Source: VietstockFinance

|

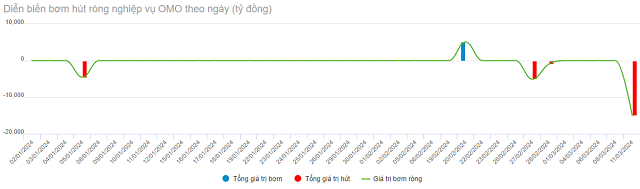

Deposits and lending rates may increase slightly but not significantly, according to Prof. Dr. Nguyễn Hữu Huân – Lecturer at Ho Chi Minh City University of Economics. He believes that if the State Bank of Vietnam attracts 15,000 billion VND, it will not have much impact on the market, but if there are consecutive sessions with large volumes, it will have some influence.

Prof. Huân believes that the State Bank of Vietnam’s move may aim to limit speculation in exchange rates in a tense exchange rate situation both inside and outside the banking sector, due to the impact of high gold prices and high import demand at the beginning of the year.

In addition, the high amount of gold smuggling also puts pressure on interbank exchange rates and the black market. Commercial banks are also actively investing in foreign currencies to seek profits from arbitrage. When there is speculation in foreign currencies, it will further put pressure on the exchange rate, thus pushing up interbank market interest rates.

When the State Bank of Vietnam issues treasury bills to attract money, money will become more scarce and the interbank VND interest rate may increase. If it increases to equal or higher than the USD interest rate, the foreign exchange speculation situation will disappear, helping to reduce exchange rate pressure.

| Interest rates in the interbank market since the beginning of the year |

However, Prof. Dr. Nguyễn Hữu Huân believes that if the State Bank of Vietnam continues to attract money, the savings interest rates and lending interest rates will also increase slightly but not significantly. This is because there is still excess liquidity in the system and data also shows that in the first two months of the year, disbursement of credit capital to the market has been difficult, not as expected, so attracting money back is a normal action from the operator.

Continuing to reduce lending rates

Dr. Đinh Trọng Thịnh – Economic expert said that liquidity has improved recently, so the State Bank of Vietnam is attracting money back to adjust the amount of money circulating in the market to prevent inflation.

At the beginning of the year, the Ministry of Finance also announced the issuance of bonds to mobilize money for public investment, so the State Bank of Vietnam’s attraction of money is just a normal pumping action.

In fact, this attracted amount of money partly contributes to reducing the money supply in the market, making the value of VND higher than it is currently.

If the State Bank of Vietnam continues to attract money, it may slightly increase the interest rates again, but Dr. Thịnh expects that both savings interest rates and lending rates will continue to decline in the near future.

“Recently, the State Bank of Vietnam has requested commercial banks to publicly announce lending rates, making the difference between savings interest rates and lending interest rates more apparent. Therefore, the reduction of lending rates is still continuing,”

he added.

The action of attracting money is short-term and more positive than in November

Meanwhile, Mr. Huỳnh Minh Tuấn – Chairman of the Board of Directors of FIDT Joint Stock Company – evaluated that the continued attraction of money may somewhat tighten liquidity in the interbank market/stock market if the attraction action continues continuously in the near future.

The liquidity volume on the stock market in the recent period has been maintained at over 23,000 billion VND/session partly thanks to the excess liquidity in the financial system and record low interest rates flowing into the economy.

With the State Bank of Vietnam tightening the excess capital volume in the interbank market, experts believe that there may be concerns that the buying demand of the stock market will decrease somewhat due to liquidity risks as well as investor sentiment.

The attraction of money by the State Bank of Vietnam is expected to not affect the deposit/lending interest rate structure of the banking system in the second quarter, in the context of credit growth still not significantly improved.

Mr. Tuấn assessed that the impact of this treasury bill issuance by the State Bank of Vietnam is also short-term and more positive than the November period.

In addition, Mr. Tuấn believes that the influx of speculative funds into the two markets, crypto and gold, is the main cause of exchange rate pressure. In recent weeks, both crypto and gold have reached all-time highs, leading to an increasing trend of speculation.

Although there are no specific figures, Mr. Tuấn speculates that the scale of speculation in Vietnam on the crypto and gold markets (especially crypto) is significant and can create strong fluctuations in the financial market.

Currently, exchange rate pressure from the free market is significant, he said. The “black market” exchange rate has reached 25,700 VND/USD when the P2P (peer-to-peer) exchange rate in the crypto market is over 25,800 VND/USD.

Therefore, “the attraction action shows that the State Bank of Vietnam is concerned about speculative activities and has to temporarily stop speculative funds with intervention measures.

“The purpose of the State Bank of Vietnam is to protect the medium-term exchange rate expectation, the bank’s exchange rate expectation of Vietnam at the level of 24,800-25,000, with a safe fluctuation range of less than 3% per year,”

Mr. Tuấn added.