After a steep decline, the stock market returned to an upward trend at the beginning of March 12th and maintained mostly positive momentum throughout the trading day. The banking sector saw a recovery in addition to positive trading in the real estate sector and Viettel Group. By the end of the session, the VN-Index increased by 9.51 points (+0.77%) to reach 1,245 points. The trading value on HOSE and HNX exchanges totaled VND 22,445.8 billion, a decrease of 13% compared to the previous session. Foreign investors became a negative factor as they sold off shares across the market.

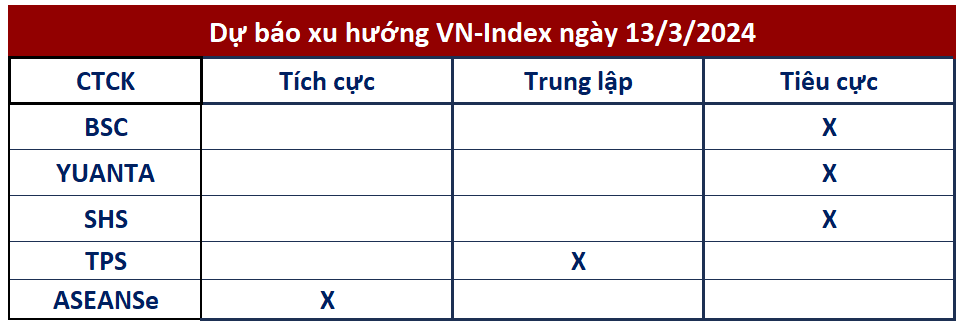

Regarding the market outlook for the next session, most securities companies still hold a relatively cautious view of the market due to the strong upward momentum in recent sessions and the lack of strong demand to push the market past resistance levels.

According to BSC Securities, the bottom-fishing money has appeared at the 1,235 level. However, the buying force is not strong, so there is still a potential risk for the market to continue to decline into the range of 1,210 to 1,220. Investors should trade with caution in the coming sessions.

SHS Securities also maintains the view that short-term upward momentum in the market has weakened. The VN-Index will continue to face the mid-term resistance level of 1,250 points. Even if this level is regained, the possibility of VN-Index forming a strong uptrend is not high. It is more likely that the VN-Index will trade within the accumulation range of 1,150 to 1,250 points.

Yuanta Securities believes that the market may continue to oscillate with alternating ups and downs in the next session. At the same time, the market is still in a short-term accumulation phase, so capital will be differentiated between different groups of stocks. Large-cap stocks may face short-term downward trends, while capital may continue to flow into mid-cap and small-cap stocks. At the same time, investors are not yet ready to return to the market and a correction phase may still occur in the next session.

Yuanta recommends short-term investors to continue to hold a balanced portfolio allocation and prioritize investment in mid-cap and small-cap stocks. At the same time, investors should not rush to bottom-fish in large-cap stocks and wait for opportunities in upcoming discounted sessions.

In the view of TPS Securities, it is very likely that the market has just had a technical rebound, and buying force and capital flow have yet to demonstrate a superior advantage. In the next session, the VN-Index will retest the important support zone at 1,235-1,240 points.

If the support level is broken, strong selling pressure may cause the index to decline to the range of 1,230-1,235 points. In a more positive scenario, if buying force emerges and gains a stronger advantage, the VN-Index can continue to target the resistance zone around 1,250-1,260 points.

Investors need to closely monitor the issuance of the Central Bank’s bonds to assess their impact on market sentiment and index fluctuations.

Similarly, Asean Securities believes that this could very well be a technical rebound with a short-term nature. The market rebounded with low liquidity, indicating that capital is becoming more cautious. Meanwhile, signals show that the market has not found a balance zone yet, but the upward momentum could continue in the next session.