Stocks SSI Research forecasts that BMP may replace MWG in VNDiamond. Mai Hương • 12/03/2024 – 15:29

SSI Research has made a forecast about the changes in the VNDiamond index basket in the first quarter of 2024. Notably, MWG shares are still considered to have a P/E ratio that does not meet requirements and may be excluded from the basket, while BMP may be added.

The HOSE-Index, VNX-Index, and other investment indexes including VNDiamond, VNFIN Lead, and VNFIN Select will rearrange their portfolios for the first quarter of 2024 with the data cut-off date being March 29, 2024, and the announcement date being April 15, 2024. The portfolio restructuring will be completed on May 3, 2024, and the new index will take effect on May 6, 2024.

In particular, the VNDiamond index will review changes in its constituent portfolio, while the remaining indexes including VN30 and VNFIN Lead will only update data and recalculate the portfolio weights.

Based on estimated data as of March 8, 2024, SSI Research forecasts that the VNDiamond index will exclude MWG due to not meeting the P/E ratio requirements.

Meanwhile, BMP may be added to the index as it belongs to the group of 8 non-financial companies sorted by the FOL ratio from highest to lowest.

With the above changes, the new index portfolio will include 18 stocks, of which 10 stocks in the financial sector will be subject to the maximum weight for the entire sector of 40%.

Among the ETFs in the market, there are currently 3 ETFs that use the VNDiamond index as a reference, including VFMVN DIAMOND, MAFM VNDIAMOND, and BVFVN DIAMOND, with a total net asset value of about 17,615 billion dong as of March 10, 2024.

In particular, the VFMVN Diamond fund has a total net asset value of about 17,187 billion dong as of March 10, 2024. Specifically, the fund’s total net asset value has decreased by -0.43% since the beginning of the year, with a net capital withdrawal of 2,280 billion dong and a NAV increase of 13.4% since the beginning of the year.

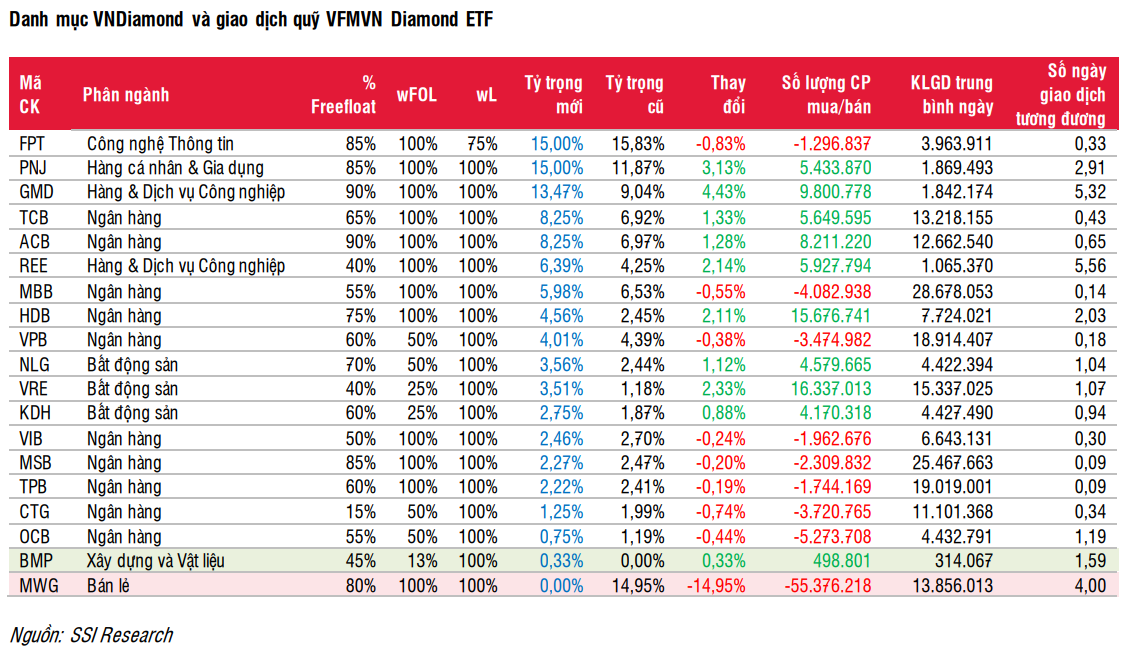

Accordingly, the VFMVN Diamond ETF will sell the second largest investment position in its portfolio, which is MWG, with a quantity of more than 55 million shares.

SSI Research’s estimate.

Conversely, BMP may be purchased with nearly 500 thousand units. In addition, stocks currently in the index’s portfolio such as VRE, HDB, REE, ACB, GMD, PNJ will also benefit the most from the sale of MWG shares.

In the stock market, BMP has increased by over 8% since the beginning of 2024 after increasing by nearly 100% in 2023. Stocks such as GMD, ACB, HDB, PNJ have increased by over 10% since the beginning of the year.

Share on Facebook Share on Zalo Share on Zalo

BMP

VNDiamond

VNX-Index

HOSE-Index

SSI Research

VN30

VNFIN Lead

Related articles

FTS Stock Included in ETF Portfolio of VanEck, Estimated to Purchase an Additional 3.2 Million Shares

On the morning of March 9, 2024, MarketVector Indexes announced the addition of FTS to the portfolio of the MarketVector Vietnam Local Index – the benchmark index for the VNM ETF.

Read more

After Transferring to a New Exchange for 2 Years, EVF Has Been Included in ETF Index

Two Scenarios for Foreign Capital and ETFs in 2024

How Do ETF Indexes Change in the First Quarter of 2024?

Send comment

Your comment has been submitted and will be displayed after being approved by the editors.

The editors reserve the right to edit comments to comply with the content guidelines of the newspaper.

(0) Comments