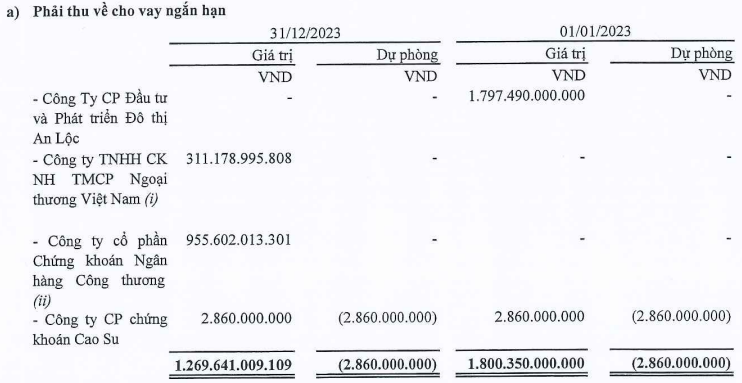

It is not uncommon for listed companies to invest their money in other stocks. However, it is not very common for companies to lend money to securities companies. According to the Q4/2023 financial statements of Saigon VRG Investment Corporation (SIP), as of December 31, 2023, the company had generated nearly VND 956 billion in short-term loans to Vietinbank Securities (CTS). This item was not recorded at the end of Q3.

According to SIP, these are unsecured short-term loans with interest rates ranging from 5% to 7% per year.

This move comes after Vietinbank Securities announced in November 2023 a resolution approving the borrowing from SIP with a maximum limit of VND 2,000 billion (including outstanding loans), then increasing the limit to VND 2,500 billion according to a resolution in January 2024.

In addition, SIP also recorded a loan of VND 311 billion to Vietcombank Securities (VCBS), a decrease of about VND 400 billion compared to the end of Q3 2023, also with interest rates ranging from 4.7% to 7%; and a loan of nearly VND 3 billion to the Rubber Securities Joint Stock Company.

The total value of short-term loans to securities companies of SIP stood at approximately VND 1,270 billion by the end of 2023.

Vietinbank Securities and VCBS are both top and long-standing securities companies in the Vietnamese stock market. SIP’s ability to lend over VND 1,000 billion to securities companies is thanks to its strong financial resources.

Specifically, by the end of 2023, SIP had total assets of VND 21,084 billion, an increase of VND 2,081 billion compared to the beginning of the year. Cash and cash equivalents amounted to over VND 827 billion, and time deposits amounted to nearly VND 3,014 billion.

In addition, accumulated revenue reached VND 11,273 billion plus prepayments of over VND 54 billion. Therefore, the total revenue of SIP included over VND 11,300 billion of accumulated revenue and prepayments. This mainly consists of prepayments from customers renting industrial land and is set aside for allocation in the coming financial years of the company.

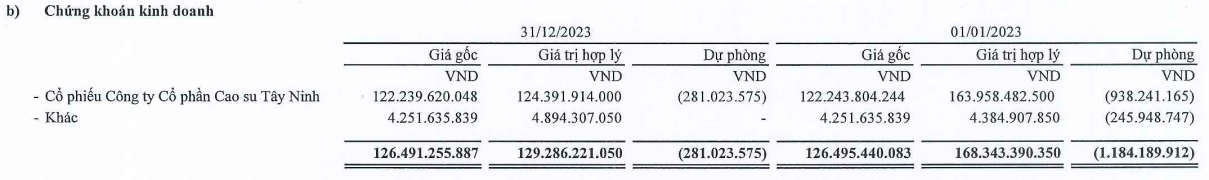

Not only does SIP lend and deposit money in banks, it is also known as one of the large investors in the stock market. At the end of 2023, SIP recorded an investment of VND 122 billion in TRC stocks of Tay Ninh Rubber Joint Stock Company, with provision of over VND 281 million. It is known that both SIP and TRC have the presence of Vietnam Rubber Industry Group (GVR) in their shareholder structure.

