2023 marks a year of growth with many challenges for the Vietnamese economy and the banking industry. Looking back at history, the profitability of the banking industry has always fluctuated strongly with economic cycles, in which the profitability of VPBank (VPBank, HOSE: VPB) has shown even stronger fluctuations than the remaining 26 listed banks: The period of stagnant growth in 2018-2019 was followed by a period of strong growth in 2020-2022. So, can the “tough year” of 2023 be offset by the “revival” in the coming period? To answer this question, we need to review the bank’s strategy and execution over the years.

From a strategic perspective…

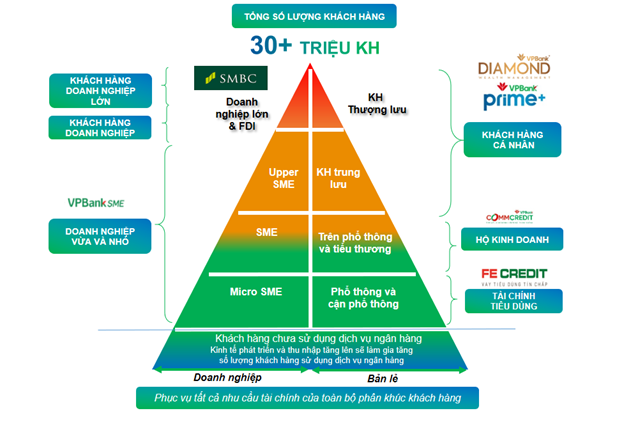

For a long time, VPBank has been known for its distinctive strategy, different from other banks: the “segmentation strategy” with the direction of the Retail Bank and three main pillars: individual customers, SMEs, and Consumer Finance. Especially in recent years, the abundant capital from strategic partner SMBC has been an important foundation for the bank to continue implementing its business strategy, providing diversified services to a wide range of customers.

VPBank is the only bank serving all customer segments, from the mass/mass-attractive customer group through FE Credit to individual customers, small and medium enterprises (SMEs), and large corporations. VPBank has designed specialized segments “made to measure” according to customer profiles, thereby providing customers with the best service experiences.

Furthermore, after completing the acquisition of OPES Insurance Company to expand the non-life insurance segment, and consolidating its strong relationship with AIA life insurance as well as successfully increasing capital for VPBank Securities to 15 trillion VND – the second-largest on the market, VPBank has completed its ecosystem, providing a variety of financial products and services to customers.

By “covering” all customer segments with a comprehensive financial ecosystem, VPBank aims to become a “One-stop shop” – the only destination that meets all essential financial service needs of customers.

Source: VPB

|

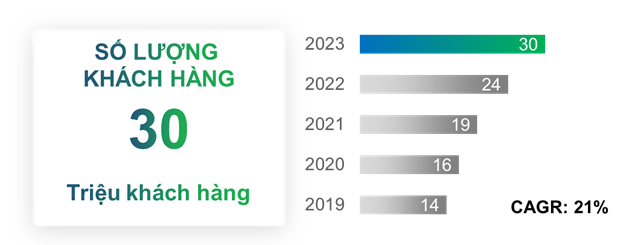

Thanks to the “segmentation strategy” and continuous digitalization, the customer base of VPBank’s entire ecosystem has reached over 30 million people by the end of 2023. This figure has doubled in the 2019-2023 period, with a compound annual growth rate of 21% per year, highlighting the efforts to implement this growth-oriented business strategy.

The strength of this strategy lies in the fact that as the economy grows strongly and spreads to different social classes, the general prosperity will reward the bank for its efforts to bring suitable financial products to even low-income workers – the mass/mass-attractive customer segment or the prominent consumer credit segment which is still considered high-risk but high-profit. However, this strategy still faces challenges as the macroeconomic environment presents many difficulties. Especially, the double impact of the Covid-19 pandemic and the slowdown in economic growth in 2023 has significantly affected the financial capacity and consumed the savings reserve of the mass customers, which is also the main segment of FE Credit. As a result, the consumer finance sector has been greatly affected, causing VPBank to increase provisions, reducing the bank’s profitability. This can also explain why VPBank’s profitability tends to fluctuate more, depending on the macroeconomic situation compared to the industry average. This has two layers of significance. On the surface, this fluctuation has clear cyclical factors, but in reality, in the period of economic growth boom, the achieved profits are not only enough to compensate for the downturns but also bring high growth compared to a stable but modest growth rate of the industry average.

… to flexible execution

With its distinctive strategy, although VPBank has experienced rapid profit growth (2013: 1,355 billion VND, 2023: 10,987 billion VND; equivalent to a compound annual growth rate of 23.3% over the past 10 years), there are still concerns from an outside perspective about its leading position in the unsecured consumer lending segment leading to a higher non-performing loans ratio than the industry average.

In reality, VPBank has always been responsive, adjusting the ratio of unsecured and secured loans according to market conditions in its efforts to optimize profitability. Based on observations, since the Covid outbreak period (2020) brought macro challenges that made the unsecured consumer lending segment face many obstacles, VPBank has flexibly boosted secured lending. Therefore, even when loans turn into non-performing loans, the bank still has a reason to manage risks and has measures to recover thanks to good collateral assets. Figures show that, unlike the period before 2020, from 2021 till now, the ratio of income from risk-provisioned loans/total operating income (TOI) of VPBank far exceeds the industry average, reflecting the bank’s determination and focus in managing risks, as well as the quality of collateral assets for loans at VPBank.

In the context of increasingly competitive markets, to stand firm and develop – to achieve strong growth goals according to the set vision, VPBank has shown its unique qualities with a breakthrough “segmentation strategy”. Particularly, with the companion of strategic shareholder SMBC, VPBank will have many advantages to successfully exploit new customer segments in the coming years – the FDI segment, capitalizing on the market opportunities brought about by the strong FDI wave into Vietnam.

In the short term, VPBank still has to overcome uncertainties from macro factors. The bank expects that its business strategy will bring sweet fruits in the long term thanks to worthy compensations in boom periods of economic growth. In a young economy with many potentials like Vietnam, it is possible to expect that a strategy with trust in the growth of all segments combined with flexible adjustments suitable for different market phases will bring outstanding outcomes for the steadfast shareholders of the bank.