Many experts say that the halving is an important event that can increase the value of bitcoin as a scarce commodity. But there are also opinions that the halving is just a technical change that speculators use to “push up” the price of bitcoin.

According to Reuters, here are 4 things to know about the halving:

WHAT IS THE HALVING?

The halving is a change in the blockchain – the underlying technology of bitcoin – that aims to reduce the rate at which new bitcoins are created. According to the design by Satoshi Nakamoto, the mysterious creator of bitcoin, this digital currency will have a maximum supply of 21 million coins.

Nakamoto himself wrote the halving event into the bitcoin code, and it works by gradually reducing the rate at which new bitcoins are created and put into circulation. So far, about 19 million bitcoins have been created.

HOW DOES THE HALVING WORK?

The blockchain technology involves creating data records – called “blocks”. These blocks are added to the “chain” in a process called “mining”. Bitcoin miners use computer systems with massive computing power to solve complex calculations, thereby building the blockchain and receiving rewards in the form of new bitcoins.

But with each halving, the rate at which new bitcoins are generated will be halved, meaning the profitability of bitcoin mining will also decrease. The blockchain is designed so that the halving event occurs every time 210,000 blocks are added to the chain, which is roughly once every 4 years. The next halving event for bitcoin will take place in April this year.

WHAT DOES THE HALVING EVENT HAVE TO DO WITH BITCOIN PRICE MOVEMENTS?

Many investors and experts believe that the limited supply brings value to bitcoin. According to economic laws, when a commodity has a limited supply, its price will increase when more people buy it. Therefore, when the amount of newly created bitcoins decreases, the price of bitcoin has reasons to rise.

But there are also investors and experts who disagree with this view, believing that the impact of limited supply on the price of bitcoin is already reflected in the current price of bitcoin.

The supply of bitcoin on the market depends heavily on mining, but this is an area with low transparency. Data on inventory and supply are not abundant.

If bitcoin miners sell their reserves of bitcoin, the price of bitcoin may face downward pressure. Understanding what is behind a cryptocurrency like bitcoin is difficult, because the level of transparency regarding who is buying the cryptocurrency and why is much lower than with other types of assets.

According to the viewpoint of many people, the halving event actually does not play a major role in the rise of bitcoin this year, but rather the price increase is mainly due to the U.S. Securities and Exchange Commission (SEC) allowing the establishment of bitcoin exchange-traded funds (ETF) in January, as well as expectations of central banks cutting interest rates.

However, in the highly speculative world of cryptocurrency trading, the explanations of analysts about bitcoin price fluctuations can turn into market stories with a self-amplifying effect, thus magnifying the volatility.

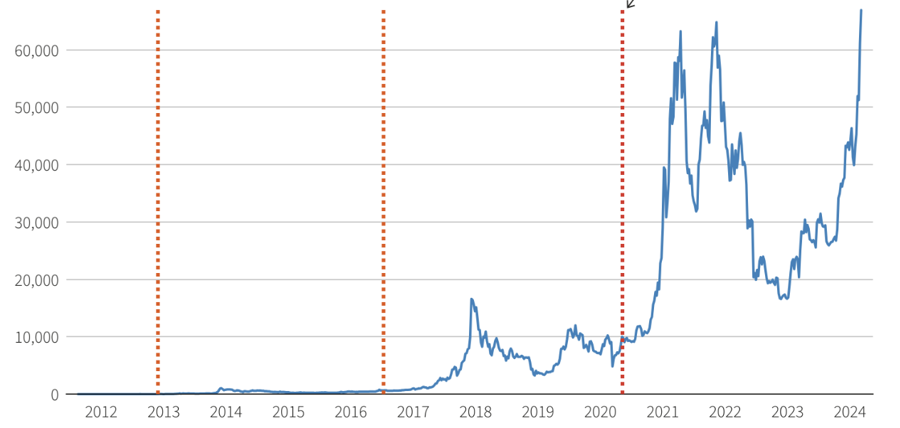

HOW HAS BITCOIN PRICE CHANGED IN PREVIOUS HALVINGS?

There is no evidence to suggest that previous halvings have caused bitcoin’s price to increase. However, bitcoin traders and miners have studied previous halvings to assert that this is beneficial for the price of bitcoin.

When the most recent halving took place on May 11, 2020, the price of bitcoin increased by about 12% in the following week. Also in that year, the price of bitcoin started to rise significantly, but there were many explanations for this price increase, including loose monetary policy and individual investors spending more time at home due to the Covid-19 pandemic to play with cryptocurrencies. Furthermore, there is no real evidence that the halving event played a role in that price increase of bitcoin.

In the previous halving in July 2016, the price of bitcoin increased by about 1.3% in the following week, but then plummeted in the next few weeks.

In other words, it is very difficult to determine how previous halvings have affected the price of bitcoin, as well as to predict the impact of the upcoming halving on the price of this cryptocurrency.

Regulators in many countries have continuously warned that the cryptocurrency market is a highly speculative market, often driven by rumors and the fear of missing out (FOMO), which can cause real harm to investors. This warning is issued even when authorities in some countries such as the United States have approved bitcoin trading products.