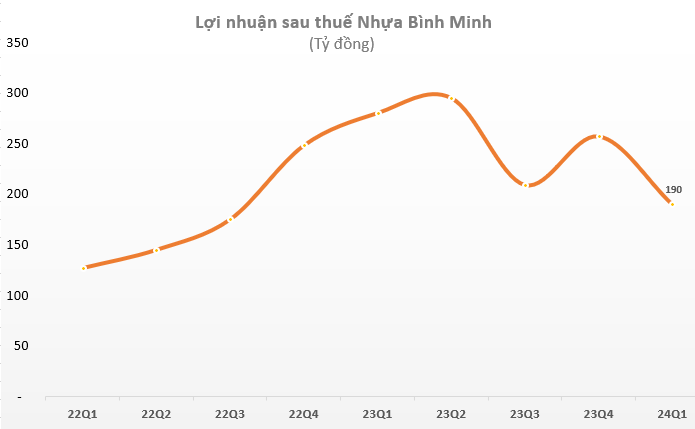

Plastic Bình Minh Records Lower Earnings in Q1 2024

Plastic Bình Minh Joint Stock Company (BMP) has recently released its consolidated financial report for the first quarter of 2024. The report reveals a 31% decline in net revenue, with a drop from 1,002 billion VND in the previous quarter.

After deducting the cost of goods sold, gross profit decreased by 23% to 425 billion VND. However, the gross profit margin improved from 38.4% to 42.4% during the quarter.

Following the deduction of various expenses, Plastic Bình Minh reported an after-tax profit of 190 billion VND in Q1 2024, a 32% reduction year-over-year. This marks the company’s lowest profit margin in the past six quarters since Q3 2022.

The upcoming 2024 Annual General Meeting of Shareholders (AGM) will see Plastic Bình Minh present its business plan for the year. The company aims to achieve revenue of 5,540 billion VND and a profit of 1,030 billion VND, representing a 6.5% increase and 1% decrease, respectively, from the previous year.

Consequently, the company has only fulfilled 18% of its revenue and profit targets for the first quarter.

As of March 31, 2024, Plastic Bình Minh’s total assets had increased by 247 billion VND from the beginning of the year, reaching 3,502 billion VND. Of this amount, the ending inventory stood at 364 billion VND, accounting for 10% of total assets. Cash and cash equivalents accounted for nearly 64% of assets, or 2,247 billion VND, an increase of 236 billion VND year-over-year.

Regarding liabilities, the company reported a meager 55 billion VND in financial debt, all of which was short-term. Shareholders’ equity reached 2,879 billion VND, with retained earnings of 857 billion VND, a 28% increase from the beginning of the year.

At the upcoming AGM, the company’s Board of Directors will propose using 99% of the after-tax profit from 2023 for cash dividends to shareholders. This translates to a dividend yield of up to 126% (distributing 12,600 VND per share). Plastic Bình Minh disbursed an interim dividend of 65% in late 2023. Upon shareholder approval, the company will distribute a further 61% dividend.

With approximately 81.9 million shares outstanding, Plastic Bình Minh is projected to pay an additional 500 billion VND for the second dividend payment in 2023. The Nawaplastic Industries (Saraburi) – a subsidiary of the Thai conglomerate SCG – is expected to receive approximately 275 billion VND due to its controlling stake of 55% in Vietnam’s leading plastics company.

Concerning the 2024 dividend, Plastic Bình Minh plans to allocate a minimum of 50% of the after-tax profit for dividend payments. Historically, the company has distributed almost all of its annual profits as cash dividends.

In the equity market, BMP shares have recently corrected to around 109,000 VND/share after reaching their historical peak. This represents a slight 5% increase from the beginning of the year and a nearly 60% rise compared to the price a year ago.

Recently, BMP was added to the VNDiamond Index, the benchmark index for four ETFs with a total asset size of approximately 16,000 billion VND.