Illustrative image

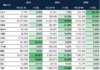

In a newly released macroeconomic report, MBS Securities (MBS) stated that interbank interest rates reached their peak on February 22 due to seasonal factors, putting pressure on short-term liquidity and pushing up overnight interest rates to 3.7%. However, shortly after, interest rates began to cool down towards the end of the month and returned to a low level.

Overnight interest rates decreased rapidly and are currently trading at 1.4%, a drop of more than 2/3 from the peak. Short-term interest rates, ranging from 1 month downwards, have also declined significantly and are currently trading in the range of 1.5% – 2%.

On the other hand, the State Bank of Vietnam (SBV) continued to conduct Open Market Operation (OMO) in February. On February 20-21, SBV injected over VND 6 trillion through OMO with an interest rate of 4% per year and a 7-day term, and this amount has matured and returned to SBV. In the meantime, there has been no activity in bond issuance. The fact that SBV did not conduct any further transactions afterwards indicates that liquidity in the system has returned to a stable state.

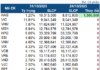

In the market, the downward adjustment trend of deposit interest rates by the majority of banks still continues. State-owned banks have not shown any new interest rate adjustment movements and the current average interest rate is 4.7% for 12-month terms, while some private banks have even lowered interest rates significantly compared to state-owned banks.

However, some banks have started to raise deposit interest rates mainly for terms below 5 months in the joint-stock bank group, ranging from 2.5-3.8% per year, in order to attract additional deposits after the Lunar New Year holiday. Meanwhile, for 12-month deposits, they still fluctuate below 5% per year. MBS believes that input interest rates are likely to hit a bottom in the first quarter and are unlikely to decrease further, primarily due to credit demand having a tendency to increase in 2024.

In the context of export growth being more positive at around 6-7%, investment and consumption both showing signs of recovery after a low base in the same period last year, analysts believe that capital demand will balance out with the current surplus liquidity. Accordingly, MBS forecasts credit growth in 2024 to reach about 13-14%.

However, in the opposite direction, there is not much pressure for interest rates to increase as the tightening cycle of US monetary policy has nearly ended. With the Fed forecasted to lower the benchmark interest rate to around 4% by the end of 2024, the pressure on the exchange rate is not significant, and SBV will have room to maintain its current monetary policy.

“We forecast that 12-month deposit interest rates of major commercial banks may increase by an additional 25-50 basis points, returning to the range of 5.25% – 5.5% in 2024,” said MBS.