GVR experienced a ceiling price increase with a trading volume of nearly 9.5 million shares. This upward trend contributed to a 2-point increase for the VN-Index. Since the beginning of the year, this stock has seen a continuous increase with a rise of up to 30%.

BID rose nearly 3%, and with its market capitalization, it was enough to drive a strong increase in the VN-Index. Although the banking sector experienced some differentiation during the session, there were still several representatives that pushed the VN-Index higher, such as TCB, VCB, CTG. In the afternoon, the market did not see much participation from banking stocks, as SHB and HDB only had a slight negative impact of approximately 0.2 points.

Many large stocks from various sectors contributed to leading the market. HPG, MSN, MWG, HAH, PVD, VRE all performed well and contributed to the increase in points today.

Telecommunications and information technology stocks had a great session. FPT, CTR, CMG, ELC, VTC all increased significantly.

The buying force dominated the session on March 12th, with nearly 400 stocks increasing compared to 340 declining stocks.

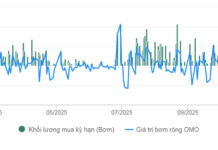

| Liquidity on HOSE on March 12th, 2024 |

Morning session: Technology and retail stocks ICT, rubber stocks surged

The stock market maintained its positive momentum and expanded its growth in the morning session. VN-Index temporarily paused at 1,243.55 points, up over 8 points. HNX-Index increased nearly 1 point to 234.8 points.

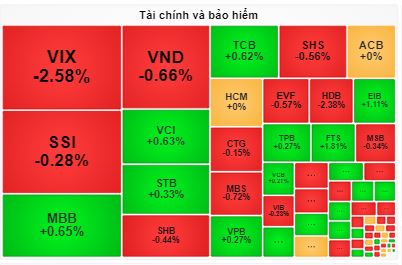

During the previous growth phase, the driving force of the market was the securities and banking sectors, which are currently experiencing differentiation. Half of the securities and banking stocks are leaning towards the green side, while the other half are leaning towards the red side.

Development of financial and insurance stocks in the morning session of March 12th, 2024. Source: VietstockFinance

|

Construction and real estate stocks dominated the market with positive growth, such as DIG, VRE, KBC, VHM, NVL, NLG… all performing well with high liquidity.

The rubber group is showing great performance. GVR, DPR hit the ceiling price.

The retail and distribution stocks ICT also had excellent performance. DGW reached the ceiling price, FRT rose more than 4%, and MWG increased by 2.6%.

The information technology stocks are also full of energy. FPT, CTR, ELC, VGI, VMG… all increased significantly.

However, market liquidity decreased significantly compared to the previous session. In the morning session, the total trading value reached VND 11.5 trillion, equivalent to about half of the previous session.

10:15 AM: Resumed upward trend

The strong increase in retail and information technology stocks is boosting market sentiment.

FPT increased by 2.4% and became the main support for the market. In the technology group, VGI increased by 6.6%, CTR increased by 5.3%, and VTP continued to hit the ceiling price.

In the retail group, FRT increased by 4.2% and continued to set new price records. MWG also increased by nearly 2%, while the distribution giant DGW hit the ceiling price.

The increase in these stocks brought positive momentum to the main HOSE index, which increased by more than 6 points. Banking stocks also turned green, with BID increasing by more than 1% and VCB, VPB, and STB also bouncing back.

By 10:17 AM, the total market liquidity reached over VND 6.4 trillion, and foreign investors were slightly net sellers.

Impressive debut of VTP

VN-Index opened with a slight increase, but the selling pressure was still dominant, causing the index to quickly reverse and decline.

By 9:30 AM, the banking group had the most negative impact on the index, including TCB, HDB, and CTG. The three major real estate stocks VIC, BCM, and VHM also contributed to this situation.

In the securities group, VCI and FTS were the rare gainers, although the increase was relatively small. The rest were mostly declining, with VIX decreasing by over 2%, VND decreasing by over 1%, MBS, CTS, VDS also decreasing by over 1%. Among these stocks, VIX is experiencing the strongest net selling by foreign investors.

HPG and MWG are also experiencing strong net selling by foreign investors. Although HPG is slightly down after announcing a profit plan of VND 10 trillion and issuing an additional 600 million shares.

The highlight of the market is VTP, which hit the daily price limit in its debut on the HOSE, pushing its market capitalization close to VND 10 trillion. With one more limit-up session, VTP will join the Large Cap group.