Hoa Phat Group Joint Stock Company (Max HPG-HOSSE) announced the Board of Directors’ resolution approving the contents to be submitted to the 2024 Annual General Meeting of Shareholders.

Accordingly, HPG sets a target revenue of VND 140,000 billion and a post-tax profit of VND 10,000 billion for 2024, representing an increase of 18% and 47% respectively compared to the 2023 performance.

In terms of profit distribution plan, VND 6,800 billion post-tax profit for 2023 is planned to be allocated VND 408 billion to funds. The remaining post-allocation profit is VND 6,392 billion.

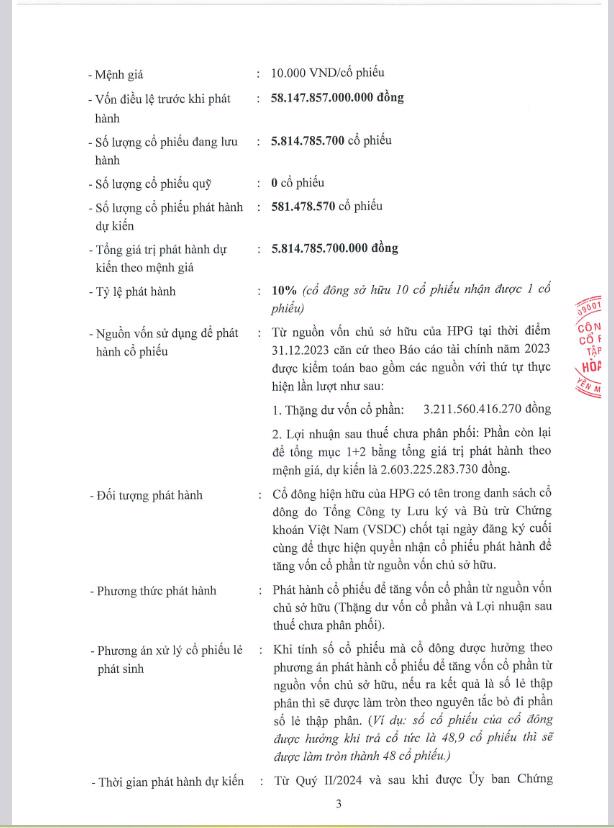

HPG proposes a plan to issue shares to increase share capital from the 2023 owner’s capital (bonus shares) with a quantity of more than 581.4 million shares, equivalent to a 10% issuance ratio (10 shares received 1 bonus share).

The capital source for the issuance will be obtained from HPG’s owner’s capital as of December 31, 2023, with the first priority being the surplus of share capital (over VND 3,211 billion) and undistributed post-tax profit (over VND 2,603 billion).

The issuance is expected to take place from the second quarter of 2024, after obtaining approval from the State Securities Commission. In addition, HPG also proposes a dividend payout ratio of 10% for 2024.

It is known that from March 11 to April 9, Mr. Nguyen Ngoc Quang – a member of the Board of Directors registered to sell 10 million shares. If successful, Mr. Quang will reduce his ownership to over 102 million HPG shares, accounting for 1.77% for personal financial purposes.

VCSC said that the target price increase is mainly due to VCSC’s adjustment of increasing the forecasted total post-tax net profit of the company after tax interest expense for the 2024-2028 period by an additional 2%, VCSC reducing the WACC assumption, and VCSC raising the target P/E from 13.0 times in the previous forecast to 18.0 times, and using a higher average projected EPS for 2024-2025 in the P/E valuation model to more accurately reflect HPG’s strong growth phase in the 2024-2025 period from the lowest profit level in the cycle in 2023.