The stock market has continuously gained points in January and February, led by the banking sector and leading stocks. Since the bottom range of 1,070-1,080 points, VN-Index has increased by about 200 points in the past 12 trading weeks.

Source: ABS Research

|

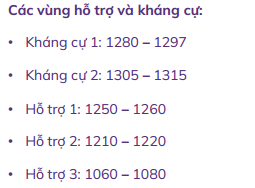

From a technical analysis perspective, the weekly trend is considered to be nearing exhaustion as the overall market enters a strong resistance zone of 1,280 – 1,290 – 1,315 points. Analysts believe this is a mid-term peak that was formed in June-August 2023, and the index is expected to experience strong fluctuations. Stocks need to absorb selling pressure before continuing the upward trend.

In the medium term, VN-Index’s upward trend has lasted for 19 weeks, approaching the strong resistance zone of 1,280-1,290 points. The market needs to establish an accumulation zone before continuing the upward trend.

The short-term trend continues to move upward in the third wave on the daily chart, and the price is synchronously rising on the daily and weekly timeframes.

ABS analysts have provided 2 scenarios for the market outlook in March 2024.

|

Market outlook in March 2024

Source: ABS Research

|

In scenario 1, there is a high probability that in the short-term, the market will adjust to the support level 2 (1,210-1,220 points), then continue to rise to the resistance level 1 (1,208-1,297 points) and resistance level 2 (1,305-1,315 points) on the daily trading chart. Experts advise investors to pay attention to the proposed important resistance levels in order to actively allocate their portfolios and avoid the FOMO psychology of chasing prices.

In scenario 2, there is a low probability of a short-term correction in the overall market on smaller timeframes (H1). Investors should observe support level 1 and 2, and reduce their positions in short-term trading.

Based on the dominant scenario of the market continuing the positive trend in the third upward wave in the short term, ABS Research recommends short-term investors to continue trading stocks that are synchronously increasing with VN-Index. Long-term investors should continue to hold stocks and observe the next important resistance zone of VN-Index.

The analysis team also suggests short-term trading in sectors and stocks that have long-term accumulation patterns, undervalued compared to the overall market, including: Leading stocks with large market capitalization (POW, REE, VNM, BCM, MSN); Real estate sector (HDG, DXG, HDC..); Banking sector (MBB, CTG); Retail (DGW) and fertilizer (DCM).

Kha Nguyễn