The stock market continued to experience continuous fluctuations in the trading session on March 5, with moments of decline to 1,257 points and low liquidity. The return of buying pressure helped the VN-Index recover well under the positive influence of large-cap stocks, especially retail stocks.

The VN-INDEX increased by 8.57 points (+0.68%) to 1,269.98 points. The foreign trading was negative with a net selling value of 79 billion VND across the market.

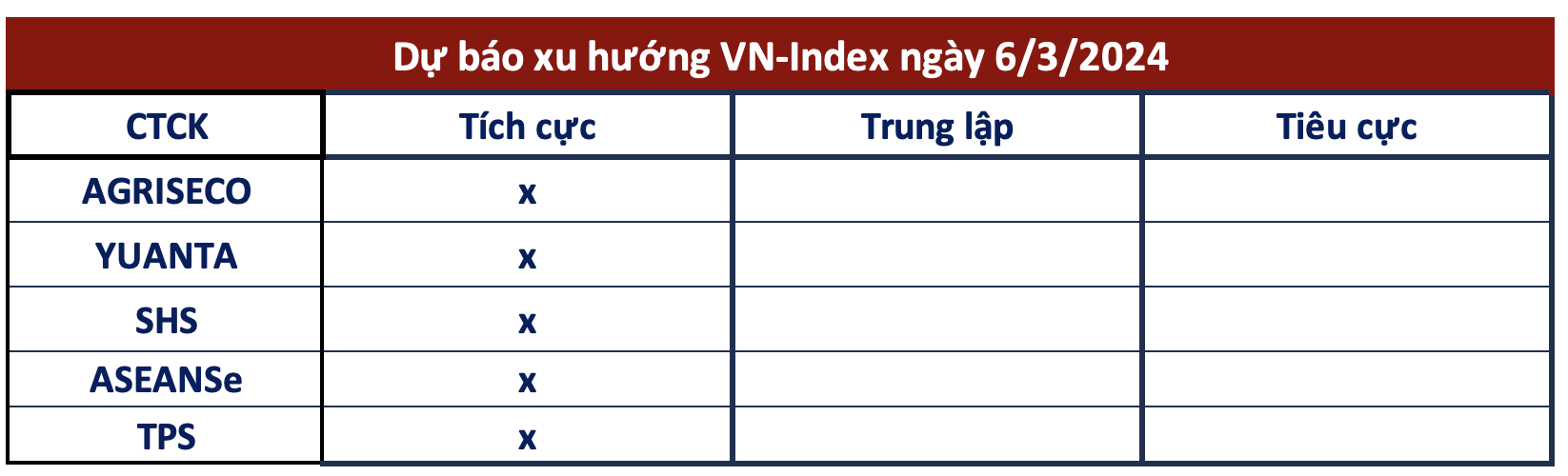

With a good increase in trading session with active liquidity, most securities companies believe that the market’s upward trend will continue. Investors are recommended to limit chasing purchases at strong uptrends and prioritize accumulating stocks during the consolidation phases.

Agibank Securities evaluated that the closing index at the highest level of the session is an opportunity to expand the positive upward trend and aim for the next resistance level around 1,280 (+-5) points. Although the fluctuations will become more apparent during the upward trend, the support level around 1,240-1,250 points is expected to play a significant role.

Agriseco Research recommends investors to avoid chasing purchases in enthusiastic uptrends, increasing the proportion of trading stocks near the accumulation price area or during corrections around the mentioned support level. Stocks that are expected to continue attracting capital inflows in the short term include banking, real estate, construction, or stocks that have not increased in price.

Yuanta Securities believes that the market may continue to rise in the next session and the VN-Index may soon surpass the resistance level of 1,268 points in a few sessions. At the same time, there are signs of capital flow shifting between stock groups instead of focusing on a few large-cap stocks as in the period from January to early February 2023.

Short-term investors can continue to maintain a high proportion of stocks in their portfolios and make new purchases. However, due to the ongoing adjustments, investors need to limit chasing purchases at strong uptrends and prioritize accumulating stocks during consolidation phases.

Asean Securities evaluated that the market recorded the third consecutive increase today with maintained high liquidity, which is a quite positive factor. This shows that the upward trend is still well supported by capital inflows. However, the large differentiation between industry groups makes it relatively difficult to seek profits in T+ (intraday trading).

AseanSe recommends investors to continue observing market movements, take advantage of uptrends to restructure their portfolios with a recommended proportion of stocks at 70%.

TPS Securities is also optimistic about the medium-term upward trend of the VN-Index. In the short term, it is highly likely that the index will have fluctuating sessions with almost sideways movements to accumulate for the next strong resistance level of 1,280-1,290 points. The support level of the index is currently located at 1,240-1,250 points. Capital flow will tend to shift between large, medium, and small-cap stock groups.

According to SHS Securities, the VN-Index may continue to increase in the short term, aiming for the strong resistance of 1,300 points. However, the analyst team notes that because the previous accumulation trend is not reliable enough, unusual fluctuations may occur in the upcoming sessions and the main index will adjust within the range of 1,150-1,250 points after the end of the uptrend.