Target pre-tax profit of 420 billion VND, down 18%

|

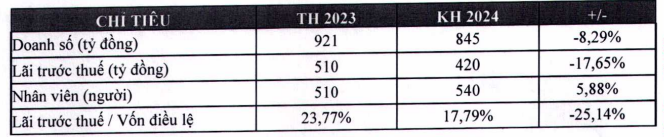

FPTS Business Plan 2024

Source: FPTS

|

According to the documents, FPT Securities sets targets for revenue and pre-tax profit of 845 billion VND and 420 billion VND respectively in 2024, a decrease of nearly 8% and 18% from the previous year. The pre-tax profit/equity ratio drops to nearly 18%, from 24% in the previous year.

Despite planning to backtrack, FPTS will still expand its staff. It is expected to have 540 employees in 2024, an increase of 30 compared to 2023.

The above plan is built based on the actual situation in 2023 and the forecast for the domestic and international economy, as well as the stock market in 2024. Regarding the domestic economy, FPTS believes that 2024 can be a brighter year, but there are still many difficulties and challenges for Vietnamese businesses.

Regarding the stock market, liquidity and scores in 2024 are expected to be supported by low interest rates and the Government’s focus on growth-stimulating policies. However, concerns about sharp exchange rate fluctuations will have a negative impact on the market; in addition, expectations for the new KRX system to be officially operational. However, there are no new products, not many new stocks listed/traded on the market, and competition in transaction fees, margin lending rates between securities companies is more fierce than before.

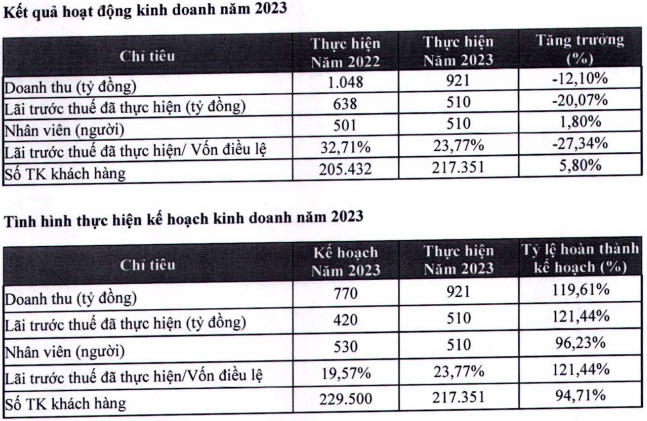

Looking back at the business results in 2023, revenue and pre-tax profit reached 921 billion VND and 510 billion VND respectively, a decrease of 12% and 20% compared to the previous year. The pre-tax profit/equity ratio also decreased from 33% to 24%. However, compared to the plan, the Company still exceeded the target.

On the contrary, the number of employees and the number of customer accounts improved in 2023, reaching 510 people, an increase of 2% and more than 217,000 accounts, an increase of 6%. However, these two indicators did not meet the plan.

Source: FPTS

|

Regarding the profit distribution plan in 2023, FPTS will propose to shareholders a cash dividend ratio of 5% for 2023, equivalent to 500 VND/share, with a maximum total amount of over 107 billion VND, expected to be implemented in the second quarter of 2024.

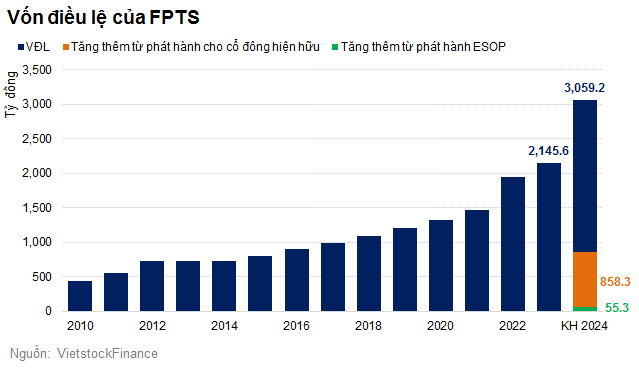

Want to issue nearly 86 million additional shares to increase equity

FPTS also proposes at the General Meeting of Shareholders a plan to issue additional shares to increase equity from retained earnings at the end of December 31, 2023 on the 2023 financial statements audited, with a maximum total of over 858 billion VND. The number of expected shares to be issued is 85.8 million shares, equivalent to over 858 billion VND (calculated at face value). The issuance ratio is 10:4 (shareholders owning 100 shares will receive an additional 40 new shares).

The capital source to be used from undistributed after-tax profits as of December 31, 2023 on the 2023 financial statements audited is a maximum of over 858 billion VND.

The issued shares are not subject to transfer restrictions, except for cases where the right to receive shares of the capital increase from equity arising from the number of shares issued under the employee stock ownership program (ESOP) in 2022 is still within the transfer restriction period, it will also be subject to the corresponding ratio and time limits with the number of ESOP shares currently restricted from transfer.

In addition, FPTS is also planning to propose at the General Meeting a plan to issue ESOP in 2024 for the management staff of the Company. The expected number of shares to be issued is more than 5.5 million shares (nearly 2.58% of the total outstanding shares), with the issue price equal to the face value of 10,000 VND/share. The source of implementation is contributions from employees.

The issued ESOP shares will be restricted from transfer for 2 years, gradually released at the following ratio: 50% of the shares will be freely transferable after 1 year from the end date of the issuance; the remaining 50% will be freely transferable after 2 years from the issuance date.

The raised capital of over 55 billion VND will be used to balance and supplement capital into trading reserve lending activities.

Both plans are expected to be implemented in the second or third quarter of 2024 after being approved by the State Securities Commission. If successful, the Company’s equity will increase from over 2,145 billion VND to 3,059 billion VND.

The General Meeting of Shareholders authorizes the Board of Directors to implement the capital increase from equity for existing shareholders and then issue ESOP. Participants in purchasing ESOP shares in 2024 are not entitled to receive shares from the capital increase. At the same time, the issuance ratio will be adjusted to ensure that the total number of shares for sale does not exceed the number of shares approved by the General Meeting of Shareholders.

Appoint 1 additional member to the Board of Directors for the 2023-2028 term

Another important item, FPTS will propose at the General Meeting of Shareholders to dismiss the Member of the Board of Directors for the 2023-2028 term, Mr. Taro Ueno. He has just submitted a resignation letter on March 4, 2024 for personal reasons, unable to schedule time to fulfill the assigned tasks.

At the same time, elect Mr. Kenji Nakanishi (Japanese nationality, born in 1966) as an additional member. Mr. Kenji Nakanishi has worked at Daiwa Securities Group from April 1992 to November 2021. He was the Manager of Overseas Business Administration at SBI Holding Inc from July 2022 to April 2023. Since May 2023, he has been the CEO at SBI Royal Securities Plc (Cambodia) under SBI Holding Inc.

Kha Nguyen