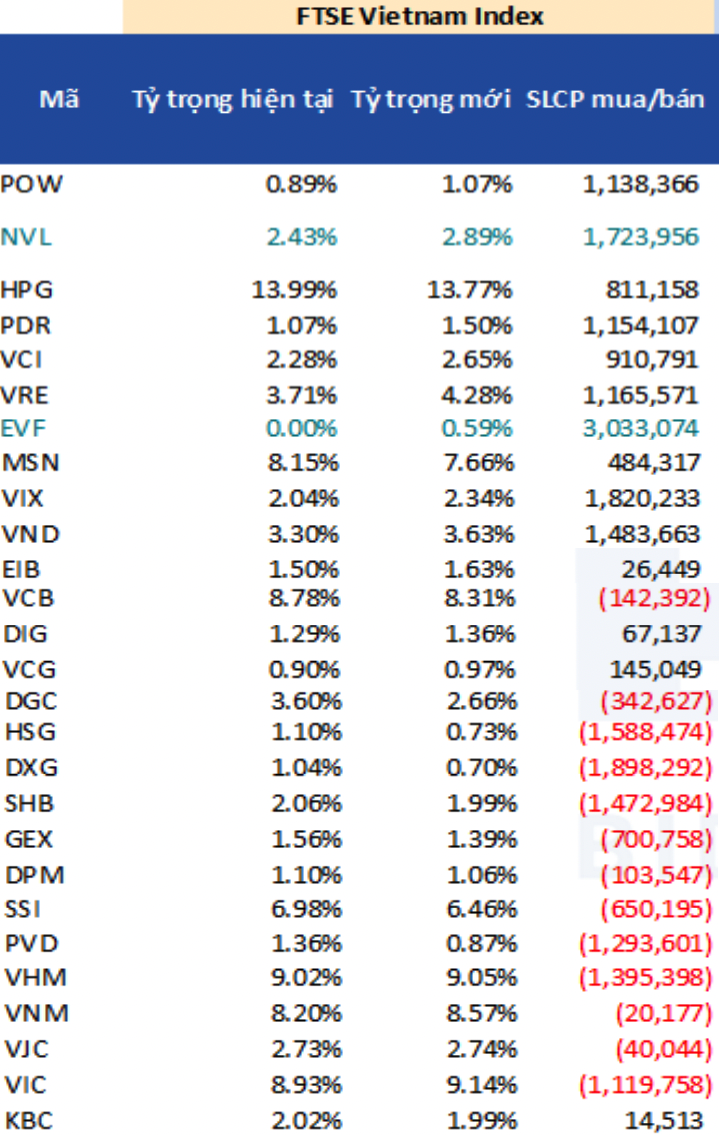

On March 1, FTSE Russell announced the list of component stocks of the FTSE Vietnam All-share and FTSE Vietnam Index – the benchmark index of the FTSE Vietnam ETF. Accordingly, the EVF stock of Power Finance Company Limited was added to the FTSE Vietnam Index basket while no stocks were removed. Currently