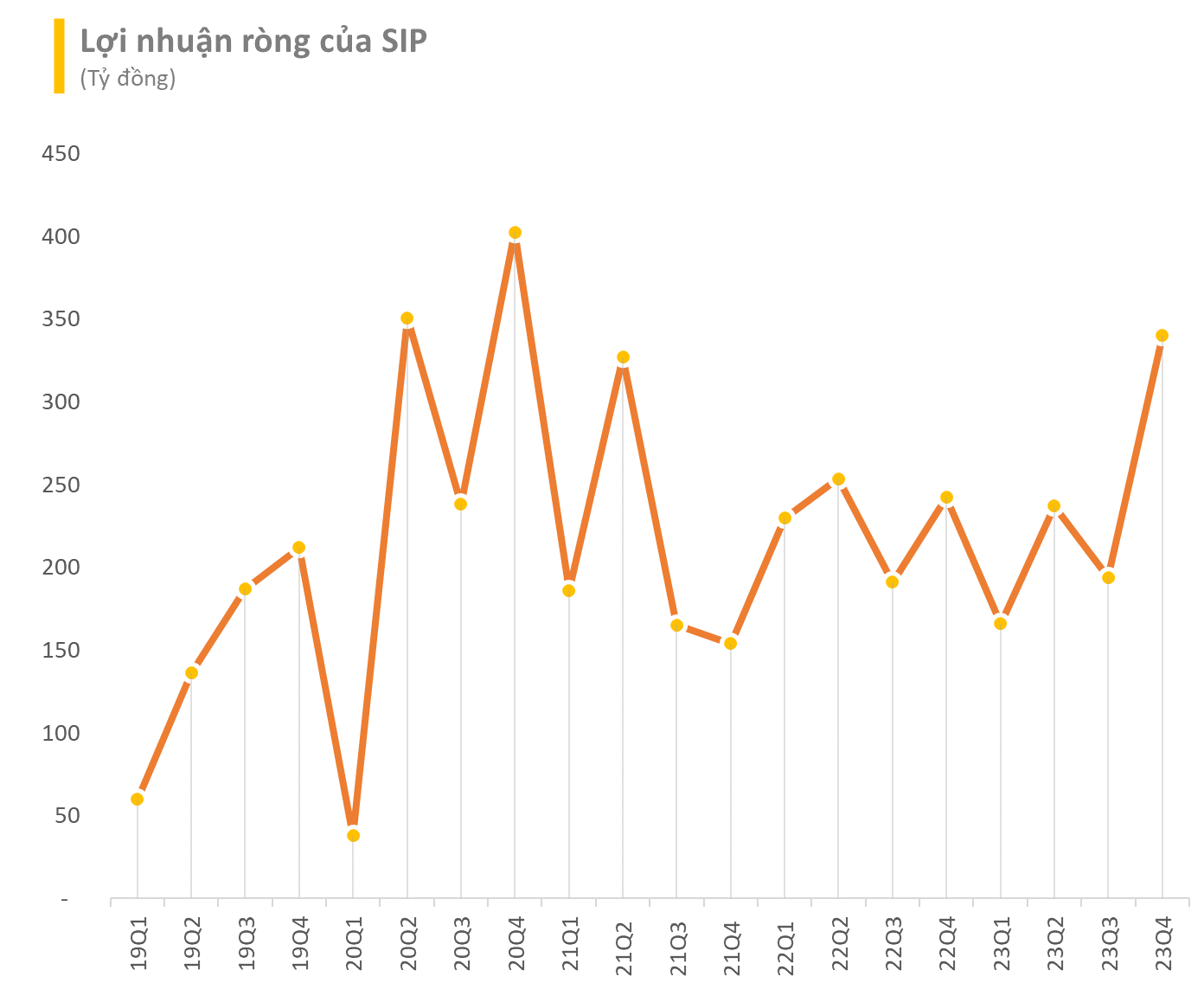

In terms of overall business performance, as of the end of 2023, SIP recorded revenue of over VND 6,676 billion, a growth of 10% compared to the results of 2022; after-tax profit reached VND 1,036 billion, an increase of 3%.

Compared to the plan of VND 5,312 billion in revenue and VND 755 billion in after-tax profit. Therefore, the company has exceeded 26% of the revenue target and exceeded 37% of the profit target.

Recently, GVR announced a restructuring plan, in which it is expected to divest its capital in member units, including SIP. Currently, GVR holds over 3.6 million SIP stocks, equivalent to nearly 2% of the capital.