Market Update: VN-Index Drops as Selling Pressure Increases

The VN-Index opened with a slight gain in the morning session but soon turned bearish. Selling pressure intensified after the lunch break, causing the main index to plummet. Investors who had hoped to bottom-fish were disappointed as many stocks traded at a larger discount today.

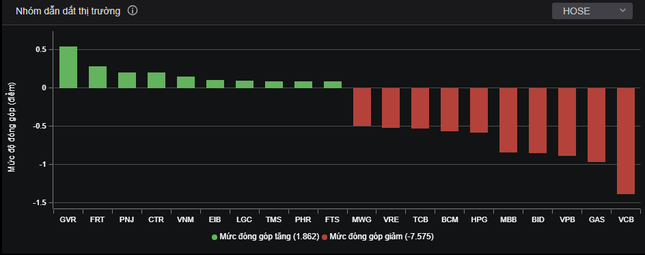

On the Ho Chi Minh Stock Exchange (HoSE), 392 stocks were in the red, with large-cap stocks leading the decline. VCB alone dragged the main index down nearly 1.5 points, while GAS, VPB, BID, MBB, HPG, BCM, and TCB added to the selling pressure. Stocks that had previously contributed the most to the rising trend were the worst performers today. The banking sector was heavily in the red, with only EIB and HDB showing slight gains. All other stocks, including the newcomer NAB, declined, with NAB dropping 2.4% after a small increase on its debut last week.

The banking, real estate, construction, and securities sectors were all in the red. High-liquidity stocks such as HPG, SSI, MBB, VND, VIX, and MWG all recorded strong selling pressure.

Investors also expressed concerns about the increasing exchange rate. On a notable note, the State Bank of Vietnam made a significant move today by issuing treasury bonds. The bonds have a 28-day term and are auctioned off with interest rates determined by bid and single price methods. The auction results have not been announced yet.

While the overall market struggled, several individual stocks still made notable moves. CTR hit its ceiling price, reaching a historical high of 112,500 VND per share. CTR’s market price has increased by 25% since the beginning of the year and doubled compared to a year ago. Viettel-related stocks such as VGI and VTK also performed well. On March 11, the VTP shares of Viettel Post will debut on the HoSE with a reference price of 65,400 VND per share.

The agricultural sector traded more positively than the overall market, with DBC up 4.1% and seafood stocks like IDI, ANV, CMX, and MPC all gaining.