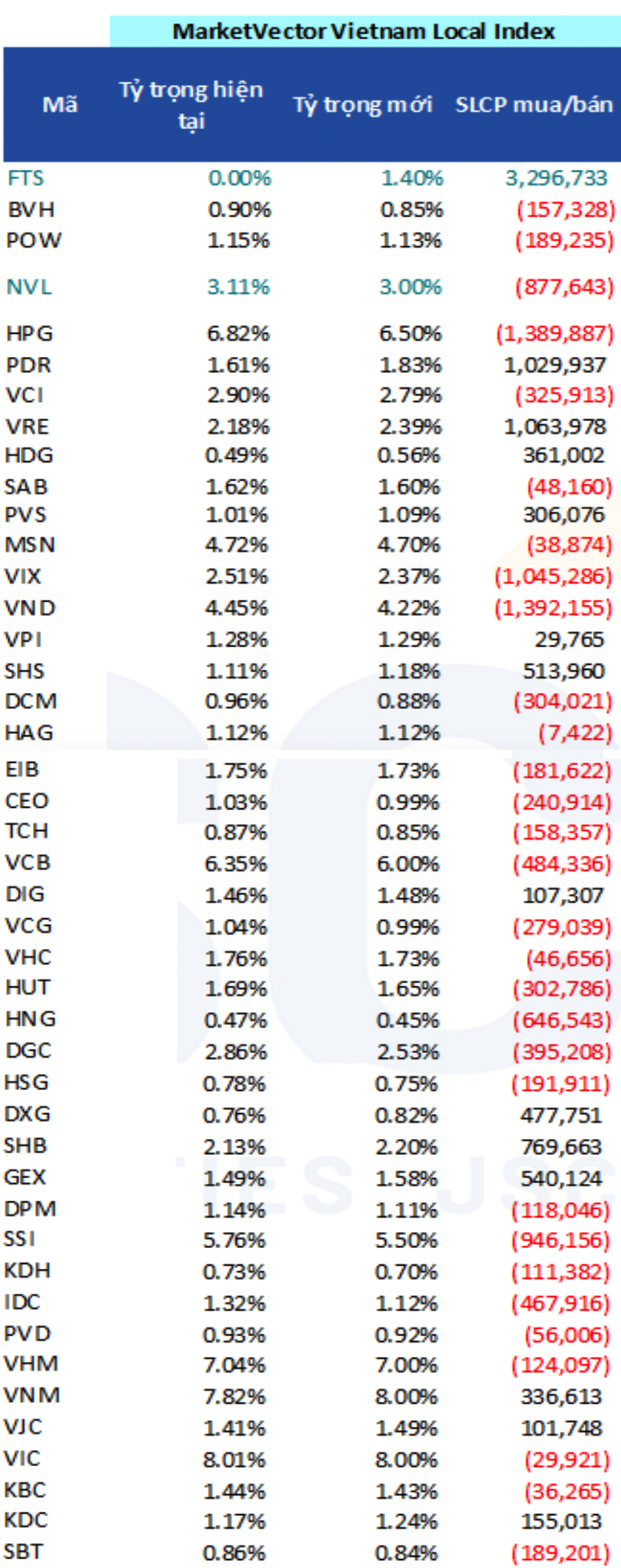

On March 8, MarketVector also announced the list of stocks included in the MarketVector Vietnam Local Index – the underlying index of Vaneck Vectors Vietnam ETF (VNM ETF). Specifically, the FTS stock of FPT Securities was newly added and no stocks were removed.

On March 15, the ETF funds referencing the two above-mentioned index baskets will complete the portfolio restructuring process. As of March 12, the total assets of VNM ETF reached USD 541 million and USD 351 million for FTSE Vietnam ETF.

In their latest report, BIDV Securities (BSC) made projections for the component stocks and the buying/selling volume of stocks for the ETF funds referencing the above-mentioned index baskets.

In particular, for FTSE Vietnam ETF, BSC forecasted that the fund would buy over 3 million EVF shares to add to its portfolio. In addition, it would also buy 1.8 million VIX shares, 1.5 million VND shares, 1.7 million NVL shares, 1.2 million VRE shares, 1.2 million PDR shares…

On the other hand, FTSE Vietnam ETF could sell 1.9 million DXG shares, 1.6 million HSG shares, 1.5 million SHB shares, 1.4 million VHM shares, 1.3 million PVD shares…

Source: BSC Research

For the VNM ETF, BSC predicted that the fund would buy over 3.3 million FTS shares to add to its portfolio. In addition, it would also buy 1 million VRE shares, 1 million PDR shares, 770 thousand SHB shares…

On the other hand, FTSE Vietnam ETF could sell 1.4 million HPG shares, 1.4 million VND shares, 1 million VIX shares, 945 thousand SSI shares, 878 thousand NVL shares…

