The Vietnam stock market has undergone a volatile week of trading with 3 upward sessions and 2 downward sessions. After 4 consecutive weeks of gains and 4 continuous months of upward movement, the VN-Index closed the trading week with its biggest drop since August 2023.

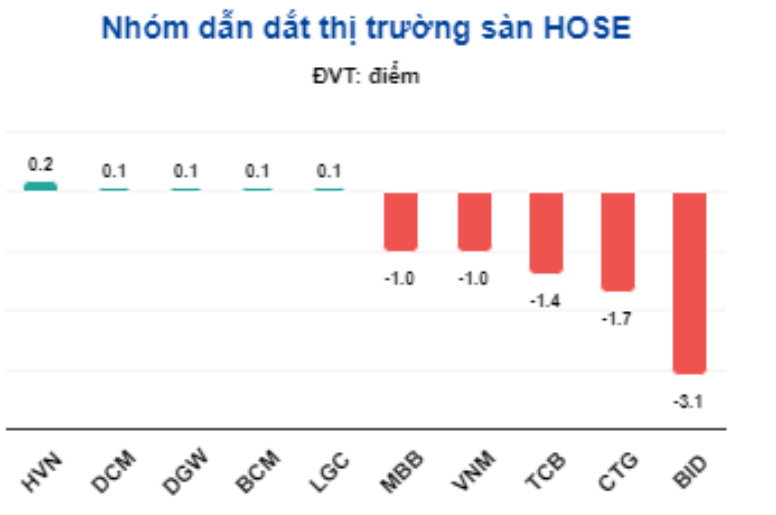

The VN-Index dropped 21.1 points (-1.7%) to 1,247 points, with selling pressure concentrated on blue-chip stocks that have seen significant gains recently, such as the banking sector, before spreading to the whole market. Many bank, securities, oil and gas, and real estate (penny stocks) experienced significant declines due to profit-taking pressure.

Over the weekend, on March 9th, on various forums, stock groups were still actively discussing yesterday’s VN-Index adjustment session and worrying that the market may continue to decline. Conversely, some opinions believe that the decline is an opportunity to buy stocks for those holding cash after the recent continuous market upswing.

Market movement on the sharp decline session of March 8th. Source: BETA

Dinh Quang Hinh, Head of Macroeconomic and Market Strategy Department in VNDIRECT Securities Company, stated that profit-taking pressure has increased significantly when the VN-Index failed to break the resistance level of 1,280 points in last week’s session.

“Despite experiencing a strong correction session, investors should not panic sell stocks. In reality, the market’s upward trend has not been broken as the index is still trading above the MA20 line. Concerns about interbank exchange rates and market liquidity have shown signs of easing. Market sentiment may soon stabilize,” said Dinh Quang Hinh.

According to VNDIRECT, investors should carefully observe the buying force at the support level of 1,230 points (+/- 10 points). If this level can be maintained, the market’s upward trend will be preserved and capital may flow into stocks that have accumulated momentum in recent times. Specifically, stock groups that have demonstrated good accumulation momentum like the steel, securities, real estate, and some mid-cap stocks…

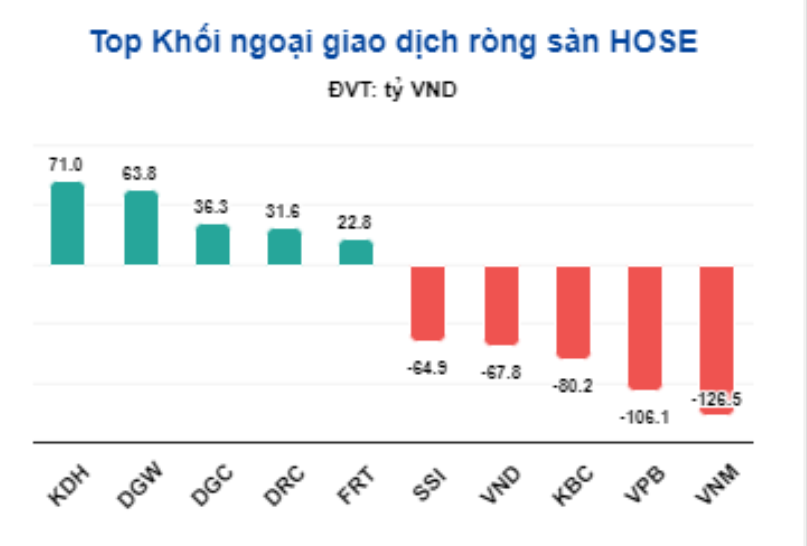

Foreign investors sold off nearly VND 700 billion on the heavily declining trading session of March 8th. Source: BETA

Meanwhile, Mirae Asset Securities Company analyzed that after a week of failing to reclaim the 1,270 – 1,280 point range, the VN-Index may enter a correction phase. The short-term support level for the index is currently the MA20 moving average line (1,232 points).

Experts at SHS Securities Company also believe that looking at the short-term perspective, the strong correction in the March 8th session will challenge the next short-term upward momentum, although the end of the short-term uptrend is not yet confirmed.

If the market soon recovers and exceeds the 1,250 point threshold in the coming sessions, the VN-Index still has the potential for further growth towards the strong resistance level of 1,300 points.