On March 29, Biên Hòa Packaging Joint Stock Company (Sovi, code SVI) will hold its annual general meeting in Đồng Nai. The company has announced the meeting documents.

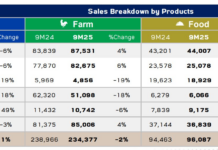

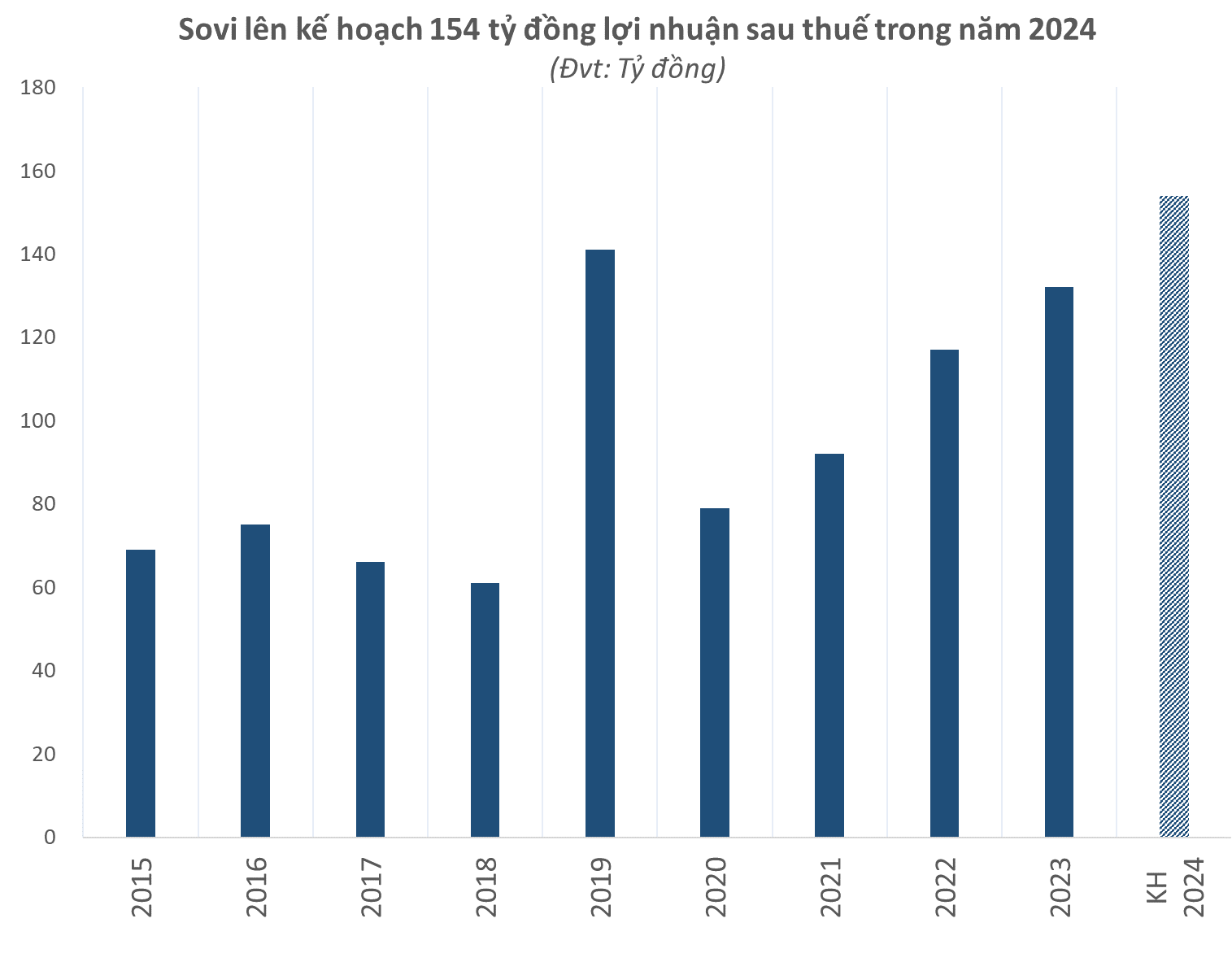

Sovi has set a plan for 2024 with a total revenue of 1,710 billion VND and a post-tax profit of over 154 billion VND, increasing by 14% and 17% respectively compared to the performance in 2023. The expected sales revenue is 1,644 billion VND. This plan is based on the target of Carton & Offset packaging output of 82,640 tons, an increase of over 11% compared to the same period. If successful, this will be the record profit level that the packaging company achieves.

At the same time, the company also plans to spend 200 billion VND on investment activities. According to Sovi, despite the low economic growth and weak consumer demand, export expectations will be positive in 2024 in the context of the global inventory reaching its bottom and significant cooling pressure on the supply chain.

Biên Hòa Packaging is one of the top 5 packaging suppliers in the Southern region, specializing in supplying packaging for many big names such as Unilever, Pepsico, Nestle, Vinacafe. The company operates mainly in the areas of Đồng Nai, Ho Chi Minh City, Binh Duong. With the SVI packaging brand, this enterprise has a scale of 3 affiliated factories, with a capacity of 100,000 tons/year, continuously achieving an average growth rate of 20-25%/year.

