I. MARKET MOVEMENT OF WARRANTS

At the end of the trading session on March 12, 2024, the whole market had 88 gainers, 56 decliners, and 34 unchanged warrants.

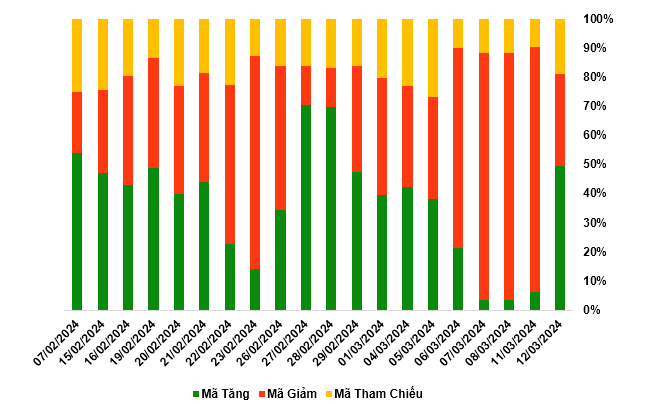

Market breadth in the last 20 sessions. Unit: Percentage (%)

Source: VietstockFinance

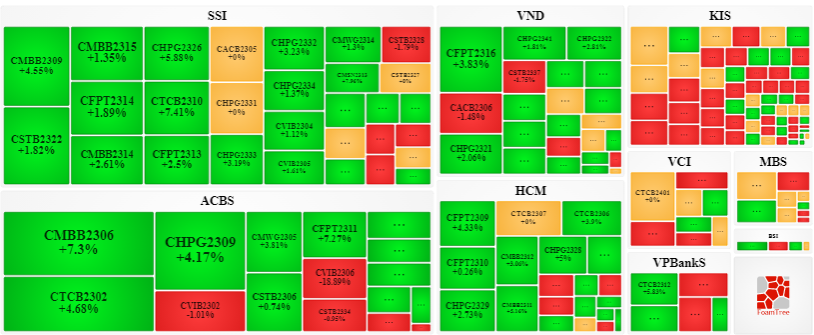

In the trading session on March 12, 2024, the buying side once again led the market, causing most warrants to increase in price. Specifically, the large warrants in the group with price increase are CMBB2306, CTCB2302, CSTB2322, and CSTB2316.

Source: VietstockFinance

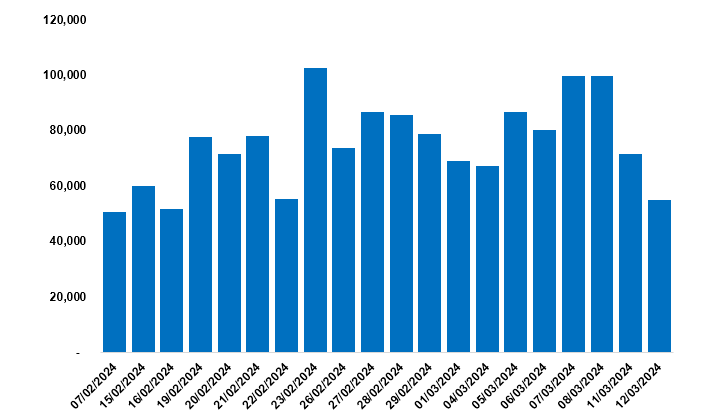

The total market trading volume in the session on March 12 reached 54.85 million CW, a decrease of 23.18%; the trading value reached 45.86 billion VND, a decrease of 25.92% compared to the session on March 11. In which, CSTB2322 is the leading warrant in terms of trading volume with 4.19 million CW; CMBB2309 leads in terms of trading value with 2.88 billion VND.

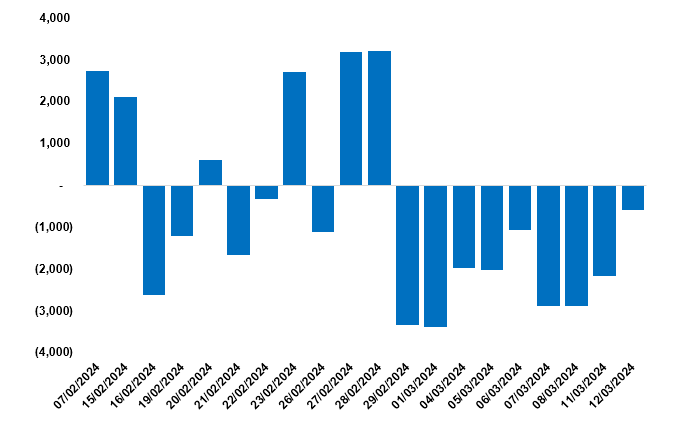

Foreign investors continued to be net sellers in the session on March 12 with a total net selling volume of 589,100 CW. Among them, CVPB2318 and CPOW2313 were the two warrants with the highest net selling volume.

Securities companies KIS, SSI, HCM, ACBS, VND are currently the most active issuing organizations in the market.

Source: VietstockFinance

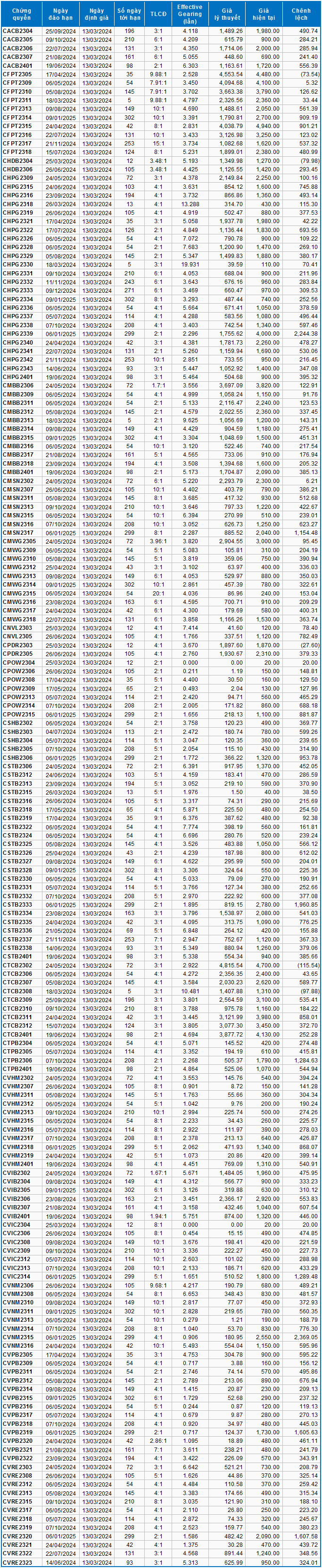

II. MARKET STATISTICS

Source: VietstockFinance

III. VALUATION OF WARRANTS

Based on the valuation method appropriate at the start date of March 13, 2024, the fair value of warrants currently traded in the market is as follows:

Source: VietstockFinance

Source: VietstockFinance

Note: The opportunity cost in the pricing model is adjusted to be suitable for the Vietnamese market. Specifically, the risk-free interest rate (government bonds) will be replaced by the average deposit interest rate of major banks with a maturity adjustment appropriate to each type of warrant.

According to the above valuation, CTCB2302 and CTCB2308 are currently the two warrants with the most attractive valuations.

The higher the effective gearing of a warrant, the larger its fluctuations increase/decrease with the underlying stock. Currently, CHPG2330 and CHPG2318 are the two warrants with the highest effective gearing ratio in the market.

Economic Analysis & Market Strategy Department, Vietstock Advisory Office