This activity is expected to take place in 2024, shortly after receiving approval from the State Securities Commission (SSC).

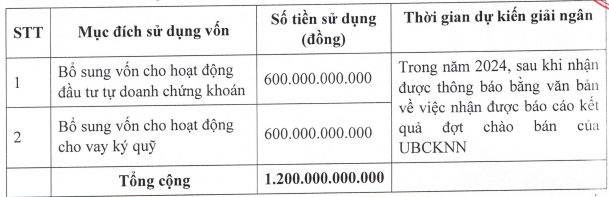

The Board of Directors also approved a plan to use VND 1,200 billion in raised capital. Specifically, half of this amount (VND 600 billion) will be used to supplement capital for proprietary investment activities, while the remaining half will be used to supplement activities for lending and securities trading. The disbursement will take place in 2024, upon receiving notification of the results of the offering from the SSC.

Source: VFS

|

Additionally, the Board of Directors decided to allocate the funds for each purpose mentioned above based on the actual amount raised from the sale guarantee period, with the proportion of allocation for each purpose being 50% of the total actual amount raised.

Regarding the above-mentioned issuance plan, according to the resolution of the Annual General Meeting of Shareholders in 2023, VFS plans to issue 120 million shares (at a ratio of 1:1), with a selling price of VND 10,000 per share. The charter capital after the issuance may increase from VND 1,200 billion to VND 2,400 billion.

| Charter capital ofVFS |

If the shares are not fully sold, they will be distributed to other entities at a selling price of VND 10,000 per share. Shareholders with the right to purchase can only transfer the right to purchase once, and the recipient of the transfer cannot further transfer it to a third party.

In 2023, VFS achieved a post-tax profit of nearly VND 85.7 billion, an increase of 36% compared to the previous year. The company’s operating revenue reached VND 200 billion, an increase of 29% compared to the previous year.

All main activities of the company have seen growth. Profits from financial assets carried at fair value through profit or loss (FVTPL) reached nearly VND 94 billion, an increase of 28%; profits from loans and receivables amounted to VND 53 billion, an increase of 45%; and brokerage revenue reached VND 45 billion, an increase of 76%.

The total asset scale of the company in 2023 reached VND 1,896 billion, an increase of 86% compared to the previous year. Of which, FVTPL assets accounted for VND 159 billion, a decrease of 51% compared to the beginning of the year. Loans amounted to VND 695 billion, almost 2.5 times the beginning of the year. It is worth noting that VFS has a long-term investment worth VND 600 billion in non-listed bonds, which will mature at a later date. This investment was not recognized at the beginning of the year.