Source: State Bank of Vietnam

|

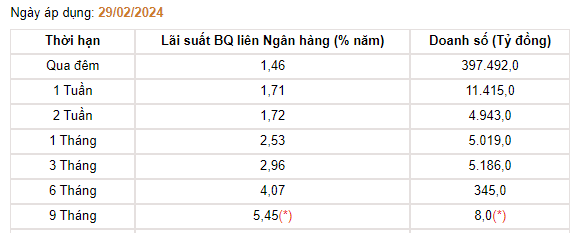

From the session of 21/02 until now, the average interbank interest rate has sharply decreased across all terms from 1 month downwards. Data from the State Bank of Vietnam (SBV) shows that as of 29/02, the average overnight interbank interest rate has reached 1.46% per annum, a significant decrease of 2.46 percentage points compared to one week ago (21/02).

The interest rate for a 1-week term has decreased to 1.71% per annum (equivalent to a decrease of 2.1 percentage points), the 2-week term has decreased to 1.72% per annum (-1.3 percentage points), and the 1-month term has decreased to 2.53% per annum (-0.2 percentage points).

| Average interbank interest rate from the beginning of 2024 until now |

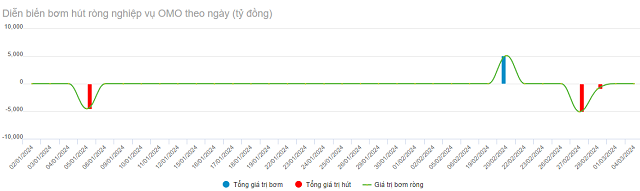

As liquidity starts to return, operators have withdrawn money from the system with an accumulated amount from mid-February until now being VND 6,037 billion through the open market operations (OMOs) channel.

Source: VietstockFinance

|

Previously, at the Government’s press conference on the afternoon of 02/03/2024, Deputy Governor of SBV Pham Thanh Ha shared that credit growth was recording at a relatively low level, even in many large banks.

He mentioned that the actual implementation in the first two months of the year saw credit growth slower than the same period in previous years, while liquidity was abundant.

Mr. Ha attributed the general reason to seasonal factors. The first two months of the year had slow growth, while credit growth was strong in December 2023, around 4%. Normally, with the seasonal factor in the fourth quarter, economic activities would be more vibrant, leading to more active lending activities. However, in January and February, which were the months of Tet holiday, credit activities would decrease and lending activities would not grow as much as in Q4/2023.

Economic expert Associate Professor. Dinh Trong Thinh evaluated that in the previous period, interbank interest rates increased significantly, while the SBV also injected money into the economy. At present, production activities have also returned to normal, and the reduction in overnight interest rates reflects the liquidity position of the banking system, which is relatively good. The supply of capital as well as cash for banks in particular and the economy in general is abundant and capable of meeting the needs of the economy well.