bidding activities to carry out some work before FID indicates some efforts in the negotiations of the parties involved.

The latest investment decision promises to bring abundant job opportunities to businesses in the upstream oil and gas region, such as PVS. In addition, although PVD has set a direction to lease self-lifting rigs abroad until the end of 2024, MBS believes that the company will still benefit from these projects by undertaking post-2024 work related to oil drilling services.

For the refining group, recent macro data is not very optimistic, accompanied by lower than expected consumption of refined oil products and lower crack spreads for these products even when supply is tightening. MBS forecasts that the reference crack spreads for various products will be lower by 5% compared to previous projections. The profits of downstream companies in the refining sector will also be affected, reduced from previous forecasts.

Chau An