The market unexpectedly surged in the afternoon session due to a series of blue-chips gaining momentum. The VN-Index closed the session with a 2.05% increase, equivalent to 25.51 points, the highest increase since November 8, 2023. Liquidity recovered to nearly 26 trillion VND with 2 bourse’s matching orders. Foreign investors took advantage to net sell 461 billion VND on HoSE floor.

The sudden increase in the index today is thanks to the combination of the pillars. In the morning session, only VCB and FPT were strong among the Top 10 market capitalization, while the rest had modest or reference increases. In the afternoon, a series of other pillars followed suit and exploded.

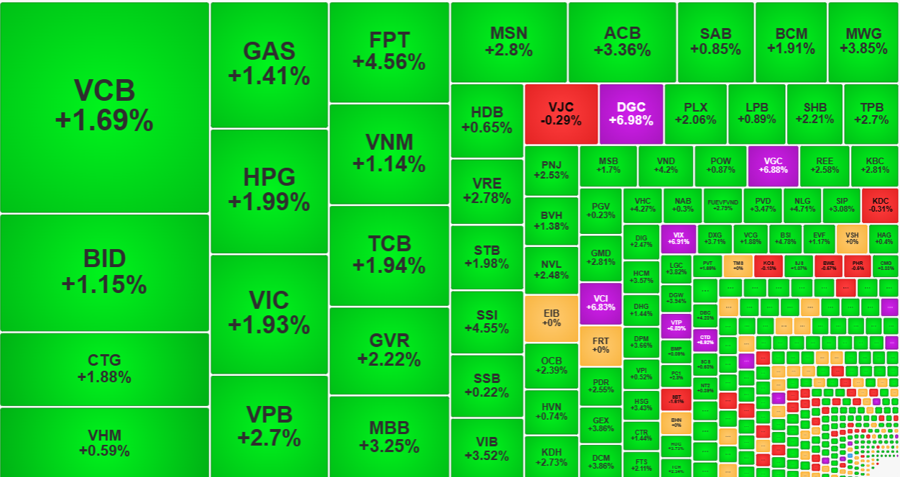

BID – the second largest market capitalization stock after VCB – increased another 1% in the afternoon compared to the morning session, closing above the reference price with a 1.15% increase; CTG – the third largest market capitalization stock – increased another 1.88% in the afternoon, closing with a 1.88% increase; GAS increased another 1.02%, ending with a 1.41% increase; VIC increased another 1.69%, closing with a 1.93% increase; VPB increased another 1.87%, closing with a 2.7% increase … Not only these new pillars strengthened, HPG, FPT, TCB, MBB, MSN also visibly strengthened. Only VCB did not increase further, closing at +1.69% equivalent to the morning session closing price. GVR even slightly decreased by 0.16% this afternoon, but still increased by 2.22% compared to the reference price.

With the VN30 basket, only GVR and VJC decreased slightly compared to the morning session, VCB and POW stood still, the rest increased. Up to 19 stocks increased more than 1% in the afternoon alone. The good trend was thanks to the fact that money flowed into VN30 much more: In the afternoon session, the liquidity of this basket was 4,930 billion VND, double the morning session. Meanwhile, the whole HoSE floor only increased about 5% compared to the morning session.

Thanks to the momentum of the top market capitalization group, the VN-Index alone increased another 12.5 points in the afternoon, which means nearly double the morning increase, closing at 1,270.51 points. The highest closing level in the previous peak week was 1,269.98 points on March 5, 2024, which means today the index is higher than the old peak. However, in terms of range, today’s session only brings VN-Index back to the peak area, because the highest fluctuation level reached by the index was 1,277.51 points on March 6, before turning downward.

Generally speaking, the total trading value on both exchanges did not increase much in the afternoon, reaching nearly 13,299 billion VND, 6.6% higher than the morning session. Therefore, it is not necessarily a large amount of money participating, but the buying enthusiasm is extremely high. Investors accept a large amount of shares in their accounts in the afternoon and continuously place high prices, thereby pushing up the price range. VN-Index closed at the highest level of the day and the breadth reached 433 advancing stocks/64 declining stocks, while the morning close was 314 advancing stocks/128 declining stocks. The number of stocks increasing by 1% at the close was 195, while the end of morning session was 132 stocks.

17 stocks on HoSE closed at the ceiling price, including many stocks with good liquidity such as DGC with 47.2 trillion VND, GIL with 11.14 trillion VND, CTD with 35.22 trillion VND, VIX with 72.97 trillion VND, VTP with 21.4 trillion VND, VGC with 25.75 trillion VND, ORS with 20.14 trillion VND, VCI with 67.73 trillion VND. Among nearly 80 stocks that increased by more than 3% on this floor, there were 27 stocks with liquidity of over 10 billion VND, led by SSI with 1334.3 billion VND, a 4.55% increase. Immediately following are the other 3 stocks in the securities group – VND, VIX and VCI.

Although the liquidity today is not unusually high, overall for the whole day, the trading volume on both exchanges reached 25.776 trillion VND, a 21% increase compared to yesterday and only slightly lower than the average level of the previous week, about 6%. In other words, the money flow returned strongly today. However, in terms of volume, this session’s trading volume decreased by about 2% compared to the previous T + 2 session.