After a 4-week winning streak, the VN-Index faced a challenge in the first session of the week. Large-cap stocks were affected, and money flowed into mid-cap and small-cap stocks, with the real estate group being the focus. Stocks in the real estate sector attracted capital as the sector had lagged behind the market’s recent gains.

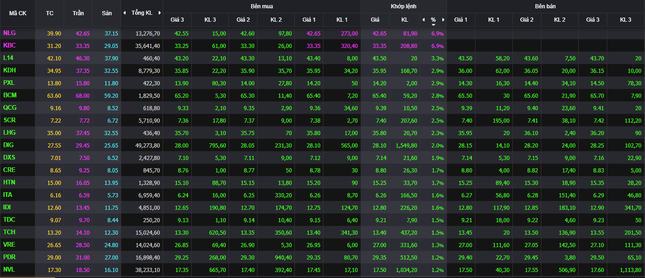

The trading value of the real estate group was nearly 8,000 billion dong, significantly higher than other sectors, far ahead of the second-highest trading value sector, which was banking (4,694 billion dong). DIG led the market in liquidity with a value of 1,400 billion dong, followed by KBC with a transaction value of 1,665 billion dong, and the stock price hit the ceiling.

The real estate group has shown strong trading performance.

Within the real estate group, NLG hit the ceiling and had more sellers. Both KBC and NLG were among the leaders of the market, along with the contributions of BCM, VRE… KDH, SCR, DXS, CRE, HTN, IDI… also saw price increases. However, the contribution of this group to the VN-Index was not significant, as their market capitalization only belonged to the mid-cap group.

While large-cap stocks in the banking sector took a break after a strong rally, a few individual stocks performed well, with HVN being a typical example. Vietnam Airlines’ stock price hit the ceiling at 13,600 dong per share. DSN of Dam Sen Water Park, BTP of Bà Rịa Thermal Power Plant…

On the other hand, the most negative impact on the market came from the banking sector, with VCB taking nearly 2 points off the VN-Index. TPB, MSB, VPB, STB also added pressure to the index.

In March, HOSE will welcome some new listings, including the banking sector. This week, on March 8th, over 1 billion shares of Nam A Bank (code NAB) will be listed with a reference price of 15,900 dong per share. Vietnam Post and Telecommunications Group (code VTP) announced that the entire 121.78 million shares of VTP will trade on HOSE for the first time on March 12th, with a reference price of 65,400 dong per share and a 20% price fluctuation range on the first trading day.

Securities stocks showed differentiation, despite the market’s enthusiasm for the upcoming launch of the KRX system. Last week, stocks in this industry had already rallied in anticipation of the KRX news. The performance of this group at the beginning of the week was relatively muted.

At the end of the trading session, the VN-Index increased by 3.13 points (0.25%) to 1,261.41 points. The HNX-Index increased by 0.95 points (0.4%) to 237.38 points. The UPCoM-Index decreased by 0.03 points (0.03%) to 91.13 points. Liquidity soared with a trading value of HoSE reaching over 25,740 billion dong. Foreign investors bought nearly 60 billion dong, focusing on KBC, DIG, VND, MWG, NLG…