Bach hoa Xanh takes the throne of revenue from WinMart/WinMart+ and Co.opmart

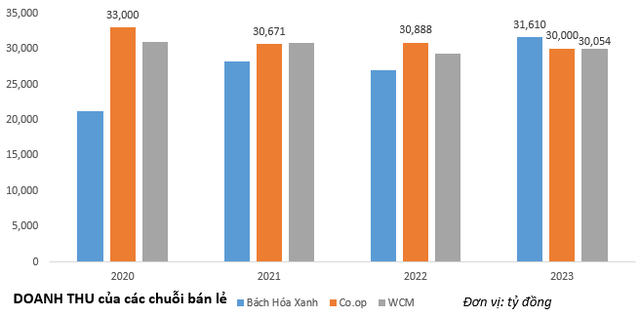

In recent years, the title of revenue leader among domestic retail chains has been alternated between Co.opmart and WinMart/WinMart+.

However, in 2023, the situation has changed. For the first time, Bach hoa Xanh’s revenue has surpassed both Co.opmart and WinMart/WinMart+ since this chain has completed its restructuring process and achieved remarkable business performance since Q3 2023.

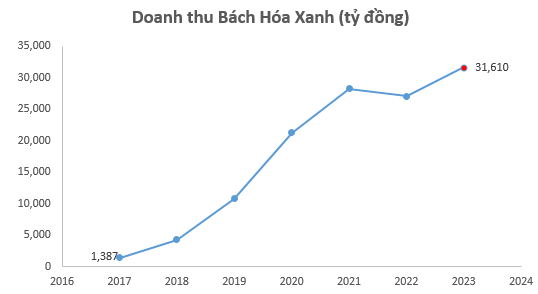

With 1,698 stores as of the end of 2023, Bach hoa Xanh reached a milestone of 31,610 billion VND in revenue, contributing nearly 15% of The Gioi Di Dong’s total revenue. This is also the highest revenue milestone ever achieved by Bach hoa Xanh.

Compiled from company reports

Regarding Saigon Co.op, recent information at the business activity review conference of the Ho Chi Minh City Cooperative Alliance (Saigon Co.op) stated that this supermarket chain maintained a revenue of nearly 30,000 billion VND in 2023. This result was achieved thanks to a good control of costs and ensured business efficiency in a challenging context.

According to the conference information, the projected profit for the whole year of 2023 of Saigon Co.op was still well on track to meet the set targets.

According to Masan’s announcement, the WinMart/WinMart+ supermarket system recorded a revenue of 30,054 billion VND in 2023, an increase of 3% compared to the same period the previous year. The revenue growth of WinMart/WinMart+ was attributed to the positive impact of opening new stores, the strong growth of converted stores, and the successful upgrade of the store model.

Bach hoa Xanh

Co.opmart – a strong rival of Bach hoa Xanh in Ho Chi Minh City

The Chairman of The Gioi Di Dong assessed that Bach hoa Xanh currently does not have a disproportionately large market share, even in the areas where the chain is present, including those where it has not expanded yet such as the North, so there are still many opportunities for expansion.

In addition, The Gioi Di Dong’s leadership also assessed that the Northern market has its own characteristics in terms of regional area, while the company is focusing on preparing the resources to expand at a speed that still ensures effectiveness.

In the coming time, Bach hoa Xanh’s chain is expected to focus only on expanding in Ho Chi Minh City due to the “still significant” consumer demand here, while many locations still do not have the presence of Bach hoa Xanh.

“District 7 and District 4 have very high population densities but limited number of stores. Therefore, we still decide to expand the Bach hoa Xanh chain in Ho Chi Minh City,” said Mr. Pham Van Trong – General Director of Bach hoa Xanh.

Therefore, in the Southern key market, especially in Ho Chi Minh City, the direct competitor of Bach hoa Xanh is Co.opmart, a long-standing and powerful retail brand.

In 2020, according to information from the business activity review conference, Saigon Co.op announced that in Ho Chi Minh City market, the revenue of Co.opmart system accounted for over 45% of the market share in the supermarket channel.

Also in the same year, Bach hoa Xanh achieved strong growth, doubling its revenue compared to the previous year. Reports from The Gioi Di Dong showed that Bach hoa Xanh is the main driver of growth in the modern retail (MT) store channel in Vietnam.

Bach hoa Xanh’s fast-moving consumer goods market share has exceeded 10% in urban areas in general and over 20% in Ho Chi Minh City.

Bach hoa Xanh

However, both Co.opmart and Bach hoa Xanh were stalled after 2020, which was the peak revenue year partly due to the impact of Covid.

For Bach hoa Xanh, it was due to model management quality issues, price and service quality controversies that had led to declining business operations following a period of rapid growth. This retail chain had to carry out a rigorous restructuring and purification process.

Until now, Bach hoa Xanh has recovered with a well-structured, efficient business system that has controlled quality and expenses and is aiming for absolute profitability this year.

Saigon Co.op

Currently, Saigon Co.op has shown great agility in adapting to modern consumer trends, selling on e-commerce platforms. The highlight of Saigon Co.op during the recent Lunar New Year was live-streaming sales on TikTok using virtual people.

Saigon Co.op has also implemented artificial intelligence (AI) technology, also known as “live-streaming sales with virtual people,” to optimize costs, reduce product prices, and support users in shopping almost 24 hours a day.

Mr. Le Van Tong, Head of Saigon Co.op’s Online Business Department, said that AI live-streaming deployment was a breakthrough step in Saigon Co.op’s digitization journey; at the same time, the unit actively contributed to the general trade development target of Ho Chi Minh City. “We hope that with this new, innovative sales trend, we will bring a more convenient and time-saving shopping experience to consumers,” expressed Mr. Tong.

Co.opmart

In 2023, Saigon Co.op introduced a new business model to the market called Co.opmart Cho Moi (An Giang) and SenseMarket – Co.opmart Cai Be (Tien Giang), which were researched and standardized to fit district-level markets and create conditions for network development in the future.

Parallel to that, the search for projects for the 2024-2025 period was also concentrated on, creating good projects to boost growth in the coming years.

In addition, Saigon Co.op focuses on digital transformation and improving logistics operations, including activities such as deploying Omni POS, self-checkouts, e-invoices, electronic payments, groundbreaking the Saigon Co.op Westward Warehouse in Lê Minh Xuân Industrial Park 3, implementing the WNS warehouse management system, converting the company’s warehouse model… to keep up with the rapid pace of current technology trends, the era of technology 4.0, and better meet customer needs.