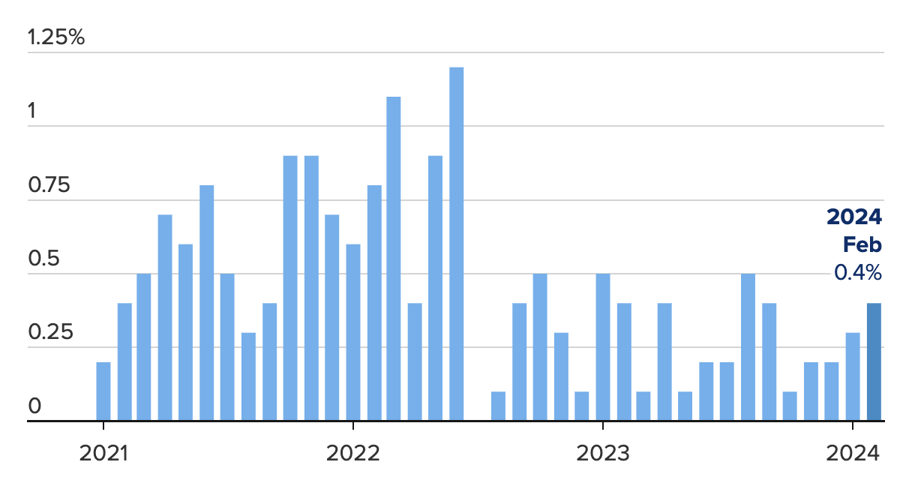

The highly anticipated report from the US Bureau of Labor Statistics, released on March 12, revealed that the Consumer Price Index (CPI) increased by 0.4% in February compared to January and rose 3.2% compared to the same period last year. The monthly increase is in line with forecasts, but the annual increase is 0.1 percentage points higher than the predicted 3.1% increase from a survey conducted by Dow Jones.

The core CPI, which excludes the volatile and frequently changing price categories of energy and food, increased by 0.4% on a monthly basis and 3.8% on an annual basis. Both of these increases are 0.1 percentage points higher than forecasted.

Compared to the actual increase in January, the year-over-year increase in overall CPI has risen 0.1 percentage points from 3.1%. The year-over-year core CPI decreased by 0.1 percentage points from 3.9%.

Although it has dropped by about two-thirds from the peak of over 9% set in the mid-2020s, inflation in the US is still nearly double the Fed’s 2% inflation target. These figures, which show a slow and persistent decline in inflation, were released as the world’s most powerful central bank prepares for its regular monetary policy meeting in one week’s time.

Among the groups of goods and services in the US CPI basket, the energy group increased by 2.3% in February, contributing the most to the overall acceleration of the index. The food group remained unchanged for the month, while the housing group increased by 0.4%.

The report shows that price increases in the energy and housing groups accounted for over 60% of the total increase in overall CPI. Retail gasoline prices in the US rose by 3.8% in February, while rental prices increased by 0.4%.

“Inflation is still above 3%, and once again the housing group is a major driver of inflation. With home prices forecasted to rise this year and rental prices only decreasing slightly, there will be no early reduction in the housing group as hoped to bring inflation down. The inflation reports for January and February will make it difficult for the Fed to lower interest rates quickly,” said economist Robert Frick of Navy Federal Credit Union to CNBC.

In recent weeks, Fed officials have signaled the possibility of starting rate cuts at some point this year, but they have also expressed caution about abandoning the anti-inflation fight too early while the pace of price increases remains high. The Fed’s statement after its January meeting indicated that policymakers needed to have “greater confidence” that inflation is actually subsiding.

In his recent testimony before the US Congress, Fed Chairman Jerome Powell continued to express caution. While saying that the Fed may be “a ways off” from the point where it can begin easing monetary policy, Powell said the Fed needs to wait until it has enough confidence to act.

According to Chief Economist Paul Ashworth of Capital Economics, the CPI report “will make the Fed wait longer to get the ‘greater confidence’ needed to begin cutting interest rates.”

For the financial markets, the Fed’s heightened caution from almost certain policy tightening in late 2023 means a repricing of assets. This repricing is based on new expectations of when the Fed can start lowering interest rates and the pace of rate cuts.

Earlier this year, the market expected the Fed to start cutting rates in March and have 6-7 rate cuts throughout the year. Currently, the market believes that the earliest easing will begin is in June, with only 3 rate cuts throughout the year, each cut amounting to a 0.25 percentage point reduction in the fed funds rate.

The solid economic growth of the US economy is the reason why the Fed relies on upcoming economic data to assess inflation prospects, and therefore the Fed cannot rush into interest rate cuts. Last year, the US gross domestic product (GDP) grew by 2.5%. In the first quarter of 2024, GDP growth of the world’s largest economy is forecast to maintain a 2.5% level – according to data from the Atlanta Fed’s GDPNow tracker.

An important driver behind the strong economic growth in the US is robust consumer spending, which is supported by the continuing hot job market. In February, the non-farm sector of the US added 275,000 new jobs, a figure higher than expectations. The unemployment rate, while slightly increasing to 3.9%, is still a low unemployment level in history.

This strength of the US economy is seen as a “double-edged sword” by experts. Sustained growth in a high-interest rate environment allows the Fed to be more comfortable in combating inflation without fearing an economic recession. However, on the other hand, strong economic growth raises concerns that inflation could be more persistent than expected.