According to a report released in February, SGI Capital continues to maintain the global allocation trend for 2024 as “No Cash Holding”. The global financial market has witnessed a strong flow of money spreading across all asset channels, from government bonds, corporate bonds, stocks, and commodities such as gold and oil. The US stock market has risen to higher valuations mainly due to optimism about the EPS growth of companies while interest rates tend to decrease.

However, there are many signs that optimism, money flow, and valuations have reached high levels while interest rates have not yet decreased, creating potential adjustment risks in the future. With a relatively close correlation history, a decrease of more than 5% in the S&P500 would be a risk warning signal for the Vietnamese stock market.

SGI Capital also noted a recent highlight that the Japanese stock market has surpassed its historical peak 34 years ago despite the limited economic growth and business performance of listed companies. Meanwhile, the Chinese stock market is also recovering strongly thanks to the rigorous measures of the Government and the Central Bank. Coinciding with China’s import and export performance, South Korea also experienced three consecutive months of export growth, positively impacting the international trade recovery trend of Vietnam.

Reports evaluate major stock markets worldwide are following the scenario of the US and global economies gently landing, avoiding recession while reducing inflation enough for the Fed and Central Banks to enter the interest rate cut cycle from mid-year. This overall scenario benefits economies with high openness such as Vietnam. The Vietnamese stock market can also benefit when global investment flows reduce concerns about recession and seek higher risk opportunities in emerging and neighboring markets.

Vietnam stock market is optimistic in the medium and long term, but short-term risks are approaching

Regarding the domestic situation, exchange rates, especially unofficial exchange rates, continue to heat up and have surpassed the previous high set in 2022. However, since the beginning of the year until now, the VND/USD exchange rate has only depreciated at a normal level, lower than the increase of the USD Index and the depreciation of many other currencies.

According to SGI Capital, if the exchange rate in the banking system continues to increase close to the selling rate of USD from the SBV, concerns about liquidity and interest rates may arise when the SBV implements intervention measures. The exchange rate will be a focal point to closely observe during this period.

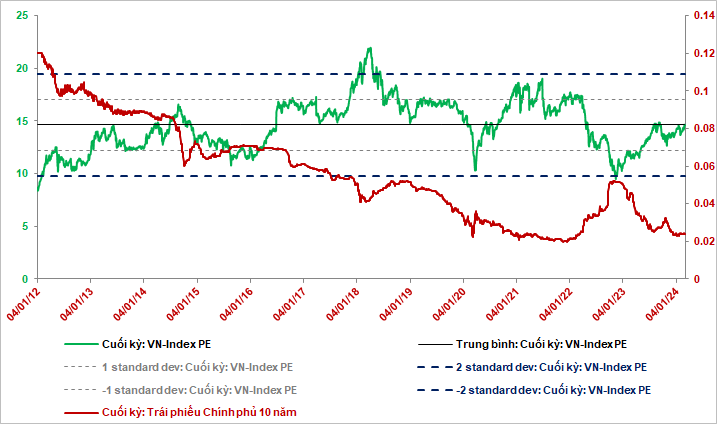

In terms of valuation, the P/E ratio of VN-Index has increased to nearly the long-term average level. SGI Capital evaluates that the market phase is priced low due to pessimism about the growth prospects have ended. Investors are expecting the economy to enter a recovery and growth cycle. Compared to the level of government bond interest rates and savings deposit interest rates which have returned to a low level, the valuation level of the overall market is still attractive. If this low interest rate is maintained stable, it will be a solid foundation to bring the economy into a recovery cycle and the stock market continues to trend upwards.

The reduction and maintenance of low interest rates along with strong support measures from the Government in the past year are helping to activate money flows into asset channels such as stocks, real estate, and stimulate business production and consumption activities. This process will continue as the global economy remains stable.

“Enterprises with financial strength and have restructured their business operations will take advantage of growth expansion opportunities better. The low-interest rate period is also an opportunity for enterprises with high debt levels to restructure and gradually recover, thereby creating diverse investment opportunities this year“ – SGI Capital commented.

The report maintains an optimistic view in the medium and long term with the economy and stock market of 2024 but notes some upcoming risk signals as general optimism increases and expectations gradually reflect on prices in many stock groups.

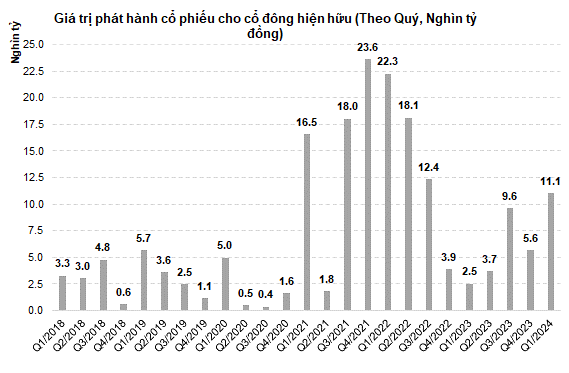

Points to note are the increasing amount of new issuances along with the increasing volume of internal shareholders’ registered sales recently. In particular, if the world stock market enters a correction phase along with intense pressure from exchange rates, it may affect the investment flow of foreign investors, thereby creating greater volatility in the Vietnamese stock market in the future.