The turning point of Sovi was recorded in December 2020 when TCG Solutions Pte. Ltd, under the management of Thai Containers Group Co., Ltd – a subsidiary of the SCG Group (Thailand), successfully bought 12.1 million SVI shares and owned 94.11% of the charter capital. The value of the deal at that time was reported to be around nearly 2,100 billion VND.

Since then, Sovi has had 2 consecutive years of good growth. In 2023 alone, the after-tax profit reached over 132 billion VND, an increase of nearly 14% compared to the same period. EPS increased from 9,086 VND to 10,319 VND. SVI’s gross profit margin in 2023 was also improved to 17.34% from 14.2% in 2022.

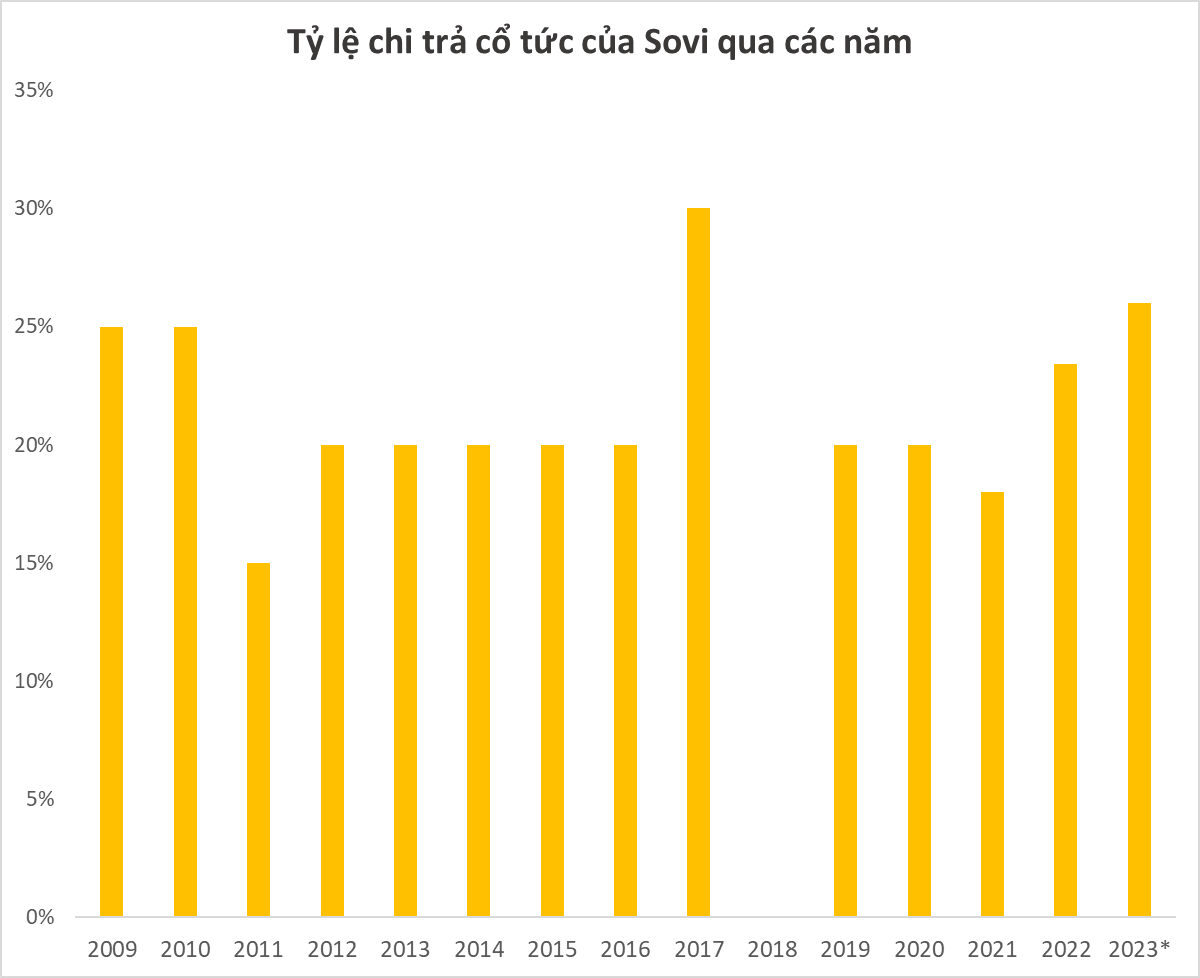

With these results, Sovi proposed to shareholders a 26% cash dividend plan for 2023 (2,600 VND/share). With over 12.8 million shares in circulation, the company will spend over 33 billion VND. This is the highest dividend rate since 2018 in this enterprise and the second highest rate since its listing (in 2017, the cash dividend was 30%).

Sovi is known as a company that maintains cash dividends annually. SCG Group, by holding the controlling amount of capital in Sovi (SVI), will pocket over 31 billion VND. Previously, in June 2023, Sovi also paid the 2022 dividend with an implementation rate of 23.4%, and SCG received over 28 billion VND. In total, since investing in Sovi, the Thai group has earned hundreds of billions from dividends.

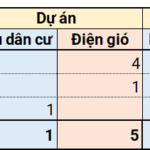

Expected dividend rate in 2023

In the upcoming general meeting, Sovi also proposes to change personnel when submitting to shareholders a proposal for the removal of the Independent Member of the Board of Directors status of Mr. Nguyễn Quý Thịnh and has received a candidate application for the replacement position from Mr. Piyapong Jriyasetapong.

In the market, SVI stock closed at 65,000 VND/share on March 7.