Source: BSC Research

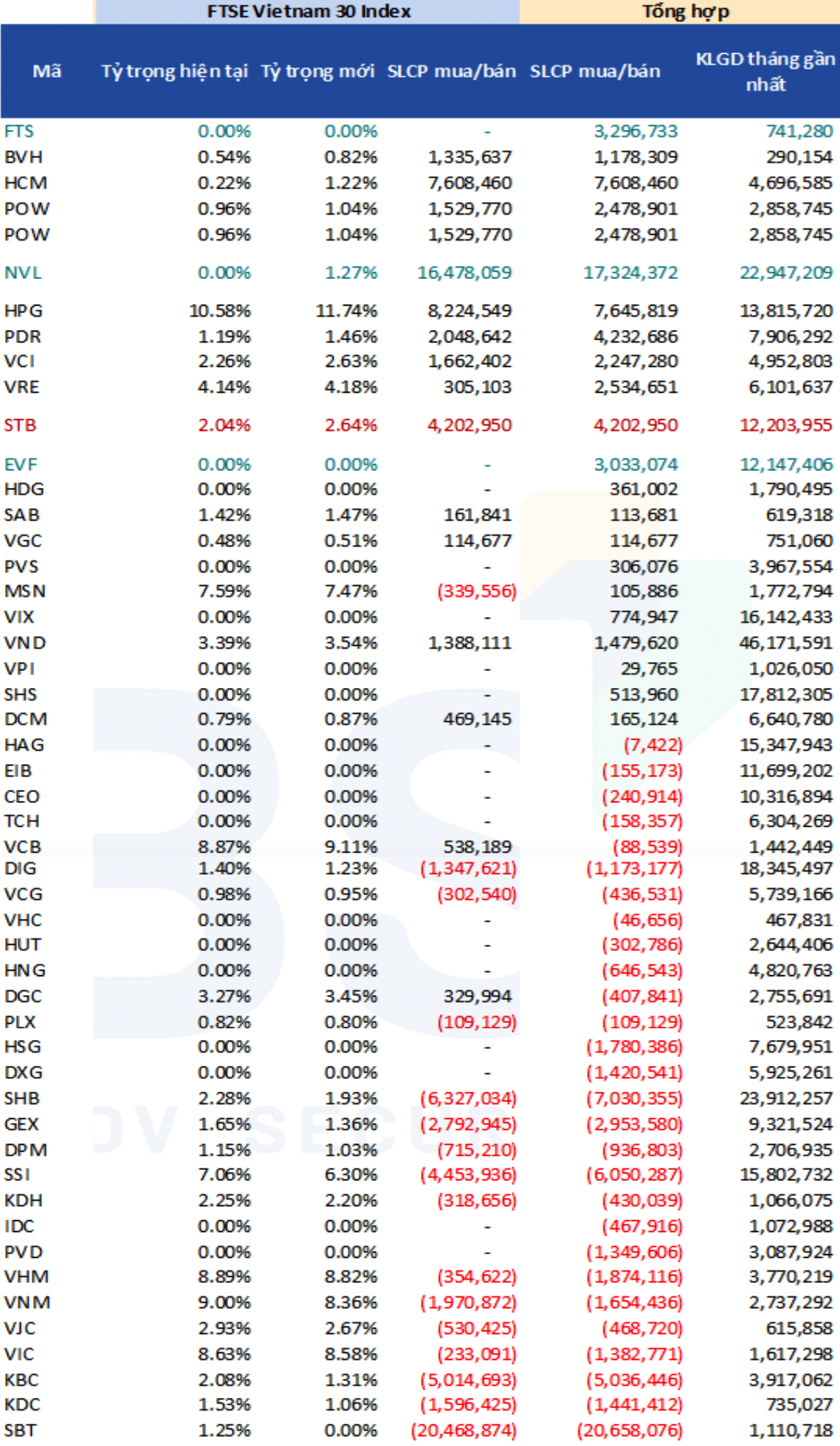

As for the FTSE Vietnam 30 Index, which is not officially disclosed by FTSE, BSC projected that this index basket would add NVL shares and remove SBT shares.

Currently, Fubon ETF is tracking this index basket. As of the end of March 12, 2024, Fubon ETF had total assets of USD 897 million, equivalent to over VND 22,100 billion, making it the largest ETF fund in the Vietnamese stock market.

Based on the above scenario, BSC projected that Fubon ETF would buy nearly 16.5 million NVL shares to add to its portfolio. At the same time, the fund could also buy 8.2 million HPG shares, 7.6 million HCM shares, 4.2 million STB shares, 2 million PDR shares, 1.7 million VCI shares, 1.5 million POW shares…

On the selling side, Fubon ETF could sell all nearly 20.5 million SBT shares. In addition, it could sell 6.3 million SHB shares, 5 million KBC shares, 4.5 million SSI shares, 2.8 million GEX shares…

In total, BSC forecasted that the three ETF funds would buy the most NVL shares with 17.3 million units. The two newly added stocks in the first quarter review, FTS and EVF, are also expected to be bought in over 3 million units.

Furthermore, other stocks projected to be significantly purchased include HPG with 7.6 million shares, HCM with 7.6 million shares, PDR with 4.2 million shares; POW, VCI, VRE with over 2 million shares; VND with 1.5 million shares.

On the other hand, SBT shares are projected to be sold the most with nearly 21 million units, followed by SHB with over 7 million shares, SSI with over 6 million shares, KBC with over 5 million shares, STB with over 4 million shares, GEX with nearly 3 million shares…

Source: BSC Research